Sustainable decentralization

Decentralization is a dynamic process and changes over time. You can have it at the beginning and lose it within a few years. It is like a democracy. If we stop to care about it then we can lose it. A protocol might be designed in a way that helps to keep the decentralization on a good level. Let's explore the topic.

It is difficult to keep the network decentralized in the long term. The economic and incentive model of the network plays a key role in this. Let’s take a look at how it works in the Cardano project and compare it to a PoW network.

We’ll also show you how to smartly delegate ADA coins to pools.

Decentralization and stakeholder roles

Decentralization is primarily about dividing decision-making power into as many independent entities as possible. The more people involved in decentralization, the more credible the network can be. The ideal situation is when each individual network user can make proportional decisions. Not every user is willing or able to run a node and be fully responsible for block creation. However, this should not deprive users of the right to participate in the network consensus. A possible solution is to give the right to create a new block in those who are interested and give other users the opportunity to support or not to support these people.

The Cardano network offers exactly this option. Let’s look at the roles in the network. First and foremost, there is a network that is interested in being as decentralized as possible and resistant to censorship. Pool operators are thus given the right to produce the blocks. The network will try to maintain a certain number of these pool operators and it will be 1000 within the main-net (100 in the Shelley test-net). This number is not a restriction from the top, but rather a kind of the desired condition. Other people will be able to increase or decrease the power of the pool operators by delegating coins.

The network should somehow prevent a pool operator from gaining a significant influence on block production. This can be achieved in the economic model, as the network itself decides who to reward and how much coins every pool receives. One of the parameters the network can consider is the size of the pools, ie stakes. The network is thus able to supervise its own decentralization and adjust its rewards. Every ADA coin owner is a network stakeholder. They are pool operators and people who delegate their coins to a selected pool. The power and influence of the pool are thus expressed in the size of the stake. The network itself has 14,000,000,000 coins ready for the first 10 years of its existence, so it is basically also a stakeholder. The pool can be strong thanks to the coins owned by its operator or delegated coins. The ratio can and will change over time. If the pool owner has enough coins, he is independent of the delegators.

You can read more about incentive mechanism in our article:

Blockchain needs a viable incentive mechanism

A decentralized public network is not only about technology. The network is maintained by people for the people…

medium.com

Consensus decision power in PoW networks

There are no stakeholders in the PoW network. Coins give you no right to participate in decentralization or decision making. The network is thus strictly divided into coin holders and miners, who are dependent on coin holders only through the coin’s market price. Miners are thus motivated to hold the coins themselves and support this idea with other people. In PoW networks, there is no limit to the size of pools that arose unexpectedly and were not in the original design. Unfortunately, the team has not dealt with this situation so far.

PoW pool operators are motivated to grow as they receive more rewards for it. The system is thus more prone to centralization and can only be avoided if people with ASIC miners prefer non-economic ideals. This can only have an influence if the pool owners do not have a large enough own hash-rate. However, pool operators usually have own mining farms and Bitmain is a producer of ASIC miners.

How to define ´decentralization´?

Many people talk about decentralization, but few would be able to say exactly what it is. Decentralization is the most important feature of blockchain. Let's look at the definition of decentralization and the precise meaning. Read more

As you can see in the picture below, Bitcoin is dominated by 4 pools, which have more than 10% hash-rate share. The largest pool has a nearly 20% share of total network hash-rate. Operators are motivated to grow and can achieve that by appropriately adjusting the amount of the fee. The higher the share of hash-rate the higher the amount of reward a pool can obtain.

Let us now look at the success in obtaining rewards for block mining in the last 7 days. The pools that have the highest hash rate are the most successful. The percentage success rate is higher than the pool hash rate share. The 3 largest pools have over 20% success rate. The biggest pool even achieved a 32% success rate. The high success rate of large pools puts small pools at a disadvantage. Small pools are able to mine just a few blocks in a given period.

In a PoW system, it is very difficult to get a significant share of rewards. For example, the BitFury pool has nearly a 3% share of the total network hash-rate and it was able to mine 28 blocks.

If you randomly grab the last 20 mined blocks and check which pools have mined them you will see that there is 5x Poolin and 4x AntPool, and 2x BTC.com. Both AntPool and BTC.com pools are owned by Bitmain so one entity has a ~23% share of the total network hash-rate and mined 221 blocks (F2Pool mined 166 blocks) in the last 7 days. Note that ~1008 blocks can be mined in a wee (6 * 24 * 7) so a single entity mines over 20 % of blocks.

If you look at the operators of the 10 largest pools, you will find that 8 of them are from China. This really doesn’t look too decentralized.

Saturation point

It is crucial that the level of rewards is reduced at some point in the size of the pool. The pool thus reaches the so-called saturation point, the point where increasing pool size ceases to have a direct effect on rewards.

The linearity between pool size and rewards must be interrupted at some point. When a pool reaches a saturation point the protocol will cut rewards. Linearity is good for smaller pools but must decrease as pools begin to gain dominance. Based on the pool size, Cardano divides rewarding behavior into two stages.

- The first one is a growth stage where the linearity in rewarding is respected. Thus, the pool might grow up to the saturation point. People delegating coins to the unsaturated pool will be fairly and well rewarded.

- The second stage is a stabilization stage where the pool is considered as large. The large pool is thus considered as saturated and increasing stake does not ensure higher rewards. It basically means that the pool operator is economically motivated to decrease the stake. People delegating ADA coins to a saturated pool will receive less reward.

Most rewards are given to a pool that does its job well. Which is it? The one that produces the most blocks within the given possibilities, ie within its size. Pools acquire the right to produce blocks based on stake size. Therefore, a pool of just before saturation gets this right more times than a small pool. It will, therefore, receive a greater reward provided it produces the blocks. The pool may fail to produce blocks and the reward is reduced accordingly.

Read our article about saturation and how to calculate it:

Delegating to the saturated pool is less profitable

In order for the network to maintain a high level of decentralization, it was necessary to devise a few rules governing…

medium.com

It is important to note that the protocol will reward the operator’s costs first and then the others who have delegated their coin to the pool. Everything happens automatically within the protocol and operators do not come into contact with the coins. When configuring the pool, operators tell the network what reward requirements they have, and the protocol then distributes the coins to operators and delegators.

Read our article about operator fees:

How Cardano pool operator fees work

The Cardano Shelley incentivized test-net has been launched and people can delegate their ada coins to the selected…

medium.com

Sustainable decentralization

Cardano wants to maintain a high decentralization in the long term, which is why it came up with the concept of pool saturation. Whales will always exist and it is possible that one entity will run multiple pools. What is important, however, is that it will be easy to set up a new pool, as only 1/1000 of the coins will be enough to pay the new pool full reward. This allows people to create a new pool or decide to delegate coins to another pool. Thus, a large number of people can balance the power of the whale to some extent.

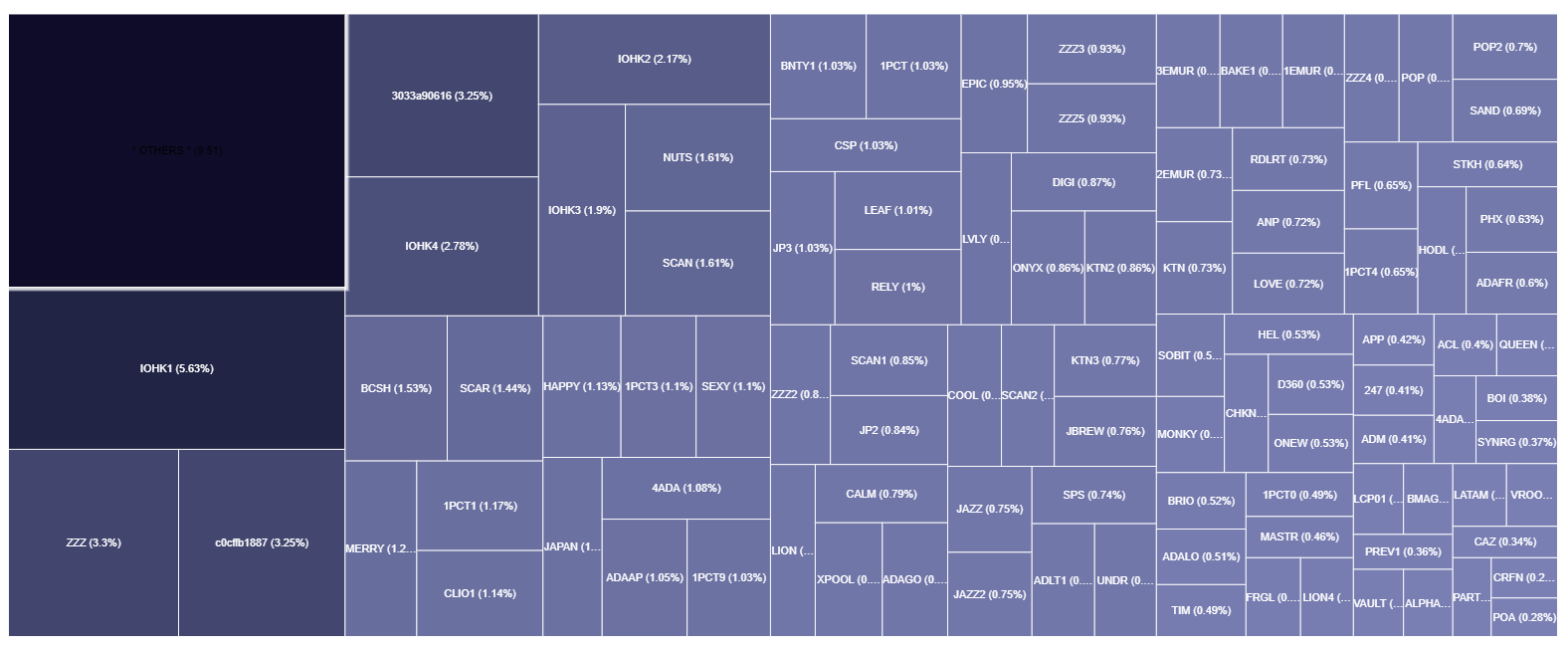

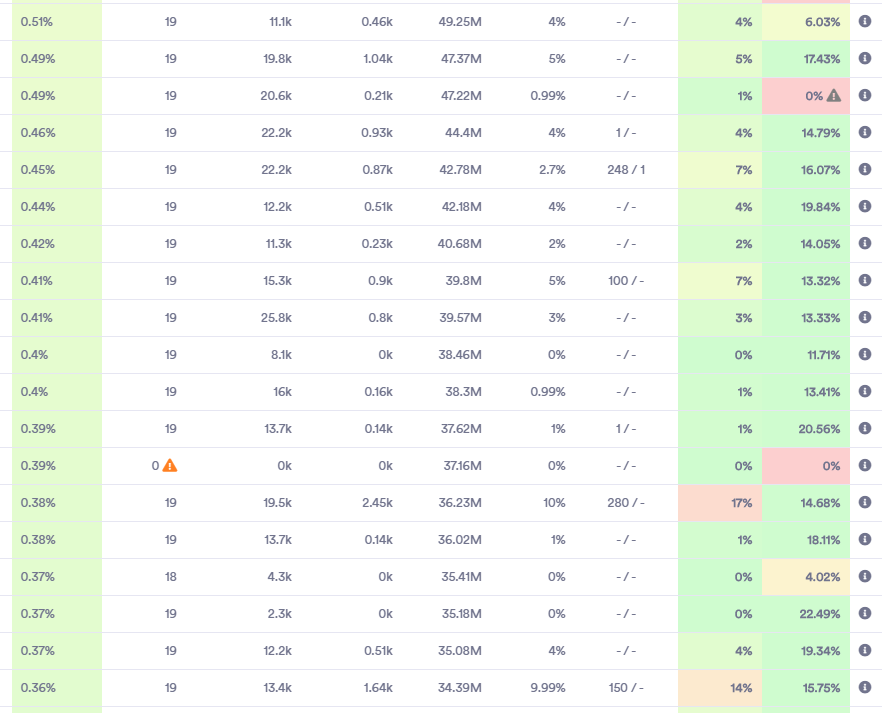

In the picture below you can see the current situation in Cardano test-net. The ideal state would be one where there were no saturated pools and most would be just before the saturation point. In the main-net, the ideal state would be one with a 1000-field grid where all grid would have the same size.

The question now is whether this model will be sustainable in the long term. As we have already said, one of the major players is the network itself, which controls the amount of reward for pools per epoch depending on the size of the pools. Other major players are pool operators and their required rewards. Pool operators can adjust fees to attract delegators. For example, new smaller pools can reduce their pay and give more delegates. On the other hand, pools before saturation may increase their reward, as they will earn more than smaller pools due to their size. Naturally, people will look for the most profitable amount of reward. As soon as a certain number of pools reach the saturation point, people begin to delegate coins to smaller pools. It can be assumed that people will be economically forced to delegate their coins in a way that all pools gradually reach the pre-saturation point.

Pool operators may be in a state where their pool is saturated and will have to remove and possibly delegate part of the coins to another pool. If the number of coins is sufficient, they can create a new pool. If not, they simply delegate ada coins to some other pool.

The reward is distributed equally to all stakeholders regardless of the saturation. Obviously, the reward must be less from the point of delegators if the pool is too saturated since the maximum possible amount of reward must be divided into more parts. In other words, the profit of a single ADA coin will be less.

Example

Let’s have a look at a simple example. The desired number of pools in the test-net is 100. For simplicity, let’s assume that a total stake is 10,000,000,000 ADA coins and let’s find the saturation point.

Saturation-point ≥ 10,000,000,000 / 100

A pool reaches the saturation point when the stake is 100,000,000 ada coins.

There are ~3,800,000 ADA coins prepared for the reward in a given epoch.

Max-reward = 3,800,000 / 100

In Shelley test-net, the max reward per epoch for a given pool is 38,000 ada coins (neglect transaction fees).

The reward, 38,000 ADA coins, is distributed proportionally to staked coins. Let’s consider a pool that is close to the saturation point, for example, the pool’s stake is 99,000,000 so the pool can get nearly the max reward.

Reward per single ADA coin = 38,000 / 99,000,000

The reward per single ADA coin is ~0.00038 ADA coin. So if you have delegated 10,000 ADA coins to the pool you will get ~3,8 ADA coins per epoch.

Let’s do the same calculation with a saturated pool whose stake is 250,000,000 (2,5%). The pool can get only the max reward.

Reward per single ADA coin = 38,000 / 250,000,000

The reward per single ADA coin is ~0.000152 ADA coin. So if you have delegated 10,000 ADA coins to the pool you will get ~1,52 ADA coins per epoch.

What if you delegate coins to a pool that has only 0,5% share, it means it is in the middle of the saturation with the pool’s stake of 50,000,000 ADA coins. The reward will be halved, perhaps 19,000 ADA coins.

Reward per single ADA coin = 19,000 / 50,000,000

The reward per single ADA coin is ~0.00038 ADA coin so a similar amount as with the pool before the saturation point. So if you have delegated 10,000 ADA coins to the pool you will get ~3,8 ADA coins per epoch.

In our example, we have neglected operator fees and transaction fees for simplicity. Assume that operator fees are the same for all examples and are set to 0.

As you can see, it is not worth delegating coins to saturated pools. You get a bigger reward if you delegate coins to smaller pools. Of course, depending on pool fees.

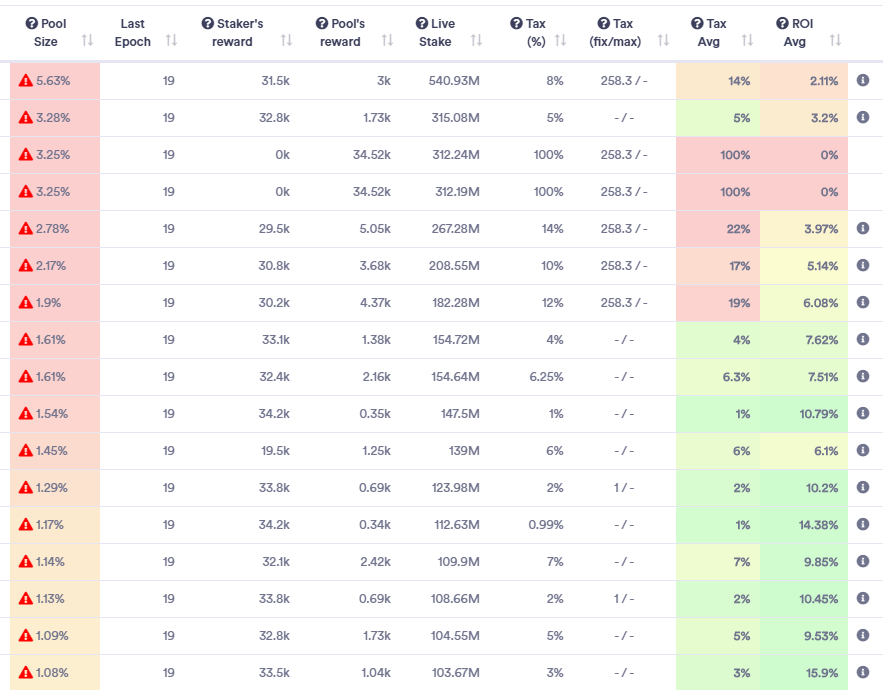

Look at the ROI of saturated pools. The average reward is often below 10%.

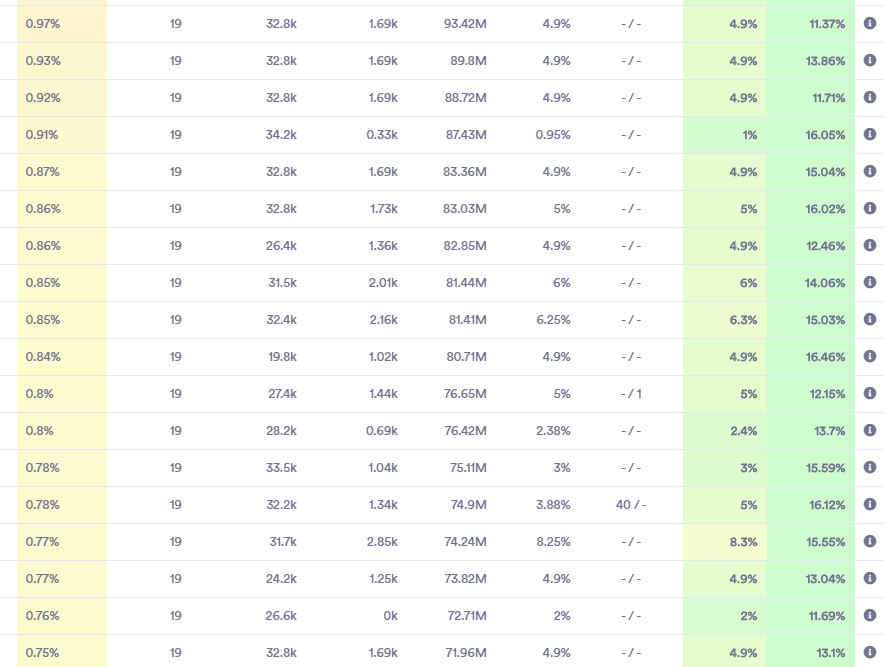

Now, look at the ROI of pools before saturation. The average reward is always above 10%.

Now look at the ROI of pools somewhere in the middle of saturation and below. The average reward is similar to the pools that are just before saturation, often also above 10%.

How to find saturated pools?

Finding a saturated pool is very simple. The images you can see above come from Adapools.org.

Cardano pools | AdaPools.org

We will be constantly improving it and if the data provided is useful to you and you want to support further…

adapools.org

It is important for you to check the column labeled Pool Size. This column shows the size of the pools with respect to the total amount of the currently staked coins. The test-net requires the existence of 100 pools so once the stake of a pool exceeds 1%, it gets saturated. Adapools even denotes saturated pools in color. Red pools are saturated (pool’s coin stake is higher than 1%), yellow before saturation (pool’s coin stake is lower than 1%)and green somewhere in the middle of saturation (pool’s coin stake is ~0,5%).

Be careful. The saturation point changes every epoch as the current number of staked coins changes. It is a dynamic process. Fortunately, you don’t have to calculate the saturation point again in each epoch. Just use the tool.

If you decide to calculate the saturation point yourself, you need to know the current number of staked coins. There are a number of ADA coins in circulation, but only a part of these coins are used for staking. This information can be found in the top-left corner under the label Total staked.

At the time of writing, there were ~9,600,000,000 ADA coins in the epoch. The desired number of pools is set to 100. The saturation point of a pool can be calculated in the following way:

Saturation-point ≥ 9,600,000,000 / 100

A pool gets saturated when exceeds ~96,000,000 staked coins (all coins that are delegated to a pool).

Summary

Delegators will primarily seek their personal gain. However, their interest is also to take care of decentralization, and as you can see, this interest does not conflict with your profit. Do not unnecessarily delegate coins to saturated pools. It is more profitable and better for the network’s decentralization to delegate coins to smaller unsaturated pools.

The economic model of the Cardano network is very interesting and we will certainly return to the topic as soon as other advantages or possible disadvantages become apparent.