Why Cardano

In June 2022, I was invited to speak about Cardano at the UTXO cryptocurrency conference in Prague. I thought about what I would tell people and chose the history of the project and its mission. This article was inspired by my PowerPoint presentation. Feel free to use the material and promote Cardano.

Origin of the project

In 2014, Charles Hoskinson left Ethereum and co-founded the Cardano project with Jeremy Wood. Three independent entities are formed, Input Output Hong Kong (later Input Output Global), Cardano Foundation, and Emurgo.

Input Output Global (IOG) is a global company with over 600 employees in 60 countries. IOG is the research and development (R&D) arm of the project. At the time of writing, more than 140 scientific papers related to blockchain technology have been published. IOG is building Cardano as a mission-critical project, i.e. similar to software for hospitals, NASA, or nuclear power plants. There is a very good reason for this. If you entrust your wealth to a decentralized network, it must be ensured that you will not lose your assets.

Cardano is being built slowly and carefully which is probably the fastest way to develop in the long run. The widespread pattern of “move fast, break things” is proving to be a broken model in light of the many hacks in the DeFi space and the recent collapse of the Terra Luna project.

Cardano encourages the creation of research labs in universities to decentralize research as well. Currently, there are research labs at universities in Wyoming, Tokyo, Athens, and Edinburgh. The IOG team does not want to have a monopoly on technology, so nothing they produce is patented. The source code and all studies are open-source.

Cardano Foundation (CF) is an independent non-profit organization based in Switzerland. It is the official owner of the Cardano brand. CF oversees and coordinates protocol development, communicates with legislators from around the world, and lobbies for cryptocurrency-friendly legislation. CF supports those who want to build on Cardano. CF also coordinates Cardano ambassadors, participates in project documentation, and supports the growth of the community.

The initial distribution of ADA coins took place from October 2015 to January 2017, mostly in Asia, due to regulatory uncertainties and ICO mania. You could first buy ADA coins on the exchange in late 2017 when the Cardano network launched. It was briefly before crypto-winter. Cardano survived the bear market as the team used this period to build technology. In 2020, the team deployed Proof-of-Stake from the Ouroboros family. In 2021, Cardano gains smart contract functionality. The team is now focusing on increasing throughput but is also working on other parts of the project. The community grew during the bear market and today the project has one of the largest and healthiest communities in the cryptocurrency space.

Coin distribution

Cardano has capped the number of ADA coins at 45,000,000,000. Approximately 26B coins were sold in the initial coin distribution. The team raised 108,844 BTC.

A portion of the ADA coins was kept by the teams. The Genesis block records that IOG will receive approximately 2.4 billion, Emurgo 2 billion, and Cardano Foundation 648 million ADA coins.

The circulation supply is almost 34 billion ADA coins, which is more than 75%. The remainder, just over 11 billion, will be gradually released into the network through monetary expansion.

Cardano has one of the fairest initial coin distributions. Not many projects can boast that most of the coins are in circulation and not owned by VC firms. But don’t expect influential investors like Mike Novogratz to talk nice about Cardano. VC investors promote the projects they have invested in. Cardano has been in the hands of the community from the beginning and VC firms haven’t had a chance to buy coins promptly.

Charles Hoskinson

Charles Hoskinson is the face of the Cardano project. He is an American entrepreneur who entered the world of cryptocurrencies back in 2012 when he bought his first bitcoins for under $1. Charles also mined bitcoins. He was one of the first people to do a course on Bitcoin. He is therefore familiar with all the OGs. You can still find his course on Udemy to this day.

Charles keeps in touch with the community and holds AMAs where you can ask him anything. Thanks to this approach, and the regular Cardano 360 video series, Cardano is one of the most transparent projects in the cryptocurrency space.

Charles is also an avid reader, farmer, traveler, and most importantly a cryptocurrency popularizer. He has built on the ideas of Satoshi Nakamoto. He mainly sees cryptocurrencies as a way to get rid of inefficient and expensive middlemen and bring decentralization to those who need it most. This approach is rare today, as many influencers are too focused on charts and speculation. Cardano can be seen as a project that builds on the original ideals of Bitcoin.

I sometimes come across the view that project leaders are the point of centralization. I can assure you that Charles doesn’t have a STOP button on his computer that can shut down Cardano. Cardano is a decentralized network in the hands of the community. Our team runs the pool and produces the blocks. So do hundreds of other independent people all over the world.

Steve Jobs left Apple and the company continues to be very successful. People continue to trust the brand and buy the company’s products. You could say that the company has survived the departure of its leader. And you know what, blockchain networks are independent of people, including leaders. As long as it is economically worthwhile to keep the network running, people will do it.

Jackson Palmer created Dogecoin from a fork of Litecoin. Now he is very skeptical and dismissive of all cryptocurrencies. Elon Musk has taken a liking to Dogecoin and the project continues to live its life.

Satoshi Nakamoto abandoned Bitcoin and nothing happened. Cardano is not dependent on a leader. It is dependent on the team, but much more importantly on the community that believes in the project and wants to see its mission realized. Charles can’t make you change the world. Many people around the world can do it if they pull together. Vision is what is important. Charles is only the one who gives it with his mouth.

If a leader leaves the project, there will always be another one. It may be a larger group of people who come to the fore. It doesn’t matter who it is. What matters is where it takes the project. It happened to Bitcoin too, Satoshi left the project and today we can see new faces like Jack Dorsey, Michael Saylor, or Jack Mallers. Do you like what these new leaders are saying? Whether you do or not, in the end, it doesn’t matter.

Let us add that Charles is not a maximalist. He respects Bitcoin and other projects that deserve attention. The blockchain industry is first and foremost about technology, and no one has a monopoly on its development.

The context of the time

If you want to understand why Cardano was created, you have to go back in time to 2015/2016. At this time, blockchain is already considered by experts a disruptive technology that can change the world, much like the Internet. However, blockchain technology was not ready for the mainstream.

The biggest problem at this time was scalability. No one knew how to solve this problem without sacrificing network decentralization. The Lightning Network white paper isn’t coming out until late 2015. It is only now in 2022 that the network is starting to be usable, but it is still not certain if it is ready for mass adoption.

It was believed that Proof-of-Stake (PoS) could not be created and would not work. Seen through today’s lens, Cardano is existing proof that PoS works.

Charles paid for lunch with bitcoins and realized that volatility prevents the use of volatile assets for routine payment. Time has confirmed that people view bitcoin and other cryptocurrencies mainly as speculative assets. To this day, bitcoins are not used for payments, and don’t expect that to happen within the next decade. Without stablecoins, it seems to be difficult to establish cryptocurrencies as a means of payment, especially in developing countries.

Even at the time, there was speculation about the economic sustainability of the Proof-of-Work concept and the phenomenon of the declining security budget. I will talk more about it in the next chapter since I consider that a very important topic.

There was also talk about the high energy intensity of PoW and the community wondered if people would adopt a protocol that was environmentally unfriendly. As we can see today, this issue is still not resolved. In China, PoW mining has been banned. America and the European Union do not know how to deal with the problem and occasionally a proposal to ban PoW comes up.

The IOG wanted the concept of decentralization not to depend on PoW. PoS is a solution that is environmentally friendly and ensures that we can continue to develop the original ideas without PoW.

Another big topic was the centralization of Bitcoin. With the centralization of mining in large halls, people feared that one day only the entrepreneurial people who had enough capital to buy ASIC miners and could get discounts from hardware and energy vendors would mine. This proved to be a relevant concern. According to one study from 2021, 10% of miners today control 90% of the hash rate. 0.1% (which is about 50 miners) control 50% hash-rate.

The IOG team recognized the potential of smart contracts and tokenization and needed a platform where new concepts could be developed and tested. This was not possible to do on Bitcoin without major protocol changes. There was a lot of debate over whether a rigid approach to Bitcoin development was the best way to go. The reality is that in order to try new concepts, new projects had to be built from scratch.

During these debates, other questions were raised. For example, who has the right to decide on protocol changes and how maintenance and development should be funded. VCs are flocking to cryptocurrencies and companies like Blockstream or Lightning Labs are VC-backed. People started talking about decentralized governance.

To this day, there are many other problems. For example, the public blockchain is transparent and everyone can see the transactions of others. The privacy of users suffers as a result. In addition, projects with a focus on privacy have been delisted from centralized exchanges. How to properly handle privacy and meet the requirements of regulators is a complex technological problem.

If you see the emergence of the Cardano project in the context of 2015, you realize that many questions were asked and no one knew the right answers. It made sense to start building a new project from the very beginning and to explore the various aspects of cryptocurrencies in detail.

Uncertain sustainability of PoW

Let’s take a closer look at the long-term sustainability of PoW networks.

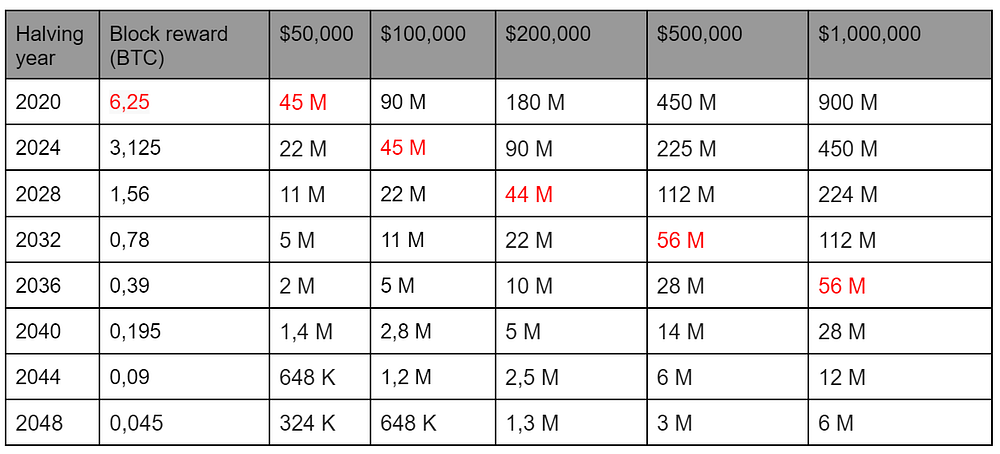

If the value of BTC is say $50K, the daily security budget is approximately $45 million. In the table, you see the halving year in the first column and the corresponding block reward in BTC next to it. The value marked in red corresponds to the security budget in the years of halving, if the budget is to be approximately the same as for a BTC value of 50K USD.

The value of BTC must rise at least 2X every halving indefinitely for Bitcoin to remain approximately as secure as now for decades to come. The potential problem is that the last ATH after halving was approximately 3.3X from the previous ATH in 2017. Bitcoin may not do 10X or more in the next few years. From a network security perspective, this is a serious problem.

Network security and decentralization are key features that need to grow with adoption. It is not desirable for the financial and social importance of the network to rise while the key features decline. A successful attack would do more damage than it does now. Moreover, the motivation to commit an attack will grow with adoption. The dependency of security on the ever-increasing value of BTC is not an ideal design.

As you can easily calculate for yourself, the value of BTC needs to be around $1M in 2036 for the security budget to keep up. By 2048, it must already be 7M USD. Bitcoin’s market capitalization will far exceed that of gold. Is this realistic? Unfortunately, no one can answer that question. Building a business on Bitcoin can be uncertain. Companies or countries want to build solutions for decades and it might not be a smart decision to build on Bitcoin. If we are to be intellectually honest and not obscure the facts, we don’t know if Bitcoin will be around in 10–20 years.

The table does not take into account the cost of hardware on the other pillar of revenue to the security budget, namely transaction fees. We already see people migrating to other layers or networks to avoid expensive on-chain fees. We can’t rely on people (or businesses) to routinely pay $1,000 for each Bitcoin transaction. We cannot imagine that anyone will voluntarily subsidize network security out of their own pocket when other, cheaper alternative networks will exist.

Let’s do a quick calculation on the possibility of a 51% attack on PoW and PoS networks. When the value of $BTC drops, so does the security of Bitcoin. At the time of writing, the value of BTC is about $25K. The current cost of a one-day 51% attack is about $23M (ignoring the TX fees and HW cost). The value of ADA coins is approximately $0.45. The same attack on Cardano would cost at least $7.5B. Thus, an attack on Cardano is about 325x more costly than an attack on Bitcoin. People seem to be planning to stake during a bear market and more than 72% of ADA coins are currently staked. An attacker would have a big problem buying enough coins for an attack. The value of the ADA coins would go up with higher demand from the attacker, which would simultaneously trigger demand from other buyers.

Let’s face it, as a community, and I’m speaking for the Bitcoin community now, we are failing in the security budget debate. We need to recognize that the problem is not as remote as we sometimes delude ourselves. We need to realize that the debate over the solution to the problem and the implementation of fundamental changes to the protocol could take as long as a decade. We must look for solutions today.

Evolution has never stopped in history

Humans have always been very good at improving technology. Blockchain will be no exception to this rule. Evolution is always about the science and research of the underlying technologies that can be used for something bigger.

Bitcoin would never have come into existence if the concept of blockchain did not exist. The concept of blockchain was first described by cryptography expert David Chaum in his dissertation back in 1982. The crucial work on a secure blockchain (literally a chain of blocks) came from authors Stuart Haber and Scott Stornetta in 1992.

Cynthia Dwork and Moni Naor invented the concept of PoW in 1993 as a way to deter denial-of-service attacks and other service abuses such as spam on a network by requiring some work from a service requester, usually meaning processing time by a computer.

Many other technologies like hashing functions, asymmetric cryptography, distributed system theory, and internet protocols had to exist before Satoshi Nakamoto was able to create Bitcoin.

By combining several technologies, Satoshi solved the problem of the Byzantine generals and constructed the so-called Nakamoto Consensus. Proof-of-Stake, as implemented in Cardano, also uses the Nakamoto consensus. Simplifying, I can say that the PoS on Cardano is similar to how Bitcoin works, except that instead of consuming energy, modern cryptography is used to determine who gets the right to produce new blocks.

It is possible only through innovation and improvements in technology that we can ensure that the concept of decentralization is here to stay for decades to come. Should we bet on one horse or have more than one at the starting line? Surely diversity and competition are better. Competition between teams is healthy and beneficial to users.

One of the basic principles of evolution is finding the best strategy for dealing with resources, as this is the only way to ensure survival. Every increase in efficiency will allow for higher adoption and use in new areas.

Let’s take an example. Each new car travels a longer distance and carries more cargo while consuming less energy. Innovation is making cars cheap and accessible to everyone on the planet. With higher efficiency, the impact on nature is lower. Market pressure is forcing car manufacturers to produce increasingly efficient engines. Laws are even forcing manufacturers to reduce exhaust emissions.

In the case of the blockchain industry, exactly the same market principles will apply. Greater efficiency will allow more and more people to use the first layers, and transaction fees will continue to decrease over time. It’s entirely possible that legislators will push for greater efficiency in network consensus and PoW may not like it. While I don’t think it’s reasonable to ban technology, we may see PoW banned with the argument that consumption is excessive regardless of whether clean or dirty energy is consumed.

There will certainly be people who are green-minded and may not like Bitcoin’s energy-intensive network consensus. It’s never happened in history that 100% of the population has agreed on one solution. A competitive environment is important for technological progress.

I am of the opinion that only the utility of the first layers can provide sufficient profit for the long-term sustainability of the network. Public networks are like businesses and have to pay their expenses. If the utility is taken over by second layers and other networks, they will profit at the expense of the first layers.

The only thing we can count on in the future is change. We will have to adapt to this change. Developers will have to constantly look for solutions to new problems. There is no technology that can survive for long without adapting to new conditions. The advent of the Internet has disrupted literally every industry. This can now happen again with blockchain technology. However, protocols must be maintained and adapted to new requirements. Decentralized governance appears to be a necessity.

Proof-of-Stake is proof that evolution works in the world of cryptocurrencies. This is not to say that this consensus is better than Proof-of-Work. It has different properties and thus different assumptions about adoption and usability. It has a better chance of surviving for several decades due to its greater efficiency and lower costs for maintaining the network. Proof-of-Stake is about 110,000 times more energy-efficient than Proof-of-Work. Therefore, it won’t have as much trouble with a shrinking security budget. But perhaps another, even better concept will emerge. Evolution didn’t end with Proof-of-Work, and it won’t end with Proof-of-Stake. Significant innovations are not only happening at the level of network consensus. The UTXO accounting model has also been upgraded thanks to the IOG team and is called Extended-UTXO.

It is naive to think that evolution has stopped at Bitcoin and we will never invent anything better. The opposite is true. We have a lot to look forward to.

People keep going on and on about whether more programmability of the blockchain is needed. Just look at the history of what Javascript has brought to the world of the Internet. Anyone who remembers Web1 probably knows that there wasn’t much else to do besides reading content. Programmability enabled the creation of social networks, and communication between people largely migrated to the Internet. Internet banking would never have happened without the ability to click a button.

The mission of the Cardano project

The IOG team is building Cardano as an inclusive, secure, and stable financial infrastructure. Cardano will not just be a transaction system. It wants to offer people alternative banking services. A decentralized identity will be an integral part of the solution, as people need this to interact with authorities and with each other.

A lot of emphasis is placed on a high degree of decentralization, as this is the feature that distinguishes the blockchain industry from conventional services. Moreover, the security of the Cardano network is largely dependent on decentralization, as it grows along with the distribution of ADA coins.

The team is committed to empowering people to own and make decisions about the infrastructure they use. This is a very complex technical problem. However, the team is on the right track and the Catalyst project proves that people can make decisions about the ecosystem without leaders.

Cardano is not a protest project that aims to overthrow governments and the demise of banks. The team is open to communicating with anyone and is working to make sure that regulations are fair to cryptocurrencies and do not hinder the entire industry from further innovation. If a blockchain is to be adopted in a particular country, it is more important to work with the government rather than try to adopt it behind its back. Let’s be realistic. Once cryptocurrency adoption threatens a state’s interests, a sudden reaction could have a negative impact. Debate and cooperation are certainly a more straightforward path, and at this point, every country in the world already knows about and regulates cryptocurrencies anyway.

The mission of the Cardano project is not to make ADA coins the new global money. No one ever said that can’t happen and that you can’t pay with ADA coins. But the team’s primary focus is on technology and finding ways to take the concept of decentralization wherever it will help make the world a better place. ADA coins are owned by the people and they can decide what they want to do with them. Through voting, people will be able to influence the future direction of the protocol. BTC coins can give you control over your wealth. ADA coins can give you the same and in addition control over the global infrastructure.

Sometimes I feel that some projects try to make a universal technology without solving a specific problem. Charles Hoskinson and his team have traveled around the world talking to governments, bankers, businessmen, and ordinary people about their problems. The mission of the project is shaped by the people and the team can focus on concrete solutions to real problems. Part of the IOG team is permanently based in Africa so that communication can be ongoing.

Through discussions, it became clear that many problems stem from corruption, fraud, non-existent digital infrastructure, abuse of power by intermediaries, and more. If I was to define it in one sentence, I would say that the problems stem from breaches of trust. A blockchain is inherently a trust machine, so it can solve many real problems.

Definition of success

Cardano will be successful if it provides people with a financial identity. Especially to those people who currently don’t have it and need it the most. That is, especially people from developing countries. However, even in developed countries, there are people who have no official identity. Even millions of people living in the USA face this problem. You will find in various statistics that 2 billion people on the planet have no identity.

Banks, companies, and possibly even countries should not own our identities. Ideally, people should decide for themselves who they trust with their private information. Decentralized identity solves this problem. Cardano has partnered with telecommunications firm Dish to use a decentralized identity. This is one of the first steps to making other companies see that it is not necessary to manage customer identities. This can put privacy back in the hands of the people.

It is clear that decentralized technologies can increase people’s sovereignty and freedom. If African countries choose to use decentralized identity management solutions, they may be freer than many Western countries in another decade.

People must be able to do without expensive and inefficient intermediaries. Middlemen will always, sooner or later, abuse their position unless there is a competition or a law that defines the exact rules of the game. If we leave the rules to blockchain technology, no one will change and abuse them to their advantage over time.

Cardano wants to enable the transformation of business models, and there is a good chance it will succeed. Governments and Fortune 500 companies are slowly adopting decentralized technologies. Today, there is no doubt that blockchain will have a similar impact on the world as the internet. People tend to overestimate the impact of disruptive technologies on society in the short term and underestimate it in the long term. People want to see miracles tomorrow and are constantly waiting for some big announcement while the transformation has been subtle and slow. In 10–20 years, blockchain will be everywhere.

People in developing countries do not need volatile assets, but money that maintains stable purchasing power over a longer time horizon. It is clear to the IOG team that tokenized dollars and algorithmic stablecoins are a much more useful payment medium than the native coins of blockchain projects. Djed is an algorithmic stablecoin that will be an integral part of the Cardano ecosystem in 2022. All banking services, especially loans and insurance, need to work with stable value. This is true not only for developing countries but also for mainstream adoption in Western countries. If ordinary people are to use alternative decentralized services, volatility must not be a barrier.

The team building Cardano has some very ambitious goals. For example, creating a platform that would allow people around the world to communicate, vote, and even decide on funding for global issues. Politicians routinely fail to address serious global problems related to climate change, for example. What is difficult to imagine today may one day be a reality. Again, I would like to point to project Catalyst, or other emerging decentralized organizations (DAOs).

Blockchain technology must be integrated with current systems and gradually replace obsolete technology. We are still at the very beginning of this process. Integrating the two technologies is relatively complex and institutions are very cautious. It can take years before they decide to completely switch to something completely new. Anyway, I’m sure it will happen.

Why does the team focus on developing countries?

Cardano is often associated with developing countries. The reason is simple. These countries often lack basic financial and social infrastructure, yet governments would like to innovate and move to digital infrastructure. It was easy for the IOG team to arrange a collaboration. Governments in developing countries often welcome help while developing countries have a functioning infrastructure. In Western countries, it is difficult to overcome the bureaucratic barrier and explain the meaning of innovation.

Western countries have a functioning banking system, citizen identity management, land registry, it is possible to pay taxes and services digitally, etc. In developing countries, people may not have access to these basic services. It happens that people have to pay at the office several times a month.

It is always easier for any team to build new infrastructure where none exists. There is no need to overcome any obstacles or to integrate complexly with an existing solution. However, teams face other complex challenges.

In developing countries, it can be difficult to build infrastructure due to high corruption. Blockchain has the advantage of being available everywhere in the world. If people have access to the internet, they can use all the services available on Cardano.

The advantage is that once services are created, people will naturally start using them because there is no alternative. The new services start making people’s lives easier immediately and adoption can be very quick. For Cardano, this is an opportunity to get tens of millions of users on the net in a short while. It is important to mention the users who will really use the network on a daily basis. People in the West often use cryptocurrencies only for speculation and thus have virtually no use for them in terms of interaction with each other. Developing countries may soon be champions when it comes to the volume of transactions per day.

Traditional banks are profit-oriented and have little interest in offering their services in developing countries. Moreover, if people have no official ID, no one will open a bank account for them. Blockchain is mission-oriented by default. Anyone can use it without permission. This also applies to the government, which will use it to communicate with its citizens.

Which sectors will be disrupted?

Don Tapscott is a Canadian business executive, author, consultant, and speaker, who specializes in business strategy, organizational transformation, and the role of technology in business and society. He is the CEO of the Tapscott Group and the co-founder and Executive Chairman of the Blockchain Research Institute. He and his brother Alex wrote the book The Blockchain Revolution: How the Technology Behind Bitcoin is Changing Money, Business, and the World.

Don believes these and other industries will see disruption from blockchain technology: money, financial services, identity, property rights, healthcare, telecommunications, supply chains, social networks, and governments.

If you think about it, you will see that the slow disruption is already happening. DeFi is essentially about the disruption of financial services. Thanks to Cardano, students, and teachers in Ethiopia will have their digital decentralized identity on the blockchain. Many people are working on disrupting all the sectors listed.

Do we need more blockchains?

Many people wonder if everything could be built on Bitcoin. I don’t think it could.

First of all, you have to remember that negotiating with governments takes time. People have to travel to a country and stay there for a while. The question is who would do that in the name of Bitcoin. Bitcoin positions itself as a decentralized network that doesn’t need spokespeople. That certainly doesn’t mean that people aren’t trying to achieve a higher adoption. But the question is what they can talk to governments about and what they can guarantee.

Governments need to talk to someone competent, ideally a team representative, because they need to know who will fix any problems. Further, if possible have requirements for functionality or integration and want to know who will do it. Governments want assurances that the network will remain functional and secure over several decades. No one wants to build infrastructure for a few years. As we showed in the introduction, no one can predict the value of BTC in the next 10–20 years. Thus, no one can guarantee that Bitcoin will remain as secure as it is today in the decades to come. It may be risky for governments to build infrastructure over Bitcoin.

It is also important that transaction fees remain low in the long term. Governments want to know how the system will behave in ten years. Imagine if suddenly the transaction fees on the first layer went up 10 times. This is an unacceptable situation for developing countries. Who can say unequivocally on behalf of Bitcoin that if the fees at the first layer go up, someone will try lowering them through technological innovation? Probably no one can guarantee that. The Lightning Network is not necessarily a satisfactory answer, as the charges on the first layer must always be paid by someone.

Cardano has a tremendous advantage in that the project is being built precisely to build a financial infrastructure on top of it. Everything is built slowly, carefully, and thoughtfully. Anyone can look at the scientific studies and the source code of the project. The academic background, the strong team of experts, and the quality of development are something that governments must like.

Some governments may be concerned about the environmental impact of PoW mining and may prefer more environmentally friendly solutions. Moreover, governments do not want to expose their citizens to speculation on a volatile asset. They want to build something completely different than what Bitcoin offers. Bitcoin is essentially just a transaction network with a volatile asset. That’s probably the most fundamental difference when you compare it with Cardano. Governments want to build basic services such as identity management, payment systems, cadastres, banking services, and connectivity to the outside world.

The missions of the two projects are different. Let’s not try to make Bitcoin the financial backbone of the world. It is unlikely to succeed, as it is seen primarily as a store of value.

While Jack Dorsey came up with the idea of building a decentralized identity on Bitcoin, the question is how the community will like it. Cardano already has such a solution and is deploying it at the moment. The community may want to defend the status quo of Bitcoin and has no interest in technological innovation. The Cardano community is literally the opposite, and the ability to evolve is one of the protocol’s greatest advantages.

Bitcoin is not technologically suited and prepared for the mission Cardano is trying to achieve. This is perfectly fine and there is no point in comparing the two projects and competing about who is better and why.

Conclusion

The text is based on my PowerPoint presentation and questions from the audience. Feel free to talk about Cardano with your friends and think about its uses. The world around us is constantly changing. All we can do is adapt to that change or use it to our advantage.