Decentralization is at the heart of Cardano

Decentralization is an absolutely key feature of public blockchain networks, as it is this feature that differentiates them from current protocols. Let's explain what decentralization is, how to measure it, and how to maintain its high quality in the long run.

TLDR:

- Public blockchain networks do not meet the general definition of decentralization, and we can observe elements of centralization in every existing network.

- The quality of decentralization is dynamic and changes over time. It can rise or fall.

- In a decentralized blockchain network, there are entities that have a higher status than others. Decentralization of networks can thus be compared to some extent with each other.

- The current quality of decentralization is not so important. Decentralization must scale with increasing adoption.

- The only way to keep the network secure and fraud-proof as the number of users grows is to scale at the decentralization level.

- The quality of network decentralization should be measured by how many people use the network and how many assets need to be protected.

- Cardano is designed in such a way that decentralization can be gradually increased.

What is decentralization

A decentralized system is a kind of system that requires the users to make their own, individual, decisions. In such systems, there is no designated central authority making decisions in the name of all participants. Instead, each participant, also known as ‘peer,’ makes their own autonomous decisions pursuing their own self-interest that may collide with the goals of other peers. In a decentralized system, there are no regulations regarding entry into or exit from the system.

Decentralization concepts can be applied in science, private enterprises and organizations management, politics, law, and public administration, economics, money, and technology. The word “decentralization” first appeared during the Great French Revolution, which saw the enactment of decentralization of government. France was divided into departments, which were separate administrative and economic units.

In the case of cryptocurrencies, we are generally talking about decentralization at the technology level, specifically at the network level. The first generation of cryptocurrencies are trying to achieve decentralized monetary policy and a decentralized transmission network through decentralization at the network level. Cardano extends this concept to the possibility of decentralizing basic economic activities such as lending or stabilizing the economic environment, the identity of the population, decision-making power, etc.

The goal of decentralization, generally speaking, is to take decision-making power out of the hands of unreliable intermediaries and put it in the hands of decentralized technology. This may create new financial and social linkages in which traditional intermediaries, such as banks or authorities, may play a less important role.

Decentralized networks are inherently global, so there are no international borders for them. People all over the world can be connected and all use the same network, which is completely independent of any government or organization. The potential of this technological achievement is not yet widely realized.

How to distribute decision-making power

Decentralization is a dynamic process and can therefore grow or decline. Decentralization is dependent on many internal and external factors such as the economic motivation of people to participate in decentralization, the network budget and reward scheme, regulation, the cost of engaging in the process, protocol adoption, and high competition.

Ideally, by the basic definition of decentralization, all participants should be equal. In the case of cryptocurrencies, this is so far an unattainable goal in practice. Thus, in any decentralized network, some entities have more rights or higher status. Obviously, the drive to be the higher-ranking one will be enormous, as there are economic benefits from high status. It can be said that in every decentralized network we can find certain features of centralization.

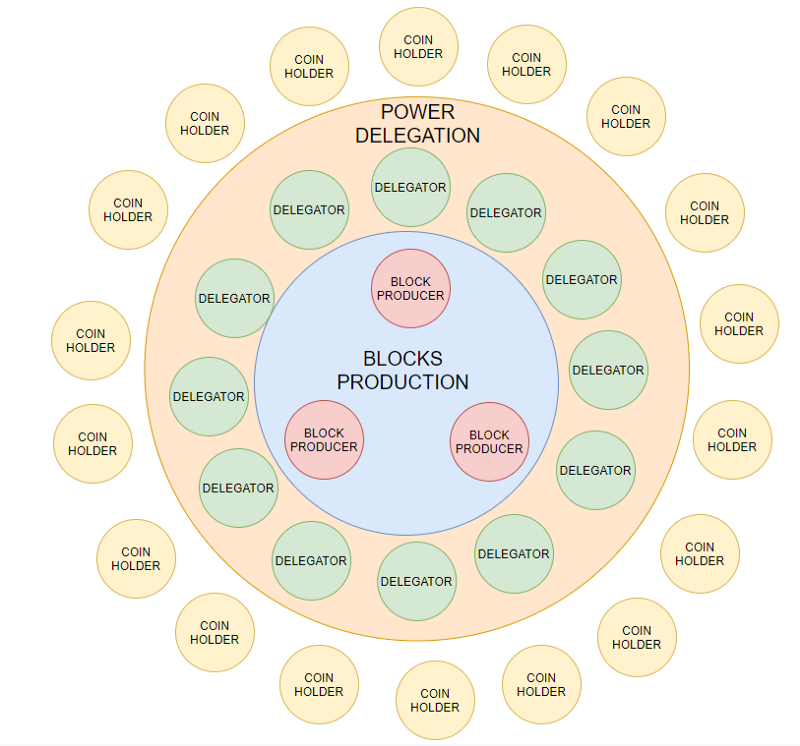

If you look at the image below, you will see a common distribution of power in a public decentralized blockchain network. You can see 3 groups of participants: block producers, delegators, and coin holders.

It doesn’t matter if we’re talking about Cardano, Bitcoin, Ethereum, EOS, Polkadot, Ripple, or Solana. This basic distribution of power works everywhere, although it may differ fundamentally in the details.

In practice, the smallest group, but the most important, are block producers. The individual members of this group are in charge of producing new blocks. These people decide whether to create a block at all, what transactions to include in the block, or what the previous block to build on. This group thus has the most decision-making power. The people in this group are the most rewarded for this work by the protocol. This is because these entities have the ability to cause some damage, so their economic motivation must be the highest. It can be assumed that no one would be willing to deliberately destroy an economically profitable business. In the Cardano ecosystem, pool operators produce blocks.

This works similarly for Bitcoin, which also uses the concept of pools. In Ethereum 2.0, blocks will be produced by validators, i.e. entities that lock a minimum of 32 ETH. However, this does not mean that pools will not be created. People who have a smaller number of ETH will also want to participate in the staking process. Therefore, pools will be formed that will bring together these smaller investors and run validators with their ETH.

As you can see, it doesn’t matter if Proof-of-Work (PoW) or Proof-of-Stake (PoS) consensus is used. The basic principles are similar everywhere.

The second important group is the delegators. What do delegators have? In principle, they have part of the decision-making power. Delegators are characterized by the fact that they are not directly involved in the production of new blocks, but they determine by their decision to whom they delegate this task. In the Cardano ecosystem, delegators can be all owners of ADA coins. There is no lower limit to the coins a delegator must own. Let us add that this process is called staking. Delegators also have an economic incentive to appropriately choose the pools that will be tasked with producing blocks. The Cardno protocol rewards pool operators but also delegators in proportion to the number of coins they hold. We can say that the group of coin holders and delegators overlap. However, not every coin holder will delegate their ADA coins.

In PoW networks, coins are not used to delegate power. Power is delegated through a hash rate. Delegators are a group of miners who delegate the hash rate to a selected pool. Pool operators receive a reward from the protocol and promise to send the miners a reward according to the work they have done. An important difference is that native coins play the role of reward, but do not carry any decision-making powers. This means that the group of coin holders have no decision-making powers and do not participate in decentralization. Decentralization thus depends only on groups of block producers (pool operators) and delegators.

In the case of PoS projects, a larger number of participants will be involved in decentralization. It is easier to buy coins on the open market and receive regular rewards for holding and delegating power. It can be concluded that Cardano gives people an economic incentive to maintain high decentralization. Decentralization increases directly with the distribution of coins among people. It is the easiest way to achieve high decentralization and to approach the basic definition of decentralization. Thus, decision-making power is vested in all network participants, not just a select group of people, as is usually the case in PoW networks.

It should be noted that a group of coin holders, but also groups of people who do not hold any coins, can operate a full node. This means that they can actively check if everything is happening in the network as expected. People are not directly economically rewarded for this activity and are in the role of observers. They have no direct participation in the network consensus. Thus, people can observe inconsistencies but cannot actively prevent them except at the social level. If the majority of entities in the block producer group agree on the rules, they will continue to produce blocks and maintain the longest chain.

From the perspective of attacking the network or the possibility of power takeover, the block producers and delegators are the most important groups and we will focus on them in this paper.

How to measure the quality of decentralization

The quality of decentralization can be compared to some extent by the number of actors in each group. Since the block producers group is the most important, the number of independent entities in this group has the strongest weight. The second strongest weight is given to the group of delegators, who essentially decide how much decision-making power the entities in the block producers group will have.

As we have already explained, with Cardano we have an overlap between the delegators group and the coin holder group. For PoW projects, this is not the case and we have to strictly distinguish between the three separate groups.

Obviously, a very key feature for achieving a high degree of decentralization is the economic or social feasibility of becoming a valid member of a block producer group. Entry into this group must be open and not be obstructed by the protocol as we see in the EOS or Tron projects, for example. Here the level of decentralization is essentially fixed and when someone new comes in, they displace an existing member of the group.

Decentralization is at the heart of Cardano

For the IOG team, the high decentralization of the Cardano protocol is both a top priority and a technological challenge that they are enthusiastically exploring. Decentralization is a key feature that brings disruption to current financial and social services. Without insistence on basic principles and innovation, the decentralized revolution makes no sense. We will show you why we think so. Read more

Although access is open, this does not necessarily mean that joining a block producer group is easy and economically achievable for everyone. Entry may require some financial resources. Limits must not be too low, as blocks should be produced by someone who has appropriate skin in the game. On the other hand, they must not be too high either, as only the rich would be able to enter.

The number of members in the delegator group should be also as high as possible, as it is the second most important group and can influence the balance of power in the block producers group. If there is a member in the block producer group who does not behave honestly and his behavior is not in accordance with the generally expected conditions, there must be a force that makes him irrelevant. The theory goes that in a decentralized system, there is no way to fire anyone. He can only be economically disadvantaged relative to others.

It is important to remember that decision-making power can always be bought with money, and the only question is how much the attacker is willing to invest in a possible attack or long-term permanent damage. Achieving a high degree of decentralization is the best prevention against attacks. If the majority of coins in the PoS ecosystem are owned by independent individuals who have no intention of doing harm and selling the coins to an attacker, the attacker has no chance of attacking the network. Doing harm with smaller amounts is possible, but economically disadvantageous. The impact on the network may be negligible. In the case of the Cardano ecosystem, delegators are expected to keep track of their rewards. If they delegate the power of their coins to a pool that does not sufficiently reward its delegators, they will choose another pool. This will weaken the attacker’s pool and strengthen another honest pool. The security of the Cardano protocol thus relies on high decentralization.

PoW networks work very similarly in principle. Miners provide a hash rate to selected pools and thus increase the chance of mining a block. If a pool abused its position and, for example, decided to censor transactions, miners could delegate the hash rate elsewhere. Again, they would remove the decision-making power from the malicious pool and strengthen the honest pool.

We deliberately do not want to compare individual projects with each other, as the numbers may not be fully indicative of the quality of decentralization. The details can be decisive. Moreover, as you will see in the next section, the current level of decentralization is only the beginning and there will be demand for it to grow. However, we can try to compare the largest PoW network, which is Bitcoin, with the largest PoS network, which is Cardano.

Bitcoin is the oldest decentralized cryptocurrency and had no pools at its launch. The network came to the creation of pools through gradual evolution. We can observe that the network has about 10 dominant pools. The 3 largest pools have over 10% position. These 10 pools hold 85% control of the network. Pools that together have about 15% share fall into the category of others. Bitcoin does not support the existence of pools at the protocol level, so unfortunately we have no on-chain data regarding the second delegator group. Statistics regarding delegator counts are unavailable and difficult to verify. Individual miner companies can be tracked down but it can be still difficult to find out what hash rate they have.

Let us add that large mining companies can negotiate better rewards from pools than those that are publicly advertised. Pools have an economic incentive to reward large players better, as it increases their overall hash rate and market position. Large mining firms have a strong position and can easily negotiate better terms. Low transparency puts small domestic miners at a disadvantage and leads to greater centralization.

The same can be said for the purchase of mining equipment and electricity, where large buyers can also negotiate better terms. Increasing decentralization is relatively difficult for PoW networks. The trend is rather negative and economically towards more centralization.

To provide some context regarding the delegator group, 27,000 bitcoins are mined each month. The largest mining farms can produce several hundred BTC coins per month. One of the largest farms in northern China reached 700 mined bitcoins per month, contributing over 2% of the total hash rate. If large investors decide to mine, they buy ASIC miners by the thousands and are willing to pay several million dollars to do so. There can be tens of thousands of ASIC miners in a single farm. It is important to note that from a decentralization perspective, the decision to delegate a hash rate to a particular pool is made by the people who are physically on the farm. No one else. Each new large farm pushes small players out of the game, thus reducing decentralization. Some of the decision-making power to delegate the hash rate may be in the hands of 10,000 independent individuals, or in the hands of the owners of a single farm.

How can we evaluate the decentralization of Bitcoin? Bitcoin has 10 block producers and an unknown number of delegators. Perhaps all competing networks have a larger number of block producers, usually a few dozen or hundreds. Let’s make a scale from 1 to 1000, where 1 is a centralized network and 1000 is the current level of maximum decentralization. Let’s do the same for a group of delegators, except that the upper bound will be 1,000,000. In the case of Bitcoin, PoW mining is dominated by large farms, so a significant part of the decision-making power will be in the hands of the order of 100 to 1000 individuals. Bitcoin would get the following rating: 10/1000.

In the case of the Cardano network, everything is much simpler, as the protocol takes into account the concept of pools and delegators. We thus have on-chain data that tells us very precisely the number of pools and delegators. There are almost 3000 pools registered in the Cardano network at the time of writing. However, not all of them produce blocks. Moreover, some pools are controlled by a single entity. The largest player is the Binance exchange, which has about 12% control of the network under its control. However, the very next big pool only has about a 4% share. The pools that have more than 1% control over the network are made up of about 15 entities that together have about 40% control over the network. The rest are smaller players. About 22% control of the network is accounted for by single pool operators, which operate about 68% of the pools. The number of delegators is almost 750,000.

What rating would Cardano get by our scale? There is one dominant whale in the network, 15 say bigger players, but also a large number of single pool operators. Binance is a big player, but you have to remember that the power of this exchange is delegated and people have the ability to move coins from the exchange to their own wallets. However, it can happen that someone steals the coins. It could be the exchange itself. The rest of the control of power, the whole 88%, is a fairly well-decentralized network. About 1100 pools are rewarded each epoch. Let’s agree to give the network a mark of 500 at the block producer level. In the case of delegators, this is easy, and we know that there are roughly 750,000 of them. Here again, a single entity can have multiple wallets. Let’s give the network a mark of 700,000. So the overall rating is 500/700,000.

We can say that the Cardano network is about 50X more decentralized at the block producer level and 700x more decentralized at the delegator level. We leave it to the reader to compare the decentralization of other networks and take into account important details. The resulting numbers are not that important, since as we will show in the next section, decentralization must increase as adoption increases. Thus, for the context of this article, very rough estimates are sufficient and it was not necessary to know the exact numbers.

Decentralization must scale

Let’s do a little thought exercise now. Let’s say we have a group of 100 people who want to exchange money for goods with each other. At the same time, they want there to be accounting records of this. People don’t trust each other. Not everyone knows how accounting works. Among the people, there are 2 people who know how to account and agree to keep it. In order to ensure that neither of the accountants cheats, they will take turns to keep the books on a regular basis. In addition, the bookkeeping will be completely open so that all the other 98 people can look at the ledger at any time.

If there was one person overseeing the ledger, he could do whatever he wanted. That person’s decision-making power would be centralized, and no one else would be able to correct an entry in the ledger, even if someone explicitly pointed it out.

If there are two accountants, we can talk about the decentralization of power. However, it cannot be said to be a solid disposition of decision-making power. What if one accountant, let’s call her Alice, cheats? The other accountant, Bob, will want to correct Alice’s mistakes, but Alice won’t agree. So there’s a stalemate. People will soon come to the realization that 2 accountants are not enough to decentralize the ledger. So they choose a third accountant, Carol. If there is a dispute between Alice and Bob, Carol will be the one to decide the truth. The same will be true if there is a dispute between, say, Carol and Alice. Bob will settle the dispute.

But we’re still not out of the woods. What if Alice and Bob agree to cheat together and always outvote Carol? There will be accounting errors in the ledger and there will be no way to correct them. People won’t be happy and they won’t trust the accountants. They will soon come to the conclusion that 3 people are not enough to decentralize the ledger and they need more.

How many accountants does it take to make the system work well? Instead of answering directly, we’ll bring rewards into our game. If people are happy with the accountants, they will pay them regularly for their work. The accountants will be in a very different position as they will be looking for a reward. If they want to cheat, they will calculate whether it is more rewarding to cheat or to get paid by the people. The reward must be high enough to motivate the accountant to behave honestly.

Let’s say that everything started working well for now in our game and the accountants behaved honestly because they appreciate a regular income for their work. However, there is a catch. It only works well for 100 people. Once the number of people goes up, the system can stop working.

What if the number of people using accountants increases? What if there are not 100 but 1000 people? As the number of people increases, the amounts that need to be entered into the ledger increase. The number of people has increased by a factor of 10, so potential fraud can suddenly be more profitable. If two accountants colluded to commit fraud, they would gain so much that it would exceed the regular payments over a longer period of time. The system would be in jeopardy again.

People have two options. Either increase payments or increase the number of accountants and let them compete with each other to see who can do the work of an accountant. People can even decide directly for themselves who gets the trust and who can become an accountant. I hope by now you have seen the analogy with decentralized networks.

The budget of public networks is limited and you cannot endlessly increase the rewards as the number of users of the network grows. This means that the only way to keep the network secure and fraud-proof is to scale at the decentralized level. It is essential that the network supports the highest possible number of accountants and that people themselves can choose the accountants who do a good job. So we are talking about block producer and delegator groups.

Would 3 accountants be enough for 1000 people? Maybe. What if there were 10,000 people? Not sure. What if there were 1,000,000 people? That probably wouldn’t be enough and it would be naive to talk about a good level of decentralization. No one will tell you exactly how many block producers, and delegators, there should be for 1M users. The goal is to scale the numbers of these key entities reasonably, but even that isn’t very specific. We can probably agree, however, that 3 block producers and 100 delegators for say 10M users is really very few.

The current adoption of blockchain networks is very low. Yet the networks are global and aim to be adopted by tens, hundreds, and eventually thousands of millions of people. Decentralization therefore cannot remain at the same level as it is today and must necessarily grow with the increasing number of users. With increasing adoption, it will come increasing social, political, and economic pressure on the key groups of block producers and delegators. With a small number of these entities, the risk of abuse of power will grow, whether internal, i.e. directly by the block producers themselves, or external, i.e. by regulators, fraudsters, powerful entities, and so on.

The only way to counteract the risk of abuse of power is to increase the quality of decentralization, i.e. to spread decision-making power over as many independent entities as possible. It is clear that the threat of abuse of power by the whales is greater than by smaller players. Thus, with a higher degree of decentralization, the share of whale power should ideally decrease. In practice, this may be difficult to achieve.

The degree of decentralization should thus be measured by the number of users. If network adoption increases by, say, a factor of ten, decentralization should increase accordingly. If decentralization stagnates, it will decline.

There are around 40 million addresses with bitcoins. Our rating for Bitcoin decentralization was 10/1000. We can say that 10 key entities control the assets of 40 million people, worth about a trillion dollars. Let’s compare it to the Cardano network. There are about 2 million addresses with ADA coins. Our assessment of Cardano’s decentralization was 500/700,000. So similarly, we can say that 500 key entities control the assets of 2 million people, worth about $100 billion.

The Cardano ecosystem has about 20 times fewer users, but 50 times more block producers overseeing their assets. At the same time, there are about 700x more delegators.

The big advantage of the Cardano network is that coin owners have decision rights in proportion to the size of their stake. This means that each individual ADA coin owner can be a delegator at the same time, allowing them to decide freely who they trust to produce blocks. People who have a larger amount of coins can run their own pool for themselves and trust themselves. The stakes of individual participants, and thus the decision-making power in the network, do not change over time. This means that a large entity cannot come in and reduce the stake of the coin owner through his money. In other words, until the coin owner sells, it maintains its size decision-making power.

If the number of ADA coin owners increases, the number of delegators increases at the same time. If a decision is made to reduce the saturation level (one of the configurable network parameters), the chances of new pools being created increase as the total number of coins to create a fully saturated pool is reduced. A larger number of people would be able to create their own pool, which would increase decentralization.

It can be concluded that Cardano is well prepared for scaling decentralization by design. Simply put, this is mainly due to the ability to scale up decentralization based on how the distribution of coins among people grows. If Cardano reaches 10M users, there will be 10M potential delegators at the same time. Their position will be proportional to their stake. Further, it’s the ability to reduce the requirements to create a new pool. As the value of coins rises, in general, the opportunities for newcomers or existing players decrease dramatically. For example, in the Ethereum network, you need to own 32 ETH to become a validator. As the value of ETH increases, the chances of becoming a validator decrease for ordinary investors. It turns out that setting the network parameters fixed for volatile coins is not very smart. It may be necessary to reconfigure the parameters and there may not be a consensus to do so among users. If the number of users in the Cardano network increases and there is a consensus that decentralization needs to be increased, this is easily doable. If pool saturation bounds are lowered, people with less stake, or smaller groups of people, will be able to start a new pool.

The Bitcoin ecosystem is moving towards greater centralization. The number of pools has been relatively static for a long time and has not changed much. However, the number of users is growing. In this light, we can say that decentralization is decreasing. At the miner level, one cannot expect more decentralization either. Rather, what we will see is that domestic mining will eventually disappear altogether, as only large companies will be able to be profitable.

Conclusion

Our vision of the future is that with the increased adoption of public blockchain networks and the study of on-chain data, the decentralization of individual networks will be measured very accurately over time. Just as people compare the number of users of different social groups, the number of financial transactions, volumes transferred, etc., decentralization will be measured and reported on. Decentralization is a very key feature and if the economic and social importance of networks is going to grow, there will be a strong emphasis on high decentralization. Does it make sense for the assets of half the world to be managed by, say, just 10 entities? The world would become less stable. Decentralization needs to scale, and if decentralized networks are one day to be used by a significant part of the planet, thousands of independent block producers and hundreds of thousands to millions of delegators must be responsible for the assets. We need to think about decentralization, talk about it, and scale it up. At the moment, we are at the very beginning.

PoW is great at security, worse at decentralization, and bad at scalability. Moreover, the design of this consensus does not allow decentralization to increase. PoS is great in all three areas. Security is sometimes questioned by some people, but it’s only a matter of time before people start trusting PoS more. People didn’t trust PoW much in the beginning either. PoW security relies on energy consumption, which is a unique system, but probably unsustainable in the long run. Over time, transaction fees may prove unable to provide a high level of security. In addition, high energy consumption generates controversy, which may discourage large investors. This will lower the value of BTC coins and thus result in less security. The PoW concept is good, but it turns out that it cannot exist on its own. Maybe a good way is to link one protocol with multiple consensuses. Cardano can have PoS and PoW alongside it. This would increase security and the protocol would be able to secure enough funding to run PoW. This is the distant future. However, it is a good idea to consider it now.

PoS is often criticized for people staking on exchanges and thus giving decision-making power to the exchange. PoW has exactly the same problem. People buy hash rates from third parties who run ASIC miners for them in their mining hall. In the case of PoS, people can withdraw coins from the exchange into their own wallets at any time. It is more convenient for people to hold the coins in their own custody and, most importantly, it will increase decentralization. In the case of PoW, this cannot be done so easily as domestic mining is often unprofitable. If ordinary people want to mine, they have to rely on third parties, essentially handing over power to the big players. There is an economic barrier that prevents the possible increase in decentralization.

Personally, we trust the quality of PoS security. Security is based on a high level of decentralization and an incentive model. It is important to remember that the security of public blockchain networks is also about decentralization. It’s not just about security itself in the sense of proof about the computing work, as the PoW consensus does. Will the network be secure despite the fact that the hash rate will be enormously high if a small number of entities have access to it? The risk of attack will simply be relatively high. The decision-making power in the Cardano PoS network is distributed to a high number of individuals, so an attacker has little chance of damaging the network due to low stakes. Getting a high stake in principle means buying up coins on the open market, which can be very difficult since most people are economically motivated to hold coins for their own staking profit. A lot of coins are locked up by pool operators and staked. With DeFi, there will be more opportunities to use the coins and possibly capitalize on them. Few will want to sell them. Additionally, as adoption and the number of new users grow, decentralization will grow, again making an attack less feasible. If, for example, 25M people each own 1000 ADA coins and they would not be willing to sell them at any market value, an attacker would have no chance of getting a majority to conduct a 51% attack. Ten years from now, Cardano may have that number of users and a similar distribution of coins.

You yourself have seen the gross difference in decentralization between Cardano and Bitcoin in the context of the number of users. We can say that Cardano protects users’ assets better than Bitcoin at the moment because of its higher decentralization and the possibility of its growth in the future.