Will the majority adopt sooner Bitcoin or Cardano?

Blockchain is a new technology and people tend to assume that it will be adopted as fast as it is usual for other technologies. That might not be correct since blockchain is not only about technology but also about price volatility. That might be an obstacle to mass adoption.

People often see cryptocurrencies only as technology and compare its adoption with the historical adoption of other technologies. As you can see in the picture bellow adoption of smartphones was much faster than the adoption of cars. So adoption is faster and faster as the whole society runs on.

However, I think that the adoption of cryptocurrencies will be very different than with common technologies. Let’s consider an example with the adoption of a cell phone. If you adopt a cell phone after two years after your neighbor than you can buy a newer and better model and pay less money for it than your neighbor had to pay two years ago. So you have better technology for less money and your neighbor will probably buy a newer model as well soon (throwing away the older model). Notice that if you postpone adoption then conditions are better for you.

It is vice versa with cryptocurrencies. Early-adopters were able to buy a lot of coins of bitcoins for less money than now newcomers might buy for the same money. So newcomers are able to buy fewer and fewer coins as the price goes up. The rising price makes it difficult for newcomers to adopt technology. Volatility is a big enemy and people will not adopt a volatile asset if there will be another option. A stable coin would be much easier to adopt.

It will not be easy to achieve mass adoption of Bitcoin and it cannot ever happen despite the fact that the price will be very high. Banks and institutions will probably buy the majority of coins before the majority of people will manage to adopt it. Thus there will be a few new millionaires and a few banks owning Bitcoin. The question is what will be a benefit for people. Will Bitcoin be rather a speculative asset for bankers or digital money for the population? The first is more probable.

It is not correct to show people the chart above and claim that the adoption of Bitcoin will be the same as the adoption of a cell phone.

Is the price speculation real adoption?

The question is whether price speculation is real adoption. It is not. Bitcoin is a great speculative and volatile asset. The market is not mature so it can be easily manipulated. A lot of bitcoin coins sit only on a few addresses. There are big whales waiting till the price goes up to dump the market. Noobs might lose a lot of money. It is quite easy for whales to pump and dump the price and we can often see it. It has already a name. Bart’s head.

Cardano PoS vs. Bitcoin PoW

You were interested in how Cardano PoS is different from Bitcoin PoW. There are many significant differences and both projects are different advantages and disadvantages. Let's compare them. Read more

All that is not the real adoption of cryptocurrencies. In my view, adoption is about the daily usage of decentralized technologies to get some benefits like freedom, fairer loans, ability to create a cheaper and fair contract between parties without a chance somebody can manipulate it.

It is true that the Bitcoin price rises from the moment Bitcoin came into existence. Due to the price rise, we can observe the big hodl community. Nobody wants to use Bitcoin for payments until making at least 10X. Paying with Bitcoin is like paying with a stock of Tesla. It makes no sense. Mean of exchange and speculative investment are two different things.

Newcomer buying Bitcoin will probably hold it. As a side effect, newcomers subsidies the wealth of early adopters. So early adopters happily sell coins while newcomers wait for pumping. It cannot work like that forever. From the point of adoption, the Bitcoin scheme is just a pyramid where newcomers help to early adopters get richer. Newcomers take over the risk and early adopters celebrate.

From the game theory perspective, newcomers might be more profitable to start using and pumping different projects than the older one which has been already pumped. The potential of the price rise might be bigger with newer projects. Sure, if banks and institutions will jump on it as well what is economically advantageous also for them.

Can Bitcoin fight with banks?

Bitcoin should fight with banks but instead of it now Bitcoin helps banks to be even bigger. How the majority of people can benefit from that. Well, we can speculate on the price. Will that bring us a better society and fairness in the financial world? Nope. You can argue that people can buy a piece of Bitcoin and nobody can censor it or take their wealth from them. That is true, but the question is who really needs that in real life? Do we really need to hide our wealth and leave the country including all our friends crossing borders with seed in mind? Or is it better to have a chance to live where we are and improve the current financial world? For hiding of wealth can be used nearly any major project. It cannot be Bitcoin. People use Tether in Venezuela since it is a stable coin and transactions are faster and cheaper. Do not be confused that everybody talks only about Bitcoin.

Where we are with adoption?

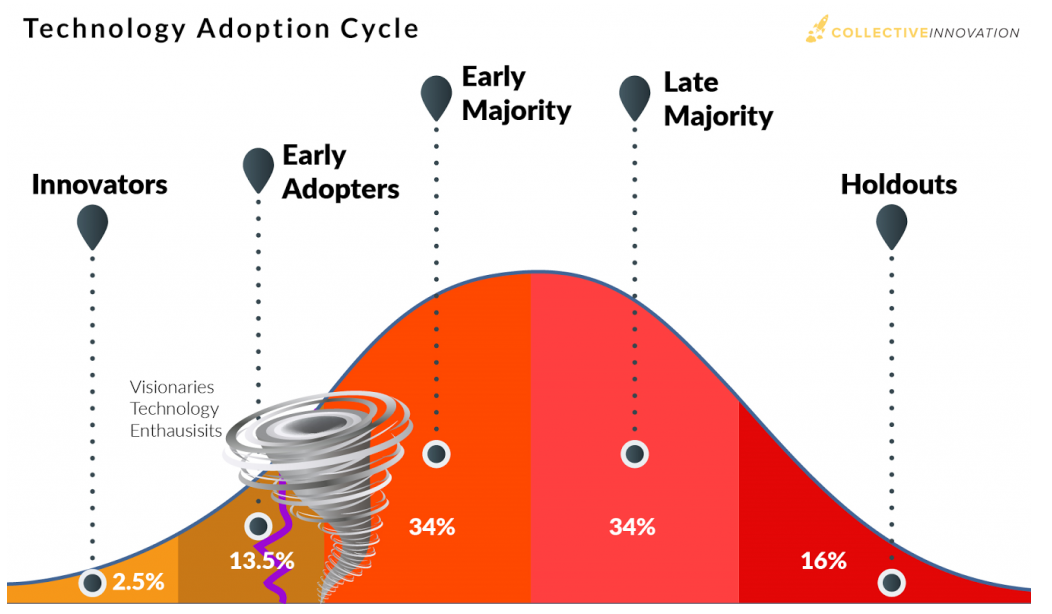

In 1962 Everett Rogers came out with a book called Diffusion of Innovations. In the book, he outlined the process of adoption of new ideas by a population, specifically consumers. He also categorized people based on their adoption timing. See the table below.

In every group, there is a given percentage of people. There is only 2,5% of innovators followed by 13,5% of early-adopters.

So where we are? In my view, we are somewhere between innovators and the early-adopters phase. Most probably we have not crossed more than 10% adoption yet. Early adopters are pickier than innovators so the technology must be more mature to be adopted by the masses. The early majority expect perfectly working product without any risk from usage. It must be great from the UI point of view.

Can be Cardano easier adopted than Bitcoin?

I think so. Cardano will be better prepared for mass adoption than Bitcoin from point of early adopters and all next groups (early majority and late majority). Cardano teams think about what we will need in 10 years, not what we need tomorrow. Thus, Cardano will have faster and cheaper transactions. Cardano will scale and transaction fees will not rise when more people come to use the system. Transactions can be cheaper if there is a bit amount of them. The key to having cheap transactions is to resolve the scalability issue and decrease the cost need for running the network. PoS is cheaper than PoW.

Cardano will be able to provide context to any transaction. So authorities can easily process it. Smart contracts will open new so far unprecedented possibilities. Making digital smart contracts will be cheaper and safer than involve real (often expensive) people in the process.

Cardano will be interoperable. It will be easy to connect Cardano with other existing financial systems. There will be one great example right at the beginning of the Shelley era. There will be approximately 72 ADA taxable events per year for people who delegate coins to a pool. Taxes must be paid for staking. It might be a nightmare since every stakeholder gets a reward every 5 days and the price of ADA will be different every time. Cardano wallets allow you to export your transaction history and the export format will be suitable for importing into the existing crypto tax software. Users will be able to choose units of accounts, so e.g. USD. So at the end of the year, you will be able to easily provide all the necessary information for the tax authorities. The software should make things easier and Cardano will help users with taxes.

If you look at Cardano from point of benefit for people than smart contracts and tokens will help us more than Bitcoin. Banks might buy a lot of ADA tokens for the price speculation. But still, if you have a single ADA you will earn new Lovelaces (sub-units of ADA) every 5 days. Your wealth will grow. Not only the wealth of whales and banks. From the point of adoption based on the rising price, it is even better to hold ADA than keeping a small piece of bitcoin.

Even if all ADA will be bought up by whales Cardano still allows to deploy smart contracts and issue new tokens. Tokens might be used as a means of exchange within any community, nations included. If you think that we need inflation to keep the national economy working then Cardano allows a defining level of inflation via smart contracts. It could be possible to set the level of inflation via smart contracts and voting. Possibly every person in the group can benefit from inflation. All can be configurable.

Wealth can be always bought up by wealthy people, institutions and banks. However, nobody can do it with utility. Cardano will be highly useful in the financial world and everybody can benefit despite the price of ADA.

Cardano will be able to create sound money. It can be ADA and can also be any token if it will be used within a nation. It will be running on a permissionless, open, decentralized and public blockchain. If people should use sound money and use it every day then the network must be scalable and secure. The only security is not enough if transaction fees are high and settlement takes an hour. We need both abilities and still, use it on the decentralized network. If you think we can build the same on Bitcoin you are wrong. Lightning Network (LN) will not be as secured as the first layer of Bitcoin and currently it is not ensured that the route between two users will always be found in LN. Cardano might be much better in all aspects and it will be ready sooner than Bitcoin for global sound money. In addition, Cardano will have extra features that Bitcoin will probably never offer. Having smart contracts and currency on a single platform is better, than having two platforms or networks for that. Can you imagine that there will be Lightning Network for fast transactions, RSK platform for smart contracts and other networks?

Cardano will be a unique financial platform responsible for scalability, security, and decentralization. Smart money must be programmable. It will be a required feature and programming language Plutus will be the safest tool to build smart contracts. Cardano’s future is bright.

Summary

In my view, Cardano’s adoption will be much easier and faster. The world is more ready for crypto adoption than before 10 years. Bitcoin adoption could be pushed back by scalability issues. Still, volatile price prevents adoption a lot. People will adopt utility faster than a speculative asset. Moreover, Cardano will be more technologically matured than Bitcoin so better available for early-adopters and early-majority groups.