Cardano PoS vs. Bitcoin PoW

You were interested in how Cardano PoS is different from Bitcoin PoW. There are many significant differences and both projects are different advantages and disadvantages. Let's compare them.

We would like to honestly compare Cardano Ouroboros PoS with the Bitcoin PoW consensus algorithm. It will be only a high-level comparison and I will create a summary table at the end. PoS and PoW are both good protocols. However, they are dramatically different in many details and it has a significant influence on usage.

Why consensus is made

First of all, let’s explain why consensus is needed. In distributed networks, there should not be any central authority. Consensus means that the majority of participants agree on the single version of the truth at a given moment. So there are more independent authorities and thus the decision power is distributed.

Within cryptocurrencies, users send transactions and some of them might be fraudulent. There also might be fraudulent authorities that add fraudulent transactions into a block. It would be easy to cheat if there would be a single central authority. It is much harder to cheat in a distributed environment where there are more entities participating in the mutual consensus. If there is a certain number of honest entities then it is hard or impossible to cheat. Both Cardano PoS and Bitcoin PoW requires over 50 % honest entities to ensure that the networks add blocks correctly and securely.

So the mutual distributed consensus is made to avoid a single point of failure. Everybody can join open networks, there is no KYC, so it can be expected that there will be cheaters. The consensus protocol must be robust and ensure that transactions between people will be safely processed in a reasonable time. You can understand it as an attempt to eliminate cheaters in the decision process and still be able to add new blocks in a secure way.

How distributed entities come to a consensus

Distributed consensus can be generally described in a few steps.

- Selection of a node with the right to produce the next block.

- The node with the right to produce the next block will create the block and distribute it to other nodes.

- All other nodes in the network verify the block and either accept it or reject it.

- The process continues from step 1. It is needed for the confirmation of all previous blocks. The more added blocks are above a block the higher is the probability that the block will stay in the blockchain forever.

It is quite easy, is not it? There are always more entities that are able to produce a block. However, at a given time all entities must make a consensus about a single block. There must be some rule that determines who will get the right to produce a block in step 1. Then steps 2 and 3 must follow to get again to step 1.

A node with the right to produce the next block will select transactions, validate them, and puts them into the new block. The node usually adds some required proof and/or signature and distributes the block.

All nodes in the network keep their own version of the blockchain and every single node autonomously decides whether to accept the received block or reject it. Every single node verifies the validity of all transactions in the block and all necessary property of the block including proof and/or signature. If the block is valid it can be expected that all honest nodes append the block at the end of the blockchain. The next node with the right to produce a block, if it is an honest node, will very probably extend the previously added block.

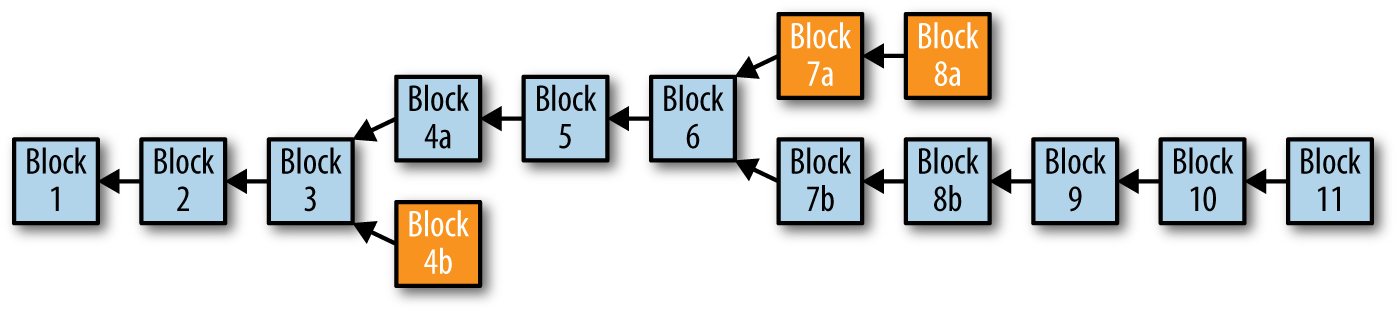

Under certain circumstances, a fork of blockchain might appear.

A node can get into a situation where it must decide where to continue. Related to the picture above, after Block 3 there is a fork. The node currently working on the next block can continue building the blue branch (Block 4a) or the yellow branch (Block 4b). After some time only one branch will survive and the other will be orphaned. In our case, the blue branch won.

Cardano and Bitcoin can coexist and support each other

Cryptocurrencies are a very competitive environment and the question is which projects will exist in the next 10 years. This will be decided mainly by the users who adopt the projects and start using them in real life. Let's take a look at how Cardano and Bitcoin compete and how they can complement each other. Read more

Forks are generally unpleasant since it basically means that some transactions will be discarded. That is why confirmation is required to be sure that block (including all transactions in the block) will stay in the blockchain forever. For example, if 6 confirmation is required then a user can be sure that the transaction is immutably stored in the blockchain after Block 10 is added.

As you can see there is another fork after Block 6 and the yellow branch has 2 blocks. That is why 6 confirmations are required. There might be more forks on the way. 6 is just a custom number and it depends on observation of the network and frequency of forks to decide how many confirmations are needed in the real world.

There are a few properties we can compare. I will explain them to you and shortly compare Cardano with Bitcoin.

Liveness and safety

Let’s first talk about liveness and safety. Liveness is an ability to unstoppably append new blocks. Safety means that only valid transactions (and block) will be added. Both abilities supplements each other.

Bitcoin’s liveness is high since at step 1 there is a competition between all mining pools to quickly propose a block. Thus if one fails the other will be ready. Thus it is ensured that a new block will be eventually prepared in a given step. However, it is a very slow process that takes approximately 10 minutes (sometimes 2 minutes, sometimes 1 hour). Bitcoin protocol does not play any role in the selection of the winner. It just defines acceptance criteria and validates them. It is proof of work = someone must have been working on the block hardly and spent a lot of energy.

Cardano protocol actively participates in the selection of the node with the right to produce a block. Every node can ask in a given slot whether it has the right to produce the block and all other nodes are able to verify it. The node must insert a cryptographic proof into the block and sign the block. If the node is not available for any reason then the slot remains empty. However, this situation is compensated by the fact that the slot lasts only 20 seconds. So there is a high probability that after the next 20 seconds another available node produces a block. We could see major delays in producing blocks only if more nodes at the same time would not available. Eventually, some running node gets the right and produce a block. We can conclude that liveness is also high in comparison with Bitcoin mainly due to the shorter period for block production in step 1. Still, Bitcoin could be considered slightly better if we do not care about other parameters like block finality, transaction speed, and fee.

Safety is related mainly to step 2 and 3. A node can create either a valid or invalid block. If the node is honest then the source code of the client validates transactions and it depends on the quality of the code. If the node is fraudulent then the invalid transaction can get into the block what makes the whole block also invalid.

In a distributed environment, step 3 is more important. The block is propagated towards other nodes and they decide whether it accepts it or rejects it. If the majority of validators are honest then the only valid block is accepted and vice versa.

So safety depends on the level of decentralization and also partly on the number of validators. If we consider transaction censorship resistance as part of safety then the higher the number of entities who can receive the right to produce a block the more secure the network is.

The block creator can create a valid block even if it censors transactions and validators might not notice that or are not able to invalidate the block. Thus it is necessary to split the block creation responsibility to as many entities as possible. Bitcoin currently has not more than 10 pools that produce new blocks. Safety is poor. In Cardano, it is expected to achieve 1000 pools so it will be higher.

Step 3 is very similar to Cardano and Bitcoin. The interesting question is what would happen if block producers would collectively decide to produce invalid blocks. All validators would reject invalid blocks but they would not be able to produce one. Let’s discuss this topic next time.

Decentralization

The number of independent entities with decision rights, what is block creation, is very important here. Any project should try the best to achieve a high number of such entities. Note that we are talking mainly about step 1 at this point. Step 3 is important from a validation point of view (safety and security), so after the consensus has been already done.

Open competition in PoW leads to having just a few entities who collected decision power. In PoW, the more powerful player, the player who disposes of a higher hash rate, the more often it wins. It just makes sense to users to delegate their hash rate to the biggest pools since they retrieve reward more often with higher sureness.

Moreover, mining is more profitable in areas with cheaper electricity. Thus, some regions are economically eliminated from mining and China is the mining king.

In PoW, only stake pool operators and small miners are responsible for running the network and are rewarded for that. The number of small miners will probably decrease in the future. At least it is the trend now as expensive ASIC miners must be bought and it is more and riskier as hash rate rises.

In Cardano PoS, all users holding ADA can participate in a consensus algorithm. It is similar to mining with the difference that there is less risk. Users can buy ADA coins and delegate them to a pool. When the user’s ADA wins the right produce a block the pool will create the block instead of the user. Stake pool operators and users will be rewarded. Thus all users are incentivized to participate in decentralization.

There is another parameter that relates to the openness of the network in sense of the ability of users to easily participate in making consensus and thus keep the network decentralized. It is cheaper, less risky and easier to join Cardano network than Bitcoin. We can conclude that Cardano is more open to users.

Cardano will be more decentralized than Bitcoin. Decentralization is not only about protocol but also about democratic governance but let’s focus on the networking level in the article.

Security

At this point, let’s talk about security as the ability to keep the history of blockchain immutable. It is believed that it is the most important advantage of PoW since it is difficult to create a block and the liveness of Bitcoin is very good. It is true but let’s have a closer look at what the security really is.

To consider a protocol as secure it must be true that nobody can change the history of ledger. The ledger is distributed on many computers around the world. The attacker has no chance to find all computers and attempt to change the ledger on all hard discs. So the only way how to achieve that is to cheat on consensus level. It is easy to create a block in PoS but it is kind of difficult or impossible to enforce an invalid block to all nodes in step 3. A node cannot do it if it has not the right to produce a block. If the node gets the right to produce a block and decides to cheat then still only a block with valid transactions and cryptographic proofs will be accepted. If an attacker has more nodes for cheating then still it is mathematically proved that the attacker needs more than 50 % of coins. So it is economical nonsense to try such an attack.

The electricity consumption in PoW was replaced by science and mathematics in PoS. It is more complex and there might be a higher chance that something goes wrong. Still, there is no reason to be scared and PoS can work just fine.

I personally consider decentralization as an undetachable part of security. Security and safety are close to each other in distributed networks. Would you consider Bitcoin secure if only two or three entities create new blocks? Definitely not since they could censor transactions, they could select a branch on which they are willing to continue so they could commit a double-spend attack quite easily. If it is true that the more decentralized a protocol is the more secure it is, then we can conclude Cardano and Bitcoin have similar security with some differences. It is difficult to create a block in the Bitcoin network but only a few entities do it and once a valid block is created it will be accepted. It is also difficult to create a valid block in the Cardano network and an attacker would have to overcome modern cryptography.

The fact that there might be forks of blockchain cannot be considered as a secure and required state. If there will be more pools in the Bitcoin network then there is a bigger chance of forking. So there are some security limitations in the Bitcoin consensus. In will be fewer forks in the Cardano network.

Security relates to steps 1, 3, and 4. In Bitcoin, the most important step is 1 since validation is just about the PoW check in step 3. In Cardano, besides step 1, step 3 is a bit more important than in Bitcoin since it is the point where the whole network decides whether the block will be accepted or not. Do not take it wrong. In step 3 it is verified that step 1 was correct in both cases for Bitcoin and also for Cardano. Cardano cares about own decentralization and can verify that the correct node produced the block and provided valid proof. It is very similar to Bitcoin. The difference is that in Bitcoin PoW required energy consumption and the correct hash is the only criteria for a block acceptance. In Cardano, there is cryptographic proof instead and also decentralization is ensured.

Bitcoin has been running for 10 years. It tends to centralization but it can still be considered as very secure and it has been proven by time. We cannot say the same about Cardano. Next 3–5 years will show us.

Scalability and finality

Scalability is an ability to process all transactions as new users come in time. It is easy to scale when the network is used only by a few people. However, it is more and more difficult as a number of users gradually grows. Scalability is mainly related to step 1. As we have already described, Bitcoin spent a lot of time in step 1 so it cannot scale well and also the finality will be slow.

We have easy work here with the comparison. If we consider that both projects will have a similar size of the block then more scalable is Cardano just for the reason it has shorter block time. It is 20 seconds against 10 minutes. It is a very rough comparison since we should have to compare also transaction size and other parameters. It is expected that within the Shelley era Cardano will manage 250 transactions per second (TpS).

Moreover, PoS can introduce sharding so in the future, we can expect thousands of transactions per second. For now, let’s conclude that Cardano is more scalable than Bitcoin.

There is a block finality and transaction finality. Let’s focus only on transaction finality. A transaction can be considered as final when a user can be sure that the transaction will stay in the blockchain forever.

So a new transaction should be inserted into a block as soon as possible and then it depends on the required amount of confirmation. If we take the number 6 for Bitcoin as the required number of confirmations then the finality is approximately 2 minutes for Cardano and 1 hour for Bitcoin.

Bitcoin has a slow consensus so if there is higher traffic then there is also a higher probability that transactions will stay in a transaction pool for a longer time. Even days if new transactions will have higher fees.

Transaction costs

Transaction fees are influenced by two aspects. Firstly, the number of transactions the network is able to process in a given time and secondly, by the cost needed for keeping the network running.

In the previous part, we concluded that PoS is better scalable. It is just a common sense that if the system is more scalable and processes a higher number of transactions then the fees might be lower to collect the same amount of value.

PoS also consumes much less electricity than PoW. PoW requires electricity as a middle-size state while PoS suffices with the energy needed for one big house.

It is expected that transaction fees might go to dollars after a few next halving if the network should remain secure. We can conclude that Cardano will always have lower transaction fees and we can expect higher fees in Bitcoin in the future.

Sustainability

This topic is not discussed a lot but I think it is very important. People would like to have a digital gold. It is generally believed that it is a Bitcoin. However, I can see some obstacles. Gold is very stable for thousands of years but Bitcoin is a very young project and changed dramatically in the last decade. Gold does not care that we invented electricity, internet and distributed networks that are secured by consumption of the electricity. Bitcoin and other projects depend on that. So protocols can never be as stable as gold. Gold does not need anybody for survival. Protocols do. However, we can do our best to ensure a high level of sustainability.

If you hold a cryptocurrency then your wealth depends on the ability of the network to add new blocks in a secure way. PoW has generally one big disadvantage that brings instability from the economic model perspective. It is very expensive to keep the PoW network running and in the future, there might not be a sufficient reward to ensure security.

PoS is a much better concept in this regard since it is quite cheap to run the network. The more transaction users send the more fees will be collected and the fee can remain low. It will be still enough for rewarding stake pool operators and users. Cardano will be here in 100 years and it will be probably cheaper for users to build some business or just use it. So from a sustainability perspective, Cardano is more similar to gold and I am not afraid about the Cardano network in the future. I am afraid of Bitcoin.

Consensus reward fairness

We have already touched the topic above. Cardano rewards participants proportionally exactly by ADA holdings that users have. It is not true in Bitcoin where a few major players grab the majority of rewards and small players on one plugged ASIC miners have no chance to mine a block. Cardano is fairer than Bitcoin in the rewarding mechanism.

Overview

Let’s have a look at the overall result. The used scale: poor, fair, good, very good, excellent.

Evaluation notes

We have taken into account other projects we know so, for example, we did not put the best mark “Excellent” for transaction speed to Cardano. There are a few faster consensus in the crypto-space. DPoS and Ripple/Stellar projects might come to a consensus within a few seconds, however, they sacrifice a certain level of decentralization. We used the mark “Good/Poor” for a transaction fee of Bitcoin since we have already experienced price spikes at the of the year 2017. We considered “fair” for the first time, but gave the “Good” mark to Bitcoin in sustainability, however, at the moment it is not clear whether the team will be able to deal with the issue. We have used many “Poor” marks for Bitcoin. The reason is that in comparison not only with Cardano but with many other projects, it is correct to say that Bitcoin is not decentralized, it is slow and consumes a lot of energy. It is not necessarily wrong and Bitcoin can improve some parameters in the second layer. You can consider the “Poor” mark for Bitcoin in safety as too strict evaluation but we have already seen some manipulation with transactions. Moreover, it is possible to reorganize blockchain and it was considered during the hack of Binance exchange:

https://medium.com/@tamas.blummer/how-to-bribe-miners-to-re-org-d48025cb3788

So despite we considered “Good” first, we finally used “Poor”. Let’s discuss that.

Conclusion

The first layer of Bitcoin will never scale and it will never be used by masses on a daily basis. Still, it can be used as a store of value since it is secure and it has been here 10 years. To be here the next 20–30 years some changes will have to be done to ensure security and sustainability. Cardano will offer much better network properties and we will see whether the protocol will be adopted by users. It is possible that Cardano will be able to serve millions of users, maybe more. It is the project we will probably use on a daily basis and it can also be used as a store of value. The store of value that will scale. There is a lot of room for more projects. Not only for Bitcoin. Let’s find the best usage for each one on our way to a decentralized society.

It is just a theoretical comparison so take it easy. Bitcoin runs for a while and Cardano must still prove that our evaluation is correct. Do not hesitate to contact me if you think something is wrong. I can change it if you persuade me. I am open to discussion.