What does it mean for Cardano to be a platform?

Cardano has entered the Goguen era in 2021 with it becoming a smart contracts platform. This brings many benefits and the potential is tremendous, but it requires some caution from users. Let's explain what the platform is and what it means for users.

TLDR:

- A platform is a kind of environment in which a program can be executed. You can use smart contracts on a Cardano platform.

- Smart contract apps are created by third-party developers and their intentions may not always be honest.

- Cardano may be the most secure platform in the world, but that doesn’t mean it will automatically apply to third-party applications.

- The IOG team takes no responsibility for third-party applications. IOG is only responsible for the Cardano platform. Everyone in the world is free to decide how to use it.

- Cardano will have an appStore and certification program. Users will have more confidence that they are using quality and secure apps.

- It doesn’t matter if we know the authors of applications or not, because more important is open and freely accessible source code that anyone can look at and verify its correctness.

- Do we need platforms? Let’s ask a better question. What we want or can improve in our society through decentralization. Then we can ask how to achieve that.

- It does not make sense to own the value via a blockchain network and then, the moment you need to use it in the real world, lose this absolutely crucial advantage and entrust the coins to a third party that enables fast payments or other financial services.

- A rich ecosystem has many advantages. First and foremost is the large network effect. The more options a platform has, the more it will be used.

What is a platform

We guess you already know well what is a platform but maybe you are not aware of it. Let us explain. To put it simply, a platform is a kind of environment in which a program can be executed. If you read this text you have a computer with your favorite operating system. It does not matter whether it is a Samsung cellphone with Android OS or a laptop with Windows OS. You can download an arbitrary application from the Internet and run it. It can be said that you can extend the possibilities of your computer and thus you have access to more functionalities. For example, you can download a movie and use a player to watch it. You can also chat with your friends, or use internet banking. You basically decide about functionalities you want to have on your computer.

Every program, or if you want an application, has to be written by someone. Programmers produce applications for a specific platform. So programmers must have some kind of development environment that allows them to write the application. For example, it is possible to write an application in the Java programming language. The programmers download the Java development environment and write the application. They then test this and, if it works as expected, offer it in some form for users to download. The application will only work for users who can run it on their computers. Fortunately, Java is supported almost everywhere.

Broadly speaking, the platform is your hardware and operating system with support to run Java applications. However, a platform can also be a web browser that allows you to run extensions. Programmers need to know how to write such an extension and what development environment to download.

What is a Cardano smart contract platform?

Cardano allows developers to write a smart contract (script) in the programing language Plutus. Plutus smart contracts consist of two parts: the on-chain part that is executed on the blockchain, and the off-chain part that is executed on the user’s machine or client’s side.

For simplicity’s purpose, let’s say that a smart contract is an application. The application is written by third-party developers. Users can decide to use the application. If they decide to do so they interact with the off-chain part of the application. They provide inputs or instructions that result in the execution of the on-chain part. For example, a swap transaction can be constructed that is executed in the blockchain. To be more precise, there is a special piece of software, let’s call it a Virtual Machine, that is dedicated to executing applications. Virtual Machine understands the Plutus smart contract instructions (the code written by developers) and executes them.

Smart contracts are executed in a decentralized way so they do not rely on third parties or centralized entities. They are stored in the blockchain and the whole network can verify the execution. The process is transparent and irreversible. It means that once a given smart contract is deployed and given conditions are fulfilled based on an interaction of users, given pre-programmed actions will be taken.

For example, if a swap condition is met (funds of Alice and Bob are in the escrow, or value fed by an Oracle is as expected), given transactions are created to swap tokens between Alice and Bob. The result of the smart contract execution will be stored in the blockchain forever. It means, that both Alice and Bob will be exclusive owners of swapped tokens until they decide to send them to somebody else.

You can see the platform as a layer or extension above the basic Cardano layer, which provides absolutely basic operations such as network consensus, network transaction transfer, ledger maintenance, staking, etc. The platform offers options to extend this basic functionality by issuing tokens, programmability, integration with other networks or services, etc. The basic Cardano layer, for example, will not allow the creation of stable coins, as it needs to work with inputs from the real world, specifically with the real market value of assets. If digital coins, such as the ADA, are to be used as a reserve asset, there must be some automated logic that will take care of issuing stable coins and reserve tokens. For a stable coin to gain the trust of users, it must be decentralized. This means that smart contracts must be used to automate the logic of all needed processes.

Let’s give another example. The transaction network will allow Alice to send coins unconditionally to Bob. The platform will allow developers to build a service that can temporarily lock coins in safekeeping and send them to Bob only if a specific condition that Alice and Bob agree on in the physical world is met. Bob will only receive coins from Alice if he sends her a certain number of other coins. Alice and Bob can thus reliably exchange ADAs for wrapped BTC or NFT, for example.

The trust model of platform users

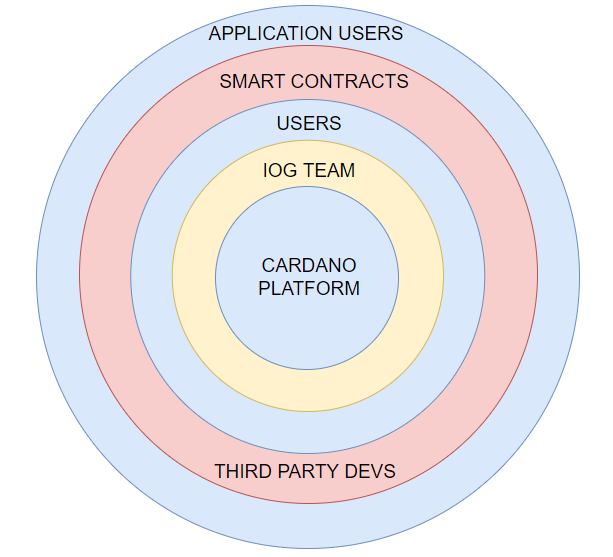

Now you have a good idea of what a platform is in the world of blockchain networks. Let’s describe the trust model from the perspective of the platform users. You can think of it as layers, where the bottom one represents the Cardano platform and the top one represents the users. There are many layers in between.

- Cardano is a decentralized blockchain network that is maintained by nodes. The first layer contains the blockchain, transaction network, and stacking capabilities. Cardano is a platform, so in this layer, there are also Virtual Machines that execute smart contracts and many other pieces of infrastructure.

- The IOG team is responsible for the development of the Cardano network, including all the tools and infrastructure that make it a platform. In the context of the trust model, the team is also responsible for developing the Plutus development environment, which is used by third-party developers to write smart contracts. The team strives to provide the most secure infrastructure and tools for running third-party applications.

- Users are not forced to use third-party applications and can only use Cardano. This means using the functionality that the IOG team is responsible for. Specifically, to send transactions, issue custom tokens, or delegate coins within staking. Using these basic features of the Cardano network does not require trust with third parties.

- Third-party developers who write applications are also users in a way, as they need to use Plutus development environments, test-nets, Virtual Machines, etc. Third parties trust the IOG team and the Cardano platform. Once they deploy their smart contract applications on the Cardano main-net, users can voluntarily use them.

- Users who choose to use the smart contract application trust not only Cardano platforms but mainly third-party developers and their ability to ensure the security of their application. Things like security, privacy, source code quality, usage fees, availability, etc., all of this is in the control of the teams that create smart contract applications.

There is no direct link between the IOG team and third-party app developers. The IOG team is only responsible for the quality of the platform. This means that they are in control of the network decentralization, scalability, Virtual Machine, Plutus development environment, developer documentation, etc. The IOG team is not responsible for the behavior or the applications delivered by third-party teams. It is important to be aware of this distinction.

Third-party teams may not be competent and may not produce a quality application. If there is a bug in the app, users may lose their wealth. The teams may even be scammers. For example, they may ask users to subsidize a project by delegating coins to a staking pool they run. After collecting ADA coins, they may never deliver the project and the tokens they gave out to delegators will be worthless.

Anyone in the world can issue their own tokens on Cardano. The real value is usually decided by the issuer. Tokens can be a promise for the future, just a reward, or they can represent things in the physical world. It is up to the users to verify the value of the tokens. If, for example, Apple decided to issue APPL tokens on Cardano and said that a long-term holder of the tokens would get a 10% discount on new merchandise from the company, the tokens would gain value. If a scammer names the tokens that way and claims the same thing, the tokens would have no value and would be a scam.

The IOG team is responsible for the platform and its capabilities. The platform can be used by anyone in the world to realize their goal. However, the goals may not always be sincere. Thus, the platform can be misused to enrich fraudsters. If you put powerful new technology in people’s hands, some will use it to build beneficial things for others, others will abuse it. The building is always harder than cheating. Each person, and by extension, the decentralized service, must earn their trust. This may take time.

It is necessary to distinguish between what a decentralized platform is and what an application is. Decentralization will not protect you from fraud. If you fall for a scammer who promises to send back double the coins you send him, it’s your fault. You signed the transaction. In this scenario, the transaction network and the fact that everything is done in an anonymous environment were used to commit fraud. The app is a sort of extension over the capabilities of the transaction network. It is a kind of extension that allows developers to add new functionalities, such as decentralized exchanges. This advantage is balanced by the fact that the authors of the applications must be trusted.

It works exactly the same in the traditional world. Anyone in the world can create a fake Java application and try to get you to download it to your computer. If you do that, the application will somehow harm you. You can’t blame the manufacturer of the computer or the operating system. They didn’t do anything wrong. You chose to download and install the application from an untrusted source, or from an untrusted vendor.

Experienced users only install trusted apps on their computers or phone. For example, the Office application from Microsoft, which also produces the Windows operating system. In the case of the Cardano network, users can only use the transactional network and staking. In this case, they only trust the source code, which is largely contributed by the IOG team.

We don’t want to give the impression that using smart contract apps is dangerous. If the app is well written, the source code is public and anyone can check it, and the app is used by a large number of users over a long period of time, the risk of losing wealth decreases significantly. If a decentralized exchange works for more than a year without problems, you can use it with confidence too. The dAppStore and certification program will help increase trust.

Cardano may be the most secure platform in the world, but that doesn’t mean it will automatically apply to third-party applications. Never forget this.

Application store and certification

Can the IOG team do anything to help people protect their wealth? Obviously, in a free decentralized world, the IOG team cannot vet all third parties and determine which projects are legitimate and which are not. The Cardano platform is open to anyone who wants to use it and build their services on it. To protect users, it is possible to build something similar to what already exists in the traditional world. You are probably familiar with App Store what is a kind of marketplace for applications that you can download to your smartphone. Cardano will have something similar. A dAppStore and a certification process will be available to ensure that users will use verified and secure applications.

Developers will be able to upload their dApps to the dAppStore. Thus, they will become available to other users. It must be said that there will be no censorship on the dAppStore and everybody will be able to upload dApp.

Naturally, it will be possible not to use dAppStore and promote dApp in your own way.

Developers can freely decide whether they let their dApp be certified. A certified dApp gives users assurance about the behavior of smart contracts. There will be a kind of automated logic checks, manual auditing of smart contracts, and even the possibility of formal verification. People will naturally trust more certified dApps since there will be a certainty that they behave as expected. A process and/or someone competent has verified that.

Users will see all available applications on the site, including certification status. Other metrics such as the number of downloads, user satisfaction, lifetime, etc. may be available. The role of the certification program is the prevention of code-level security vulnerabilities. Every team can introduce a bug unintentionally that can lead to the loss of users’ wealth. The purpose of the certification is to discover bugs before the applications will be used. This type of protection might not be 100% bullet-proof. However, the level of certainty will be much higher than we can see in the current DeFi environment.

Decentralization, anonymity, and trust

Some people are not clear about the possibilities of decentralization and what role people play in it. Every program had to be written by someone. This applies to the first layers of the Cardano network, but also to Bitcoin. It doesn’t matter if we know the authors or not, because more important is open and freely accessible source code that anyone can look at and verify its correctness. Confidence in the project is thus built primarily on the source code and the time for which the code works reliably.

The source code authors do not own the network and have no way to influence it. For example, if they do not have the resources needed to create new blocks, they cannot do so, as well as prevent anyone else from doing so. Decentralization ensures that the network runs completely independent of the team that wrote the source code. Of course, each network has a team that maintains the source code. Source code writing cannot be fully decentralized.

In the case of smart contract applications, the principle is exactly the same. Someone writes the source code of the smart contract and offers it for use. If a team reveals its identity, it can be more trustworthy, as it goes to market with its own skin. If a team wants to remain anonymous, it can make someone feel like they want to do something wrong. Of course, this may not be the case and the reasons may be different. For example, a team may want to avoid prosecution. From the point of view of trust in the source code, anonymity is not necessarily required, as other people may declare that the code is well written and will most likely work well.

Decentralization can provide features such as the immutability of history, resistance to transaction censorship, free access, and more. Most importantly, however, no individual can change network properties and no one can stop the network. No one can do this internally, such as a team, or externally, such as the authorities. In the context of applications, this means that their execution has the same properties as the network itself.

If Alice signs a transaction that sends 1000 ADAs to Bob, no one is able to prevent that transaction. Some random node in the network places the transaction in a new block, and the rest of the network accepts the block with the transaction from Alice. It works very similarly with applications. The execution of a once deployed application will be unstoppable and the execution will be distributed so that no centralized entity will have control over it. If any team deploys a decentralized exchange, for example, it will have no control over token swaps.

Do we need a smart contract platform?

If you look at today’s world and the financial processes that take place in it, you will find that they are more complicated than just direct payments from sender to recipient. The financial world works on trust between the individual participants and at the same time on their trust in the authorities and the legal system. If the payment participants don’t know each other, they don’t naturally trust each other very much. In this case, it can be difficult for them to interact financially. With declining confidence, the risk of losing funds increases. Concluding an agreement in an untrustworthy environment is more difficult and usually requires some form of contract. Both parties need to rely more on the legal system.

Financial operations can be long-term in nature. It is not always possible to pay immediately for a specific good or service. Sometimes it is necessary to pay in advance or, conversely, to defer payment. It is quite common for payment to be conditional. Loans are a typical example of a long-term financial operation. One party will lend the other a larger amount of money and expects the other party to repay the loan on a regular basis in smaller amounts. Although the loan can theoretically be implemented through a number of transactions between participants, these transactions have a certain context. There may be some interest rate and regularity in the game. The higher complexity of financial operations requires higher complexity in terms of network or platform capabilities.

People are not equal at the level of their status. We live in a hierarchical arrangement and some people can have delegated power. Our company will always have elected representatives and authorities. These people will be given the opportunity to dispose of resources that are not theirs but are entrusted to them. Businesses or larger financial institutions are in a stronger position because they serve more people and have something that others want to use. People are forced to trust these institutions, but their trust is often abused.

We could transfer the question of whether we need a platform to another question. What we want or can improve in our society through decentralization. We can see the problem of breaches of trust in many places in our society, and it is clear that a mere transactional system cannot improve them. An ordinary transaction system cannot handle as many basic financial operations as a trustworthy escrow.

If two parties who do not trust each other were to exchange two digital assets with each other only through transactions, they would have to find a third party that they both trust. A third party, such as a notary, would have to receive transactions from both participants and then make an exchange. If the parties did not use the services of a notary, one of the participants could easily commit fraud. He would wait for the other party to send him assets and then keep his assets, as well as the other party’s assets.

It makes sense to add functionality over a decentralized transaction and monetary system and thus increases the capabilities of the alternative financial system we want to build. That is exactly what we need the Cardano platform for. Today, no one knows exactly what we can decentralize and what intermediaries we can replace. It is not just a question of the possibilities of technology, but also of the choice of people and the acceptance of change by the people who are in power today.

Imagine that everything will remain as it is today, including the strong position of banks, big IT giants, governments, and the only thing that will change will be the replacement of fiat currencies for cryptocurrencies. Do you think that is possible? From our point of view, it is not. As decentralized networks become more and more popular in society, fundamental changes will take place at the social level. Banks cannot function in exactly the same way if cryptocurrencies prevail at the expense of fiat currencies. However, let’s not expect fiat currencies to be replaced by cryptocurrencies. Fiat currencies will undergo their own transformation and will be digital.

The platforms will be useful by allowing people to own the financial infrastructure they will use. This means that everything, including fees, changes, enhancements, etc., will be under their control. All the qualities we admire for decentralization can be preserved and no centralized authority will be able to influence it.

Further development of platforms will make it possible to increasingly replace common centralized services and processes. The future will be decided by the majority, not a few people with a strong position. This does not mean that humanity will get rid of the hierarchical order. Rather, we can expect some reorganization of society and a redefinition of the social contract. But that is the distant future. We have to start with small things like decentralized escrow services and the ability to exchange assets without centralized intermediaries. Additional services and functionalities will be added to this.

We need to constantly push the boundaries of decentralization. This is a natural human trait and it will happen whether we like it or not. The emergence of Cardano can be seen as a logical continuation of the evolution of decentralization. Cardano will allow us to build a rich ecosystem with a place for everyone. If Cardano succeeds, the boundaries of freedom will be shifted.

Let’s build a rich decentralized ecosystem

The Cardano platform will enable a rich decentralized ecosystem. The first generation of cryptocurrencies only has a transaction system, so the possibilities for use are very limited. As a user, you can basically only send and receive one kind of volatile value. The problem is that the transaction system of the first layers cannot be used for regular payments as the transactions are slow and expensive. If the biggest advantage of blockchain technology is the ability to exclusively own assets without third parties, it makes no sense to use other than decentralized networks to transfer value. The moment users are forced to give up possession of their own private keys, we return to a centralized world. It does not make sense to own the value via a blockchain network and then, the moment you need to use it in the real world, lose this absolutely crucial advantage and entrust the coins to a third party that enables fast payments or other financial services.

Each individual user decides how much decentralization they want. However, we do not believe that entrusting cryptocurrencies to third parties for normal financial operations such as escrow, loans, insurance, buying and selling other financial assets, etc., will have a sufficiently disruptive effect on society. If these services are offered by the Cardano platform, we believe there will be people who will take advantage of them. This will weaken the position of current inefficient intermediaries, such as banks, and in turn, promote a decentralized network.

The ability to issue tokens is a way to greatly expand the capabilities of the Cardano platform. Once an existing business decides to use tokens within their business, the tokens can have real value and represent physical things. If the legislation allows it, and it seems that we will see the necessary regulations soon, it will become realistic to tokenize, for example, shares. So you can have not only your favorite cryptocurrencies in your cryptocurrency wallet but also share, with all the benefits that decentralization offers. Shares, which are more stable than cryptocurrencies, can be used as collateral for a loan, for example. Smart contract apps allow you to build decentralized exchanges so you can sell shares or buy new ones at any time.

Every business needs revenue to cover its expenses. This principle must also be maintained for projects in a decentralized world. So far, this has only been achieved at the level of the first layers. Cardano’s network is one that people are happy and willing to maintain because they are rewarded by the network for doing so. The network retains a high degree of decentralization due to the fact that it is maintained by a large number of stake pool operators along with delegators, and this business is available to everyone. Decentralized projects, such as DEXes, need to create a similar model where the service fees are split between the team and the token owners. These tokens will behave similarly to shares and it will be quite natural to keep them in your wallet alongside cryptocurrencies.

On the Cardano platform, it will be easy to create algorithmic stable coins, work with decentralized identity, connect to the physical world via Oracles, use second layers like Hydra, etc. This ecosystem will be significantly richer in capabilities compared to the first generation of cryptocurrencies. First-generation cryptocurrencies, like Bitcoin, can essentially serve as a store of value or a means of exchange if you don’t mind high volatility. This limits the use to essentially payments only. Things like buying stocks will be done centrally. The buyer will send BTC to someone and the shares will be bought and held in a centralized manner. Today it works well, it’s secure and people are comfortable with it. But blockchain and platforms offer so much more. Buying shares can be done instantly, you own the shares immediately through your wallet, and the fees can be lower. If platforms offer this, it won’t make sense to use the current centralized systems.

From a network perspective, a rich ecosystem has many advantages. First and foremost is the large network effect. The more options a platform has, the more it will be used. It is realistic for the Cardano platform to process thousands of transactions per second through the second layer. These transactions will not just be related to paying for goods, as with the first generation of cryptocurrencies, but will be connected to real business, banking services, social networks, the arts and media industry, the gaming industry, the stock market, etc. Every app on your phone may someday use decentralized networks in the background in some way.

Your Netflix subscription will be a token that you pay for with stable-coin. You buy a concert ticket through another app and you can have an NFT in your wallet that will remind you of the event forever. If you decide to get a new phone, you sell a piece of Tesla stock in the store and pay. Or you pay for the phone directly with stock and somewhere in the background, everything is converted to cash. This weekend, you’ll use the token and your decentralized identity to vote in a local referendum on building a new road. The possibilities are endless and limited basically only by technology. What may seem like science fiction today will be standard boring technology in 20 years.

The high network effect will have a very positive effect on the economic model of the Cardano platform. It can be of immense value as it will provide wealth not only through ADA coins but also through tokens. For example, imagine if the top 5 companies in the world out of the top 100 tokenized shares on Cardano. The network would provide immense wealth for a large number of users. At the same time, it would collect a large amount in fees. The first layers of blockchain networks will one day face a budget problem to cover the costs associated with running the network. The only way is to create a functioning economy around it and collect a lot in fees. This will be much easier for platforms than it was for the first generation of cryptocurrencies. With exaggeration, one could say that blockchain networks must take over the financial system within a few decades or they will disappear.

There is hope that the new financial world will not be in the hands of governments, banks, and financial institutions. This world can be partially owned by all the people of the world if they want to, through native coin blockchain projects. So our future will not be decided by politicians and CEOs of big IT corporations. If you have ADA coins, you will have decision-making power in the Cardano network. If you use Cardano for all financial and social operations, you will have freedom and control over your future.

Governments are slowly losing control and the trust of the people. This power can be taken over by large corporations. The IT giants will try to create a Metaverse and there is a good chance they will succeed. The concept of decentralization can put power back in the hands of the people. Decentralization is by no means guaranteed to succeed and the current rulers are in a very powerful position. It is up to each of us to decide whether we want to use the old centralized systems or enter a decentralized world.

Conclusion

You can look at decentralization as a set of rules and operations that are unchangeable and unstoppable because they are maintained and overseen by many people and no one person is dominant. The platform extends this concept and gives people the ability to create their own set of rules and operations for other people. This is essentially an app. So the application inherits all the good features of a decentralized network. Decentralization is a concept and has no artificial boundaries in the sense that a transactional network is the last thing we can create. To send value unconditionally is a basic operation. The platform adds the ability to also create the value, send it conditionally, or create some logic over the value. For example, an algorithmic stable coin is a set of certain operations that can maintain stability in a decentralized way. The platform offers a wide range of applications and innovators can realize their visions.