The adoption of Cardano is about technology

The adoption of cryptocurrencies is driven by monetary policy and utility. Which one is more important? The adoption of Cardano is more about utility than monetary policy. However, both factors are important. Let's have a look at it.

Monetary policy vs. utility

Cryptocurrencies are technologies in the first place. However, the financial aspect cannot be overlooked. Both factors have a certain impact on society and thus they are the main drivers of adoption. Projects put the accent on different factors. Cardano is mainly about technology that will help people to solve real-world issues. Bitcoin is more about monetary policy. Both factors are not mutually excluded. Cardano also has a monetary policy. Bitcoin is useful for sending transactions. Actually, both factors are present in every project. People can adopt cryptocurrencies for both reasons. Some people will appreciate the monetary policy, others will utilize technology.

It is important to notice that people’s perceptions can change over time. Let’s give an example. In the beginning, Bitcoin was perceived as a new form of money and protest against the current bank system. People were sending bitcoins and were willing to pay by them. The desire for holding them for a long time was not so strong. It was rather an experiment that succeeded.

People did not understand Bitcoin very well and thought that sending coins is anonymous. It showed up that it is not the case. As the price of bitcoins went up people started to speculate. The willingness to spend bitcoins decreased. People started to prefer holding to spending. In the beginning, the utility was the major driver of adoption. Later on, it was monetary policy. Early adopters started to be interested in the maximum supply of coins, inflation model, etc. Nowadays, the transaction network of Bitcoin is used mainly for buying and sending coins. Monetary policy is the main reason why people hold bitcoins. We can call it by many names. It can be speculation, belief that it will be a new form of gold, maybe even a new form of money. People have different incentives for making decisions.

Is a decentralized monetary policy useful? Well, it is. What does that mean in practice? People mostly hold coins and are not willing to use them in the real economy. When people spare bitcoins for retirement then it can be said that they use bitcoins in the real economy. However, there are two parallel economies. The first one, where traditional fiat currencies are used for shopping, paying taxes, etc. The second one, that is kind of new and cool and maybe it is a great idea to be an early adopter. As a result, people do not use decentralized services in the sense of sending transactions on a daily basis.

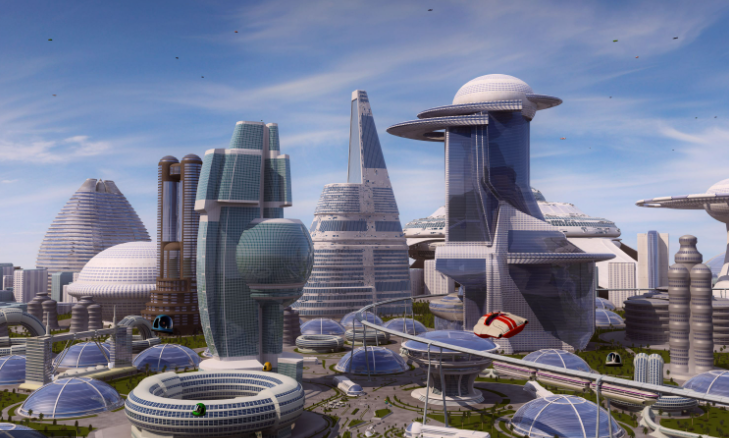

Cardano is a different beast. It is built to become a social and financial operating system. It is built for daily usage. As such, it needs to have superior technology. The first generation of cryptocurrencies is slow and maintaining the network is very expensive. As a side effect, transaction fees grow with adoption. When more people at once decide to send a transaction then the network gets clogged relatively quickly. The time of settlement can be unpredictably long and people are forced to pay higher fees when they need it faster. That is not user-friendly at all. This is not a kind of technology that people would adopt for daily usage. It can be said that slow settlement and high fees prevent further adoption.

To be clear. It prevents adoption from the point of view of daily usage. It does not necessarily prevent the adoption from the point of view of monetary policy. If you buy bitcoin regularly once per month then you will be willing to wait a few hours for settlement. You can be a bit nervous but you somehow know that coins will appear in your wallet sooner or later. Cardano is built to allow people to use decentralized technologies and provide them with a great user experience. Transactions must remain cheap and settlements must be reliably fast. Moreover, Cardano is not only about transactions. It allows people to use decentralized applications and smart contracts. Cardano is a platform so developers can create useful applications for users.

Monetary policy is always related to volatility. The demand for coins can rise or drop as the mood on the market changes. In the case of Bitcoin, the narrative of the store of value is the major influence. As the adoption of Bitcoin is still very low, approximately 1–3%, it can be hard to estimate what the value will be in the next few years. For this reason, Bitcoin is bad as a means of exchange or units of account. It does not matter much since the store of value and volatility go together well. As adoption will rise the price might rise as well. It is exactly what we want. On the other hand, if volatility prevents usage then we need some solution. The majority of people will use cryptocurrencies for payment only if it will be good as means of exchange and units of account. In other words, price stability is more useful than volatility in the sense of daily usage.

Luckily, Cardano is able to solve the issue since it is able to send not only native ADA coins but also tokens. Tokens can be stable coins. Hence, Cardano can be good as a store of value, when we talk about ADA coins, but it can also be a useful decentralized network as millions of people can use it on a daily basis. Stable coins can be used as means of exchange or units of accounts. Moreover, stable coins can be backed by ADA coins. Thus, it gives extra utility for ADA coins.

Only adoption and utility can positively influence the market capitalization of cryptocurrencies in the long term. People appreciate both a decentralized monetary policy and decentralized services. Cryptocurrencies can be adopted via the narrative of the store of value where technology is not so important and also via utility where superior blockchain technology is required to satisfy users’ needs.

Most appreciated features of blockchain

The most valuable feature of cryptocurrencies is definitely decentralization. Decentralization makes the difference between the current traditional services and services that are built on open blockchain networks. Let’s have a look at a few most appreciated features of blockchain networks. In most cases, blockchains store transactions. Nevertheless, for easier understanding, we will talk about data. Ownerships of coins are perceived as a piece of information stored in a blockchain and users do not care much about the internal representation of data. In a broader perspective, data can be your identity, access keys, and many other things. You will see features that relate to both data and qualities of service.

- Data persistence: Centralized services are single points of failure. Data can be lost when a service unexpectedly crashes or when a hacker succeeds in intrusion into the system and deletes data. Data can also be deleted by the administrator of the system or by authorities. It is impossible to delete data from the blockchain. Data is distributed all around the world and is freely available. If data is money then nobody can delete your money.

- Data ownership: Centralized services are controlled by a few individuals that have the power to do with data what they wish or what they have to do when authorities order it. Your data can be frozen, stolen, or even sold without letting you know. Blockchain allows you to be exclusively responsible for your data. It means that when you own something then nobody else in the world is able to steal it from you via changing data.

- Service transparency: When somebody has control over data then it cannot be assured that something shady does not happen. Even audits might fail to prove possible misusing of power. Thus, some transactions can be deleted or changed and only a few individuals have the privilege to do so. Nobody is able to delete or change history in the blockchain. All data are available to the whole world. Thus, an audit can be an always ongoing operation.

- Service fairness: Central authorities have full control over provided services. It means that fees, quality of services, and many other things can differ based on who you are and from where you are. You can even be excluded from the services for any vague reason. On the other hand, somebody else can use faster and cheaper services. It never happens in the world of blockchain. There are the same conditions and rules for everybody in the blockchain world.

- Service availability: Centralized services can get out of service for a variety of reasons. Failure in one place can influence many people from a given area. Alternatively, it can simply happen that a given service is not available at all in your country. For example, banks choose their customers and mostly operate in western countries. Decentralized networks are present everywhere in the world under the condition that there is internet access. A decentralized network consists of many distributed nodes. Thus, it will probably be always available.

- Service affordability: You do not need to obtain permission to use a decentralized network. Everybody in the world can freely decide to install a wallet and start using it. There is no KYC/AML, no agreements, or entrance fees.

- Service autonomy: There is no authority or central point that would dictate what should or should not happen in a decentralized network. As a result, nobody can censor anything. Even if authorities wanted to change something it is nearly impossible to do so since there is no single entity that could be easily contacted by authorities. Many individuals around the world keep the network running. Developer teams, CEOs, Foundations, nobody is able to stop a decentralized network.

- Service privacy: In most cases, data in the blockchain is not private. However, it is possible that privacy will be enhanced in the future. Even now, if people wish, they can use blockchain and keep a relatively good level of privacy. Nobody can prevent it.

This is not definitely a complete list of features. Anyway, as you can see, most features are more related to service than data. In many cases, however, a given feature relates to data and at the same time to service. It does not matter much at this point. The impact of a network grows with the number of users. Hence, we can say that it is mainly about service and individuals benefit from it on the level of data. Users share the same rules and all have the same or similar position.

Data persistence and privacy are very important features when we talk about cryptocurrencies. However, it makes sense only if there are more users in the network. Monetary policy and the store of value would make no sense for a few individuals. These features must be adopted by a larger group of people since it makes it more relevant.

The same is true for both features, means of exchange, and units of account. There is a difference, though. It can be difficult, if not impossible, to adopt a volatile means of exchange and units of account. If adoption was only 20% then it would not work. It would not even work when adoption would be 50%. Why? Imagine that a seller accepts Euro and the buyer who wishes to buy a smartphone wants to pay in dollars. They would face the problem with the exchange rate. They would have to find out the exchange rate and maybe the seller would accept the payment. What if the seller accepts the only Bitcoin and the buyer wanted to pay by ADA? Theoretically, the same could be done. However, the payment could be more expensive and it would take more time because of the need to change cryptocurrencies. It would be much easier if only BTC or ADA coins would be used. Still, there is a problem. How much is the smartphone? It is hard to fix the price of the smartphone in volatile cryptocurrencies. The price would be 1000 ADA coins one day and 900 ADA coins on the second day. The seller would need to know the price in dollars and make calculations quite often. It is too complicated for both the seller and all potential buyers. Using stable-coins makes much bigger sense.

Decentralization makes sense if it is adopted and used at appropriate places. Service transparency and fairness are great features. People do not like that blockchains are open and everybody can analyze transactions. On the other hand, it would be an absolutely amazing property when it was used at organizations that are expected to be transparent. The same could be said about the service fairness feature. Blockchain is fair when Alice sends coins to Bob. Shouldn’t banks be fair as well? It can only happen when banks adopt the features of blockchain and build infrastructure on decentralized networks. There is a big difference between the adoption of coins and the adoption of technology. The adoption on the coins level means that a bank can buy cryptocurrencies and hold them for their customers. The accountancy of such banks can still be shady and banks can refuse to provide services to everybody. Basically, nothing will change. The adoption on the infrastructure level means that a bank will change completely. Such banks would become more transparent, fair and services would be available for everybody. The features of blockchain technology would be adopted without compromises.

Bitcoin is mostly about decentralized monetary policy and store of value. The technology itself cannot disrupt banks, public organizations, and IT giants and prevent them from misusing power. Cardano is capable of doing so. It can become a service layer for entities that will want to be publicly trusted. The key features of blockchain technology can be fully utilized and the majority of people will benefit from it.

Centralization does not work

We could find a lot of examples from the real world where centralized entities do not provide good services. In the GameStop saga, an army of traders on the Reddit forum r/WallStreetBets (WSB) helped drive a meteoric rise in GameStop’s stock price, forcing halts in trading and causing a major headache for the short-sellers betting against it. On January 28, 2021, in response to WSB’s involvement in the GameStop short squeeze, Robinhood, TD Ameritrade, E-Trade, and Webull restricted the trade of heavily shorted stocks such as GameStop, AMC, BlackBerry Limited, Nokia, and Koss Corporation on their platforms. Many of the brokerage firms, including Robinhood, later stated that the restrictions were the result of clearinghouses raising the collateral required for executing trades on highly volatile stocks.

Is it fair that a centralized authority can restrict trading? What if the stock trading would be fully decentralized? Nobody could purposely influence trading. The service would just be available and nobody could censor it, stop it or restrict it. It is about trading with volatile assets but the infrastructure has nothing to do with volatility. It is only about decentralized features that could improve the service and makes it fairer and more transparent.

Cardano is a platform

Cardano is a platform. It allows developers to build a lot of useful decentralized services. The technological requirements on platforms are high. Platforms must be decentralized, they must scale and be secure. The high quality of all these properties must be achieved within one decentralized network.

Cardano is about providing a superior user experience since it is about utility in the first place. Transactions must be cheap and settle fast. It must remain like that with rising adoption. It cannot happen that transactions are cheap in bear markets and expensive in bull markets. Economic conditions cannot change by the market’s mood.

Why does not Bitcoin need to have fast and cheap transactions? We would have two answers for you. Firstly, it is not so important for the store of value. People do not need to do a lot of transactions a day. If they wanted to transact more, they would need to use second-layer solutions. Secondly, Bitcoin needs it as well but not at the moment. The value of BTC coins can be moved to other decentralized or even centralized networks in order to make a fast settlement. Make it sense to pay via PayPal? Make your own opinion on it. Anyway, Cardano is not here to make compromises in decentralization. Cardano is built to allow people to adopt fully decentralized services. It is the major difference between Cardano and Bitcoin. Cardano needs to deliver possibilities to build the same services that we consume in the traditional financial world. From a technological point of view, it is a challenge. Who said that it will be easy.

Stable coins and many other tokens can be issued on Cardano. Services can be programmed via smart contracts. These two key functionalities open many possibilities. A decentralized trading platform is one of them. Regarding the possibilities, the sky is the limit.

About belief and technology

What is the relation between belief and technology in the context of cryptocurrencies? What is more important for success? Read our take on the topic. Read more

Fee for decentralization

What does it mean when users pay transaction fees? They are willing to pay for decentralization. People are willing to pay high transaction fees just to hold a piece of Bitcoin. They are also willing to pay high fees for using services built on Ethereum. What does that mean? People are willing to pay for both decentralized monetary policy and also for using decentralized services.

High fees are a bigger problem for platforms since it directly influences adoption. People will not want to pay a lot of money just to play with decentralized applications. Developers will not be able to integrate a decentralized network with their services when a few dollars must be paid for a single transaction. Decentralization must be cheap. Decentralization must be inclusive to succeed.

Payment with decentralized stable coins makes sense only with fees will be negligible. Then, users will benefit from all advantages of decentralization and can completely migrate from traditional financial services to Cardano.

Conclusion

People buy cryptocurrencies for many reasons. In the case of Cardano, there are strong incentives to do so. It can be the mission of the project, staking, or even the digital scarcity of ADA coins. Every cryptocurrency must have set a monetary policy. Hence, the narrative of the store of value is something dynamic that might change over time with the adoption and usage of the network. People are willing to pay for decentralization and the store of value is not the only feature that is useful. Actually, Cardano can also be a good store of value and many other cryptocurrencies as well. Technological advancement will be the major differentiator. Cardano currently is and probably will remain the innovation leader not only in the crypto world. That is something that will be difficult to achieve by the competitors. Cardano will be a very valuable project if the technology gets adopted. People are smart and they will adopt superior technology if it is available. The future of Cardano is bright.