Make a better staking decision

As a Cardano stake-holder, you are probably interested in delegating your coins to a pool. In short, you are interested in staking. This article can help you to understand the big picture behind the whole staking and rewarding process. We will show you how you can find all the relevant information in the ADApools tool.

ADA coins overview

We have intentionally simplified some processes and calculations that you will find in the article. We wanted to provide understandable information for everybody. We can go deeper into details next time.

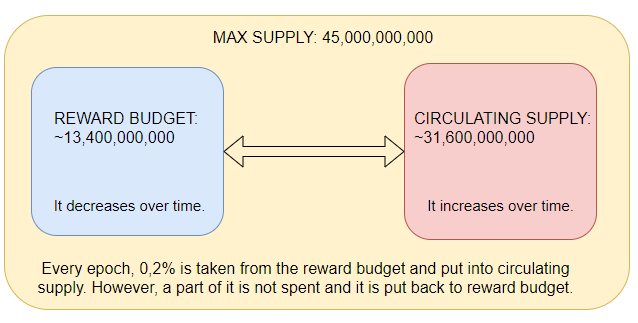

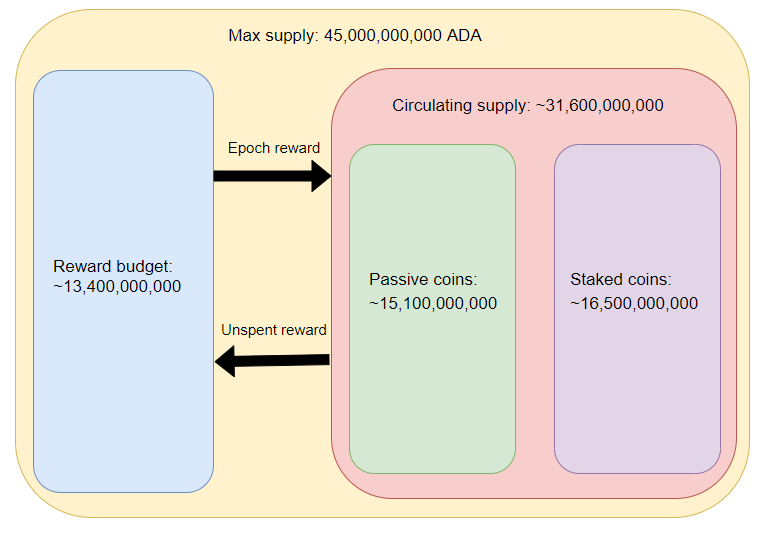

Cardano has a capped supply of coins and only 45,000,000,000 ADA coins will be in circulation. Let’s call it maximum supply. It will never change, thus, it makes ADA coins a precious resource. Currently, around the epoch 220, ~31,600,000,000 coins circulate (circulating supply) and ~13,400,000,000 coins will be gradually released by the protocol in the following years.

The protocol rewards pool operators and stake-holders for active participation in the decentralization. There are two sources from which ADA coins are taken to be used for the epoch reward (we will continue with the distribution of the epoch reward in the next chapter):

- Transaction fees: It is expected that there will not be many transactions in the beginning. The number of transactions will grow with time as the protocol will be more useful and more people will use it. Thus, the fees will gradually form the main resource for rewarding.

- Monetary expansion: The protocol has ~13,400,000,000 ADA coins for rewarding. Let’s call it a reward budget. The resource will be gradually consumed in every epoch. Thus, rewards are relatively high in the beginning and they will be lower in the future.

In the beginning, the monetary expansion will be the main resource for the rewarding and it should be gradually substituted by the collection of transaction fees. Notice, that in contrast to the monetary expansion, the collection of transaction fees do not increase the circulating supply. Coins collected in a given epoch are just redistributed from users to the stake-holders. Users pay for usage of the protocol and fees belong to owners of the protocol.

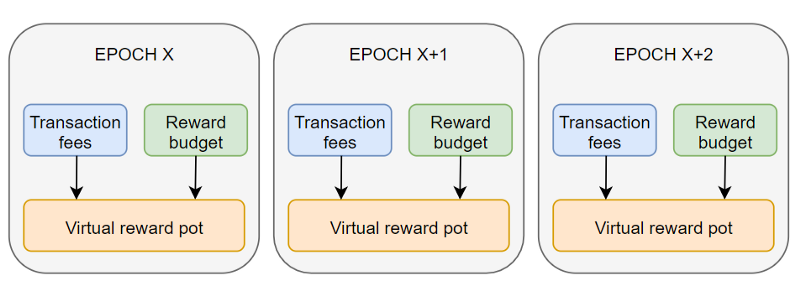

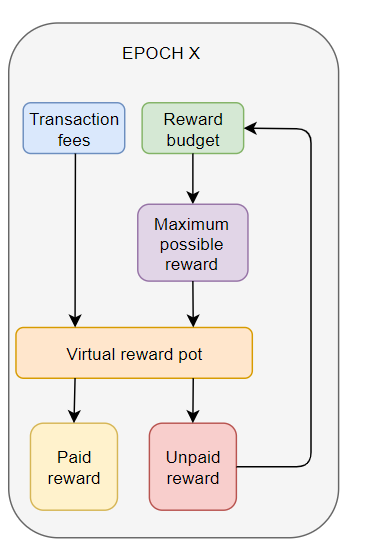

Every epoch, all transaction fees are inserted into a virtual reward pot. Currently, there are approximately 20,000 transactions in every epoch. A typical transaction fee is 0,164 ADA. It means that approximately 3000 ADA are collected as the transaction fees and they are put into the virtual reward pot. The second rewarding resource is the monetary expansion that is defined by the parameter ρ. It is currently set to 0,2%. Every epoch, 0,2% is taken from the reward budget and also inserted into the virtual reward pot. This cycle repeats every epoch.

It is necessary to mention that the 0,2% part, that is taken from the reward budget, is not fully paid out. A part of it is put back into the reward budget. The protocol always prepares the 0,2% part that represents the idealistic and maximum possible reward. Every single ADA coin is a candidate for the reward so the reward is prepared for all ADA coins in circulation. To pay out the maximum possible reward, it had to exist exactly as many pools, as it is defined by the K parameter (currently 150), all pools had to be fully saturated with the operator’s pledge, and all pools had to be 100% successful in producing blocks. In reality, however, only part of the maximum possible reward is paid out for a variety of reasons. For example, not all coins are used for staking, there are low pledges, there are nodes with low performance, and there are pools with low saturation.

The reality is that a pool can exist that has a low pledge and only a few delegated coins. If the pool creates no block in the epoch since the protocol has not assigned any slot to the pool, it will get no reward. Thus, despite the fact that coins are used for staking, no reward will be paid out to the pool operator and also to the delegators. It can happen to a middle-size pool, that the node can have some technical troubles and it will fail to create some blocks. In this case, the reward will be smaller. Notice that putting the unpaid reward back to the reward budget is actually good since there will be more coins in it for the future.

For the purpose of the article, let’s assume that roughly 50% of the possible maximum reward is paid out. The rest is put back to the reward budget. Currently, 52% of coins in circulation are used for staking and there are many small pools with low stakes.

Let’s assume that there are 13,400,000,000 ADA coins in the reward budget and there are 31,600,000,000 ADA coins in the circulation. 0,2% from 13,400,000,000 gives 26,800,000. It is the maximum possible reward. The following is going to happen:

- The sum of collected transaction fees and 0,2% from the reward budget is inserted into the virtual reward pot: 3000+26,800,000=26,803,000 ADA coins for rewarding.

- The reward budget after the deduction of the 0,2% part is: 13,400,000,000–26,800,000=13,373,200,000

- As we said, we assume that only half of the maximum possible reward will be paid out. Let’s assume that 13,400,000 ADA coins will be paid out (paid reward) and the rest, 13,400,000, will be put back into the reward budget (unpaid reward). For the next epoch, there will be the following number of coins: 13,370,520,000+13,400,000=13,383,920,000

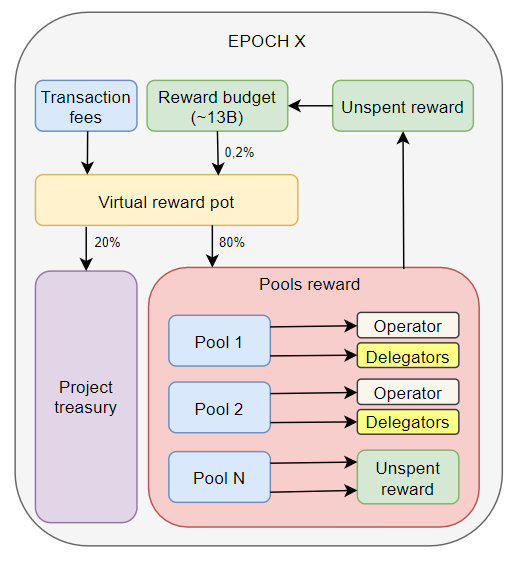

- As you will see later, from the paid reward a 20% is taken and inserted into the treasury.

- Notice that collected transaction fees are fully distributed.

- The circulating supply will be increased since the paid reward will be added to it: 31,600,000,000+15,000,000=31,613,400,000. This is a new circulating supply for the next 5 days. Notice that it will increase the market capitalization of the project.

This cycle repeats every epoch. It means that the circulating supply increases every 5 days and gradually approaches the maximum supply of 45,000,000,000 ADA coins. The reward budget will be gradually depleted. It is expected that every 4–5 years there will be just half of the reward budget. It means that there will be ~6,700,000,000 ADA coins in the reward budget in 2025. Again, it is only a rough estimate.

How is the epoch reward distributed?

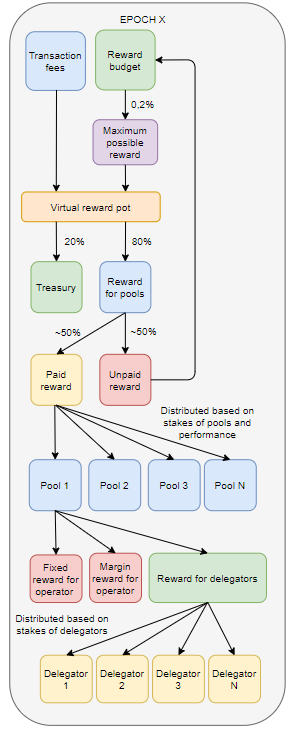

Every epoch, the virtual reward pot contains ADA coins that will be distributed. We have named it the epoch reward and it will be split into two parts:

- Treasury: The parameter τ defines the % of the epoch reward that will be sent into the project treasury. The parameter is set to 20%.

- The total reward for all pools: The rest, that is 80%, is used for rewarding pools. Let’s call it a pools-reward. The pools-reward is further distributed to operators and stake-holders.

We have shown above that the epoch reward can be approximately 30,000,000 ADA coins and it decreases every epoch. In this particular case, 6,000,000 coins will be sent to the project treasury (20%) and 24,000,000 coins will be used for rewarding pools including all delegators (80%). We will assume that exactly half of it, 12,000,000, will be paid out, the rest will be put back to the reward budget.

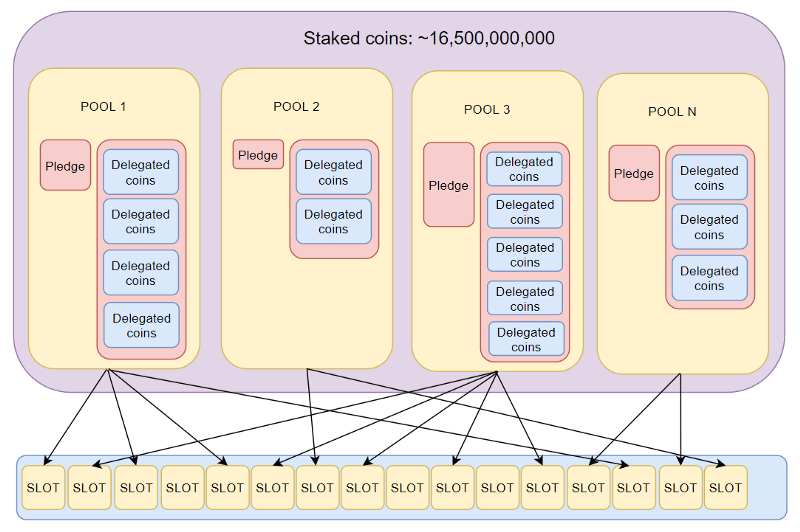

Stake-holders are both pool operators and delegators. Delegators are users that hold ADA coins and delegate them to one of the pools. It is important to say that not every ADA stake-holder is a delegator. The delegation is an active process in which coins are delegated to a selected pool. It is economically beneficial to delegate coins to a pool, nevertheless, stake-holders are not obliged to do so. Thus, not all coins that are in circulation are not actively used for staking. Users can have coins on exchanges or they will be able to use them in other decentralized projects in the future. Let’s call the delegated coins as staked coins and not delegated coins as passive coins. At the moment of writing, approximately 16,500,000,000 coins are staked (coins have been delegated to pool) and the rest, approximately 15,100,000,000 coins are not delegated. Notice that there will be no reward paid to holders of passive coins.

Staked coins are the sum of coins that pool operators used as a pool pledge and coins that stake-holders have delegated to pools. There are plenty of pools in the Cardano ecosystem and their power is the reflection of the number of coins that have been pledged by operators and delegated by stake-holders to them. Let’s call it a pool stake.

The stakes of pools are important input information for the protocol since it influences the number of slots in which pools will get an opportunity to create blocks. In other words, a pool can become a slot leader of a given protocol slot and produce a block. Epoch rewards are distributed only to pools that have created at least one block in a given epoch. Bigger pools will get more opportunities to create blocks. The creation of blocks can fail for various reasons. Thus, the success rate can vary. Moreover, the number of opportunities for creating blocks is not fully proportional to the stakes of pools. There is also a randomness factor that influences that. Thus, it is possible that the success rate of a pool can be higher than 100%. The success rate directly influences rewards.

Let’s explain it in more detail. For simplicity reasons, we will neglect the parameter d that influences the rate of blocks that are created by public pools in the first few months of the Shelley main-net. There are 432,000 seconds in the epoch (5 days) and the number is the same as the number of slots in the epoch. However, the protocol is configured in a way that blocks are created approximately every 20 seconds. So approximately 21,600 blocks are created within the epoch. Due to the randomness that is embedded in the protocol, it can be actually created more or fewer blocks.

Pool performance is calculated as the number of blocks that a pool has produced in a given epoch, divided by the expected number of blocks. The expected number reflects the proportional stake of the pool. Let’s assume that a pool has a 1% stake. It would mean that it can create 1% of blocks, which is 216. In this case, the success rate would be 100%. Due to the randomness, the pool can create more blocks than it is expected, for example, 237, so the success rate is 110%. If the pool creates only 194 blocks, then the success rate is only 90%.

Let’s assume that the paid reward is 12,000,000 ADA coins in a given epoch. This is the amount that will be distributed to all pools based on the sizes of stakes, randomness, and the success rate of pools. It is possible to make a rough estimate of the reward for a pool that is based on the stake a given pool has. Let’s assume that a given pool has a 1% stake, which is 1% of staked coins. It is 165,000,000 coins. Such a pool would get 1% of the pools-reward, which is 120,000 coins that will be further distributed between the pool operator and all delegators. Let’s call it a pool reward.

The protocol firstly rewards pool operators and the rest is given to delegators. The reward for a pool operator consists of a fixed part and margin. The fixed part is set to a minimum of 340 ADA coins. Pool operators can increase the number but most of them stick on 340 coins. When a fixed part is deduced then the margin is calculated from the rest. Then, the margin is also deduced. The margin is defined by a percentage that the operator wishes to keep as a reward. It is mostly set from 1% up to 5%. The higher percentage could be considered as excessive margin. Nevertheless, operators can set it as they wish. The deducted fixed part and the deducted margin is the reward for the pool operator. The rest belongs to delegators. Let’s show it in the example.

Cardano Staking

Let's dive into Cardano staking and explain how it works. Read more

A pool obtained 120,000 coins as the pool reward. The operator keeps 340 coins as the fixed part and sets the margin to 2%.

- Pool reward: 120,000 coins

- Rest after deduction the fixed part: 120,000–340=119,660

- Margin: 2% from 119,660 gives ~2,393

- Operators reward: 340 + 2,393=2,733

- The reward for delegators: 120,000–2,733=117,267

As you can see, the operator will get approximately 2% of the pool reward. The rest is distributed to delegators. It is important to mention that the ~5% annual reward is prepared for every single ADA coin. If you, as a delegator, stake your coins to a pool and the pool gets the reward then you will also get the reward. It actually does not matter whether you delegate your coins to a small or big pool. You will always get a very similar reward in the case that the pool’s performance is good regarding block production. The reward for delegators is distributed proportionally. For example, if you have 1% of stake within a given pool, you will get 1% of the rewards. In our example, 1% from 117,267, which is ~1,172 coins. Notice that also the pool operator is a stake-holder. The operator has a pledge (the stake that has been used during the creation of the pool) and it is also the subject of rewarding.

Let’s have a look at how an epoch reward can be calculated. The annual reward is set to ~5%. It is needed to split the reward between all epochs in the year. Let’s calculate it for 50,000 ADA coins. The epoch lasts 5 days, it means that there are 73 epochs in the year. 5% from 50,000 is 2,500 what is approximately the annual reward. If you divide the annual reward by the number of epochs, you will approximately get the epoch reward. In our case, it is ~34 ADA coins. We have neglected one important thing. Every reward is automatically used for staking by the wallet. It means that you stake more coins every epoch.

Let’s shortly summarize what happens in every epoch. Transaction fees and 0,2% from the reward budget are inserted into a virtual pot. 20% of the virtual pot goes to the project treasury. 80% of it is used for the rewarding of pools. Only a part of the coins that are to be used for rewarding pools is paid. The unpaid part is returned back into the reward budget. The reward for pools is distributed based on stakes of pools and their performance. From the pool reward, the operator is rewarded firstly. The fixed part and margin are deducted from the pool reward. The rest is distributed to delegators based on their stake.

Saturation

The heart of the Cardano protocol is decentralization. To prevent the existence of big pools, there is an idealistic size of pools that is ideal for the network. Thus, the protocol supports it in a way that once a pool reaches a certain size the rewards diminish. Saturation is the term that indicates that the stake of the pool is higher than it would be ideal for the network. The stake of a pool consists of the operator’s pledge and delegated coins. Saturation was designed to signal delegators that they should delegate to other pools with a lower stake to maximize their profit.

Saturation can be easily calculated from the circulating supply and the number of pools that are supported by the protocol. The number defines the parameter K and it is currently set to 150.

Saturation = 31,600,000,000 / 150 = ~210,600,000

As we said, the circulating supply grows every epoch due to epoch rewards. Thus, the saturation level also increases over time. It is very probable that the parameter K will be increased in the future to support higher decentralization.

ADApools tool

Now, you know the basic theory behind the whole rewarding process. We will describe the ADApools tool that you can use to find useful information.

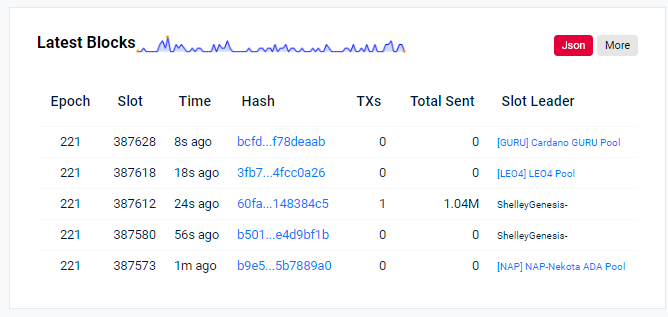

On top of the dashboard, you can find the basic information regarding epoch and slots. Every epoch lasts 5 days and can see when the epoch 221 ends. A Live Stake is the number of ADA coins that are used for staking and the number of delegators that have delegated coins to pools (59525). It is 16,71B. Notice that the Live Stake reflects the actual state of coins in the epoch 221. The protocol uses Active Stake as input information for rewarding. It is the state that has been snapshotted in the previous epoch 220 and reflects the state of coins at the end of the epoch 219. Notice that the Active Stake is 16,5B. You can also find a percentage that indicates how many coins from the circulating supply is used for staking. As you can see, it is 52,9%. The last piece of information relates to the number of pools and the price of ADA in USD and Satoshi.

In the next block, you can find information regarding blocks. For example, you can see how often blocks are created, who were slot leaders, and how many transactions were in blocks.

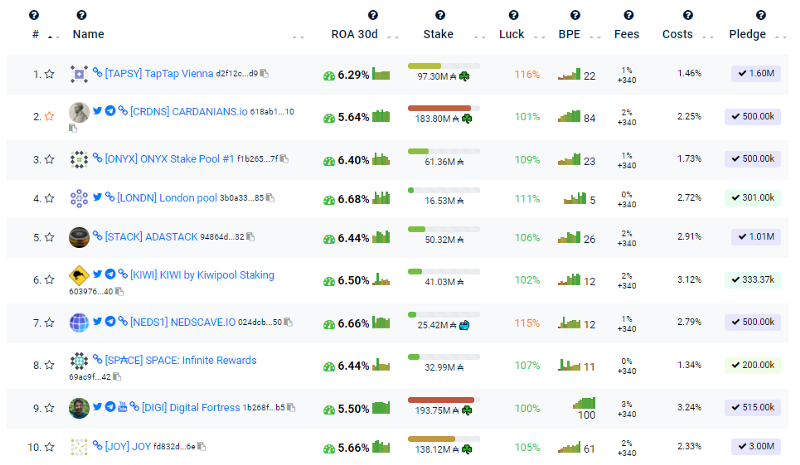

The most interesting part regarding the rewarding is the overview of pools and related statistics. A special ordering algorithm is used for ranking since there are more parameters that have to be taken into account.

The Name is the name of pools and you can also find tickers of pools. You can also copy/past Pool ID.

ROA (Return of ADA) is the expected annualized return of ADA based on the result of staking for the last 30 days. It is the reward for delegators after the deduction of the reward for operators.

The Stake represents coins that form the power of a pool. It consists of operator pledges and all delegated coins. Do not forget that also a pool operator is the stake-holder.

The Luck reflects the protocol randomness. If a pool creates more blocks than it would be expected based on the stake then the number is higher than 100%. And vice versa, if a pool creates fewer blocks than it would be expected then the number is less than 100%. The information is calculated based on all past epochs. It is important to know that it does not matter whether a pool is currently above or below 100%. Within a year it should ~100%.

BPE (Blocks per Epochs)shows the number of blocks that have been created in past epochs. If you scroll up then you can select the individual columns and see the exact numbers. The number behind the columns is the number of blocks that have been produced so far in the actual epoch.

Fees are the rewards for operators. You can find the margin (you can see %) and the fixed part (just a number that represents ADA coins, mostly 340 what is the required minimum).

Costs are the percentages of the total pool reward that operators keep for themselves. It means how much is an operator reward perceptually when fees are deducted from the total pool reward. It is calculated from the Live Stake.

Pledge shows the stakes of pool operators.

Let’s now discuss a few important things.

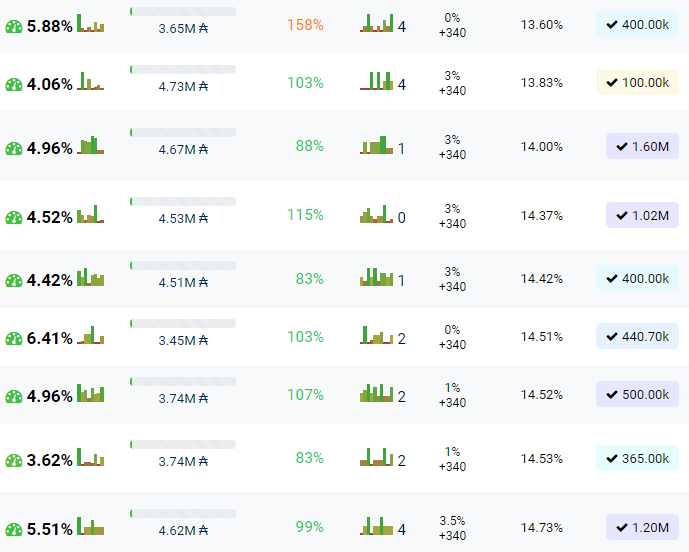

Do not forget that a pool is rewarded for producing blocks. If the stake of a pool is below a certain threshold then it might not become a slot leader. If the pool creates no block in a given epoch then it will get no reward. It means that the operator will not be rewarded and also all delegators that have delegated coins to the pool. Randomness plays an important role in the case of such pools. Currently, pools that have around 500K–4M stakes might become slot leaders or might not. It can happen that a pool can become a slot leader 2x per epoch with a 150K stake. It can also happen that a pool with a 5M stake will get no opportunity to produce a block. It is safe to delegate coins to a pool that has produced a few blocks in past epochs and that has the same or higher stake. It can happen that a smaller pool produces blocks just due to one delegator that has delegated 2M coins. In the case that the delegator decides to delegate coins to another pool the opportunities of the pool to create blocks decrease. You can delegate coins to smaller pools but you need to watch the stake.

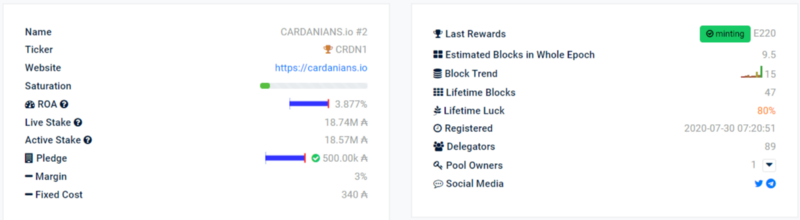

The number of delegators is also interesting information. If you click on the name of a pool you will see many details. For example, you can see the Live Stake and Active Stake of the pool. You can see how many blocks have been created by the pool for the whole life in Lifetime Blocks. The Delegators field is the number of delegators that have currently delegated coins to the pool. You can find other interesting self-explanatory information.

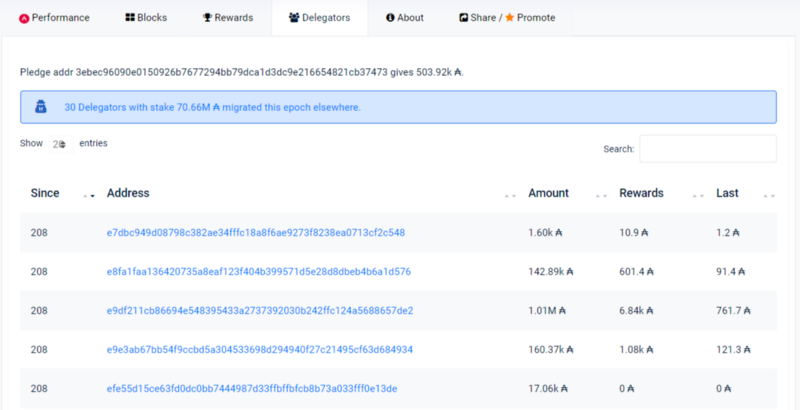

The more delegators have delegated coins to the pool the higher probability is that the pool will keep the stake. Of course, there can be a whale with a big stake so if the whale decides to leave then the pool’s stake will be significantly affected. If you click to the Delegators tab you will find information about delegators.

You can notice that smaller pools have Costs higher than 10% despite the fact that margin is relatively low. It is caused by the fact that 340 ADA coins are the required minimum. It is the mandatory reward for operators and they cannot decrease it even if they would like to do so. Sadly, when a pool has a lower stake then also the reward per epoch is lower. When a pool reward is for example 2,615 ADA coins, 340 coins make ~13% even in the case that the operator sets the margin to 0%. It should be said that for the delegators, the reward is still quite solid so do not be afraid to support smaller pools if you find a good reason for it.

You will find much more interesting information in ADApools and the tool is under development. New features are added quite often. Do not hesitate to support developers by donations or delegating to the ADApools pool [POOLS].

The magic behind epochs

In the article, we have not covered another important topic regarding epochs. You should know that if you delegate coins to a pool in epoch 221 then the stake will be used in the epoch 223. That is why ADApools shows the Live Stake and Active Stake. We recommend you to read the article about Practical staking information.

Conclusion

We hope we succeeded in the explanation of the rewarding process and mechanics behind Cardano. As we said in the beginning, we have simplified it a bit not to overwhelm you with details. Nevertheless, if you spot a mistake or our simplification is misleading, let us know and we will correct it.