Cardano grows in important stats

It can be difficult for people to make a good estimate of a project's potential. There are a lot of false narratives floating around in the cryptocurrency space. In this article, we'll look at the stats that really matter and we provide relevant context. You will see that Cardano does very well in stats, but hard data is not the most important thing for adoption.

TLDR

- Cardano is a mission-oriented project and success will be measured based on positive contribution to society.

- Blockchain projects have different missions and their adoption will follow a different trajectory.

- Market capitalization is always the result of many causes. The causes of success will vary from project to project.

- In less than 1 year, the number of addresses holding ADA coins has more than tripled. In terms of transactions per 24 hours, Bitcoin is only slightly better than Cardano. The difference is not even double.

- Cardano is a relatively young project that is only now coming to the fore. Nevertheless, there is interest in it on social media. Over the past two years, interest in Cardano has increased 10x. In the case of Bitcoin 3x.

- Cardano has led the stats related to activity on GitHub for years.

- The development of blockchain technology is important because we still don’t know what is the best solution for the future. No technology in the world has long-term dominance. Leadership can only be maintained through innovation.

- The degree of decentralization, scalability, security, programmability, tokenization capabilities, governance, network usage fees, second layer quality, are all characteristics that can be objectively compared to each other.

- Total Value Locked in the Cardano ecosystem makes a new ATH every month.

- In the sixth round of Catalyst, $4M in ADA was available for 711 applications. Almost 45,000 wallets have voted and 151 projects have received funding.

- The growing value may attract new users, but if adoption is built on speculation, it may not last long. Long-term adoption must be built on utility.

- To assess the potential of a project, it is critical to understand the stage of development it is in. There is data that no statistics will capture. It’s important to look at a project holistically and connect all the important factors.

- Adoption is not just about hard data and comparisons. Personal preferences are also important.

Market capitalization is a consequence, not a cause of success

One of the false narratives in the cryptocurrency world is that the measure of success is the market capitalization of a project. People are able to dismiss a project based on the decreasing market value of the coins. Cardano is a mission-oriented project and its purpose is definitely not about short-term speculation. Success will be measured based on the rate of adoption and positive contribution to society. This is a long-term mission and takes time.

The technological development of the project is still at an early stage. Cardano has a working Proof-of-Stake and it is possible to create decentralized services through smart contracts. However, this is just the beginning. The development of the protocol and infrastructure is not over and will continue. Creating decentralized services and their adoption takes time. Dealing with companies and governments also takes time. Deploying a solution at the state level is a job for years, not months.

It is important to understand what stage the project is at. Proof-of-Stake on Cardano was launched in 2020. Smart contracts came in 2021. The first DeFi services started appearing in early 2022. Protocol adoption has only just started and there is no point in comparing this to other projects that have been around longer. Bitcoin was launched in 2009. Clearly, its adoption will be significantly greater.

It makes no sense to argue that Cardano has no chance because it can’t outperform Bitcoin or Ethereum. The missions of Cardano, Bitcoin, and Ethereum are fundamentally different. The projects are also fundamentally different from each other technologically. Therefore, the adoption of the projects will also be completely different. There will be users who will just hold BTC and never use DeFi services. On the other hand, there will be users who will use Cardano on a daily basis. Many people will use both Bitcoin and Cardano, which is a reasonable middle ground. The rivalry and tribalism between projects are silly and only take place on social media. It will have minimal effect on mass adoption.

People should distinguish more between cause and effect. Why is Bitcoin now the number one by the market capitalization? Obviously, because it is the oldest project, despite the fact that it is still very young. For years Bitcoin had no competition, as the first attempts were basically just copies. The first good attempt was Ethereum. Cardano is another one of many. Technologically different competition is basically only now emerging. Bitcoin’s high market capitalization is a consequence, not a cause. The causes are age, high network effect, technology, popularity among institutional investors, community defending the status quo, etc.

Are there causes that may affect the market capitalization of Cardano? Apparently yes. In part they will be similar to Bitcoin and Ethereum, in part they will be unique. Cardano has a strong community, a rapidly growing network effect, a sound technology that will continue to evolve. What makes Cardano unique? Cardano uses PoS consensus, so users can stake their ADA coins. Therefore, it can provide passive income to ADA coin holders. Cardano is a platform, so the network effect will grow not only based on the ability to store value but also based on functionality. This functionality is interesting for developing countries that can build their social and financial infrastructure on top of it. This process is in progress, especially in Africa. There is real interest in Cardano. Fortune 500 companies are also showing interest.

Cryptocurrencies are bringing disruption to the financial world in particular. The financial world is not just about money and transmission networks. The financial world is about banking services, about contracts between users, about creating trust between two parties who do not trust each other. The financial world is closely interconnected with other sectors. The idea that we will create a new digital non-state money and use it centrally like current fiat money would be considered a failure of the whole industry. It is more likely that the concept of decentralization will penetrate other sectors, as current fiat money is. If you want to buy, say, a stock, you have to trust the third party you send your order to. Then they will fill your order. If it is possible to do the same thing in a decentralized way and at the same time it is faster, cheaper, more reliable, more resistant to censorship, and more secure in terms of misuse of funds or personal data, that is probably our future.

Market capitalization is the result of several phenomena, but they all essentially depend on adoption and the size of the network effect. The higher the network effect, the more beneficial the network will be to society. The success of IT giants such as Google, Amazon, Facebook, and Twitter is built on exactly the same principle. There are multiple big IT giants because they differ in capabilities and functionality. Google doesn’t have a community to urge others not to use, say, Facebook. The competition takes place on a technological basis. Google, for example, has tried to create a social network.

People use what they need. It’s silly to advise someone to hold Bitcoin and not use DeFi on Cardano. People won’t take silly advice and will naturally use the services available. If these services offer people some benefits, they will be popular and their network effect will grow. Maximalism on a technological level has never worked and will not work in the world of blockchain technology.

Cardano’s market capitalization will grow over time as a result of its success in growing the network effect. This process takes time. You can tell if Cardano is on track not by the current market value of ADA coins, but by the statistics that tell the story of adoption and interest.

Growth in the number of users and transactions

Cryptocurrencies are perceived as an alternative to fiat money, mainly due to the immutable monetary policy. Cryptocurrencies are generally a better store of value in the long term than a medium of exchange in the short term due to their high volatility. However, despite the volatility, cryptocurrencies can be used to pay for goods and services. Cryptocurrencies are non-state money and no one can mandate their use in a particular territory. Adoption is dependent on the free decision of individuals. Success will be higher the more people consider the coins of a given project as a store of value or money. In this regard, it is important to keep track of statistics regarding the number of wallets carrying ADA coins.

Finding out this figure can be complicated by the fact that people may hold cryptocurrencies on centralized exchanges or use other custodial solutions. The exact numbers of holders are therefore relatively difficult to estimate. What we can determine relatively accurately is the number of blockchain addresses holding the coins. It is also easy to find out the number of active addresses, i.e. addresses that have used the coins in the last 24 hours. This figure correlates with the number of transactions.

At the time of this writing, there are approximately 3.5 million addresses with ADA coins. Approximately 1.1 million users delegate ADA coins to pools. Roughly 100,000 to 160,000 people per day send a Cardano transaction.

If we were to compare these figures with Bitcoin over the same period, we would find that there are approximately 40 million addresses with BTC coins. The number of active addresses, and therefore transactions, is approximately 100,000 to 300,000 per day.

Bitcoin has more than a 10-year lead over Cardano in adoption if we count Cardano adoption since 2020 when Cardano switched to Proof-of-Stake consensus. In the number of on-chain coin addresses, Bitcoin is only approximately 11x larger. In terms of transactions, the difference is not even double. Other factors can affect the statistics, such as the Lightning Network reducing the number of transactions on Bitcoin. The Lightning Network (LN) has roughly 90,000 open channels. LN nodes with active channels are about 20,000. Let’s add that Cardano can move multiple UTXOs in one transaction thanks to Plutus scripts.

To add context, as recently as May 2021, Cardano had only 1 million addresses with ADA coins. By December 2021, it was already at approximately 2.5 million. At the time of writing, it’s already 3.5 million. The number of users has more than tripled in less than a year.

In terms of the number of transactions per day, Bitcoin is only slightly better than Cardano. With Cardano’s DeFi boom yet to come, it is realistic that Cardano will soon surpass Bitcoin in this statistic. Cardano is a platform, so its strength lies in the growth of the network effect in the sense of directly connecting users. This is what makes Cardano different from Bitcoin.

Bitcoin’s mission is primarily about holding BTC coins in your wallet and making payments if necessary. Bitcoin’s mission is not about financial services competing with banks. Cardano is being built to enable the building of social and financial infrastructure. In addition to payments, it wants to enable financial services like loans, insurance, savings, stock trading, etc. For this kind of use case, adoption at a local level, for example at the state level, is important. Therefore, the IOG team, in collaboration with governments, is trying to use Cardano in developing countries. Cardano can be used in developed countries to tokenize current financial assets if regulation allows. In our view, it is a question of time.

Creating a direct network effect and seeking the adoption of decentralized services at the level of governments, companies, and institutions is extremely important for the success of Cardano. In other words, while institutions can hold BTC as a hedge against inflation, they can use Cardano services on a daily basis. At the same time, they can also hold ADA coins and stake them for ensuring passive income and for decision-making rights in the Cardano network.

Social media

In order for adoption to grow, people need to be interested in the projects and be able to find relevant information online. Social networking sites greatly help the adoption of cryptocurrencies. Let’s take a look at some statistics for Bitcoin, Ethereum, and Cardano.

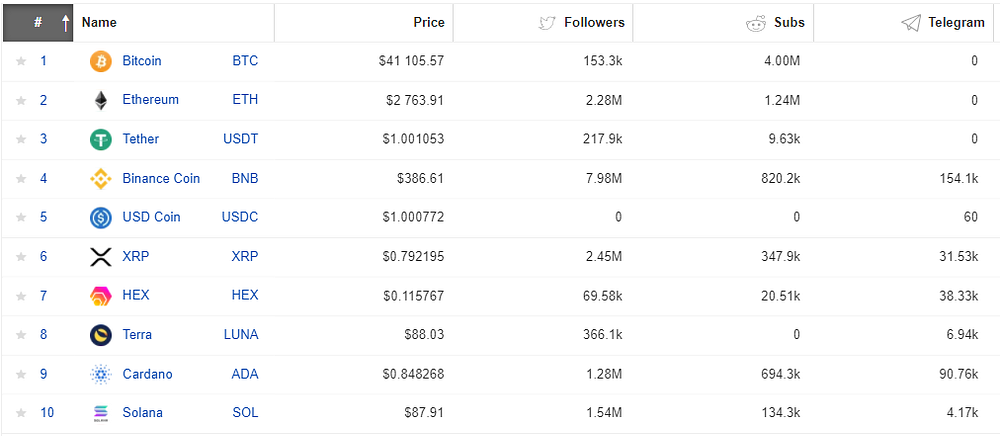

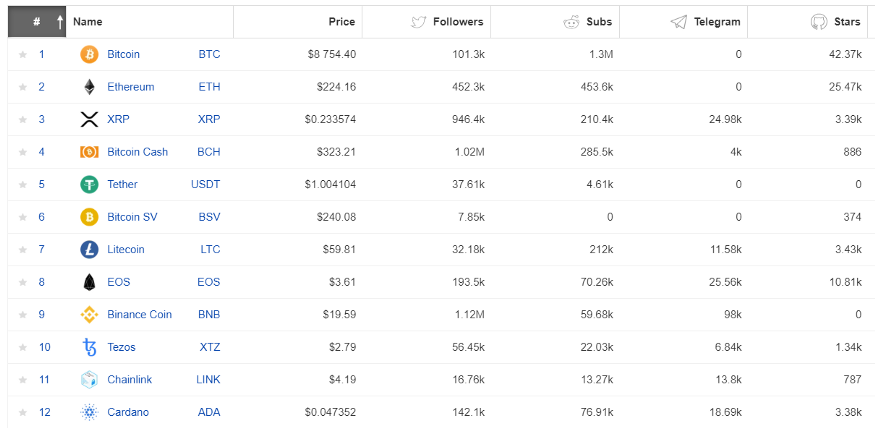

According to the CoinPaprika portal, Bitcoin has 150k followers on Twitter, Ethereum 2.3M, and Cardano 1.3M followers. We don’t know why the number is so low for Bitcoin and it is more than likely that Bitcoin dominates this statistic. As for major Twitter accounts, the official Bitcoin account with the handle @Bitcoin has 4.4M followers. Cardano Foundation has 830K followers, IOG has 250K, and Charles Hoskinson has 875K. Ethereum account with handle @Ethereum has 2.2M followers and Vitalik Buterin has 3.5M.

On Reddit, 4M people follow Bitcoin, 1.25M follow Ethereum, and 700K follow Cardano.

In Q1 2020 we wrote a similar article and the figures were as follows. Bitcoin had 100K followers on Twitter, Ethereum had 450K and Cardano had 140K. Reddit had 1.3M members in the case of Bitcoin, Ethereum had 450K and Cardano had 75K.

The important thing is the trend. In two years, interest in Bitcoin on Twitter has increased 0.5x (we repeat that this figure is unreliable and there are many Twitter accounts with many followers), Ethereum 3x, Cardano 9x. On Reddit, it was a 3x increase for Bitcoin, 1.5x for Ethereum, and 9x for Cardano.

As for Facebook, there are many Bitcoin groups that have around 10K — 50K members. Bitcoin Magazin group has 108K members. The official Cardano group has 230K members. In our country in Central Europe, the largest Bitcoin group has 35K members, Ethereum has over 18K members, and the Cardano group has 12.5K members. Cardano is doing well on Facebook.

Another interesting metric is the number of YouTube followers. Over 300K people subscribe to Charles Hoskinson’s videos on YouTube. The videos are watched by 40K — 80K people. Some older videos have over 100K views. The official IOHK YouTube channel dedicated to protocol development has 133K subscribers and the videos are watched by around 1K to 3K people on average. Some older videos have over 10K views. The official YouTube channel of the Cardano Foundation has almost 25K subscribers and the videos are watched by over a thousand people.

The official Ethereum YouTube channel has 75K subscribers. You can find several videos there that are 5 years old and have around 10K views. Bankless, a well-known Ethereum channel, has 140K subscribers. The videos are watched by 1K — 3K people. Some episodes have reached the 10K views mark.

With Bitcoin, the situation is more complex as many people are into technical analysis and few are addressing fundamentals. There are many podcasts. For example, What Bitcoin Did, which is subscribed to by 77K people and views are averaging around 15K to 30K. Some videos have exceeded 100K views. Perhaps the most famous Bitcoin influencer dedicated to fundamentals is Andreas Antonopoulos, who has 310K subscribers on YouTube. Videos are watched by an average of 8K — 20K people. Another YouTube channel dedicated to Bitcoin is Anthony Pompliano, who is followed by 360K people. Videos are watched by an average of 10K — 20K people.

Let’s add that there are many YouTubers who are only dedicated to the Cardano project. Similar to Facebook, Cardano is doing very well on YouTube.

The age of the projects is reflected in the social statistics. Many people are creating content about Bitcoin on various social networks. However, the same is happening with newer projects and it makes sense that the number of content creators is smaller. Bitcoin has a significant lead, however, the dominance is not high. According to LunarCrush, Bitcoin’s social volume is 430K, Ethereum’s is 130K and Cardano’s is 30K. Bitcoin’s social dominance is at 27%, Ethereum’s at 8%, and Cardano’s at 2%.

Roughly, we can conclude that about 2x more people are interested in Bitcoin than Ethereum and about 6–12x more people than Cardano. In the case of Cardano, it is not easy to determine the exact distance, as we find different results on different social media.

That’s not a bad result for Cardano at all. It’s important to remember that almost everyone in the world has heard of Bitcoin and the statistics are unlikely to improve significantly at the expense of other projects. On the other hand, we can see a steep rise in interest in other projects. In the case of the Cardano project, people’s interest has increased almost 10 times in two years. We expect that younger projects, including Cardano, will soon catch up with Bitcoin in media interest. People who have only heard of Bitcoin and devote most of their time to it are likely to become interested in other projects. Bitcoin’s dominance will likely diminish in favor of new projects.

GitHub commits and technology development

Is the blockchain industry more of an economic revolution or a technological revolution? From our perspective, it’s a combination. New technology will enable the disruption of the financial world. Not just the financial world, it must be added. The cryptocurrency movement is not just about blockchain and PoW. Today it is also about Proof-of-Stake, smart contracts, the possibility of tokenization, second layers, etc. The evolution continues and has not stopped with Bitcoin. If you look at the history of money, you will see that it is constantly changing and evolving. It started with barter and through the seashells that served as money, we got to internet banking.

It is naive to assume that development will stop with Bitcoin or Cardano. The evolution of money will continue. It is possible that within a few decades we will abandon internet banking and move to blockchain. Within a hundred years, we will move to something completely new.

Satoshi Nakamoto connected older technologies, namely distributed network theory, asymmetric cryptography, Proof-of-Work, and blockchain. That, in a nutshell, is the foundation of Bitcoin. Satoshi would never have created Bitcoin if many talented scientists had not created these technologies before him. The interconnection of these technologies is the absolute foundation of decentralization in the Internet environment. New technologies will be layered on top of this foundation and the possibilities will expand.

Technological progress cannot be stopped and never has it been in the history of mankind. Who would have believed even 10 years ago that we would be able to replace coil engines and produce cars with electric motors? The world of the Internet and protocols is no exception to the evolutionary process. Facebook is the largest social network and it has 2.9 billion users. YouTube is right behind with 2.2 billion. In third place is WhatsApp with 2 billion. Do you think Facebook would have maintained its dominance if it hadn’t changed during its existence? Facebook is investing a huge amount of financial and human capital to maintain its position, yet it is more than likely to lose it sooner or later.

Some may think that things will be different with digital money and that we will have just one single protocol that will be around for centuries. It cannot be ruled out, but it is the less likely option. In the world of technology, it is impossible to maintain dominance in the long term. It’s a little easier in the physical world where the government tells you to use a certain fiat currency. But even here there are changes, either in the form of use or complete replacement.

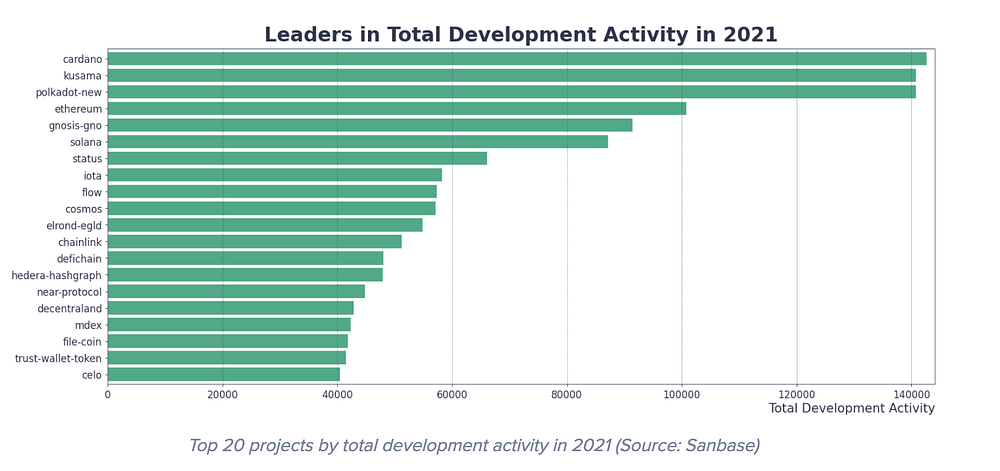

The investment in the development of the protocol and its technological dominance is what can keep it relevant for a long time. Cardano has been the leader in terms of developer activity on GitHub for several years and is the most growing project.

In addition to Cardano, the top ten include projects like Ethereum, Polkadot, and others. A similar figure can be found on many independent sites that compare activity on GitHub. Bitcoin can be found at the tail end of the top twenty. Bitcoin is considered by the community to be finished and not changing much. It’s an unusual approach in the tech world, but if the team and the community want it and think it’s the best approach, that’s perfectly fine.

From our perspective, we are still too early in the adoption of cryptocurrencies to say what is the best solution for the future. Cryptocurrencies are a new thing in many ways and we don’t have answers to many questions about the long-term sustainability of the economic model, scalability at the first layer, governance over protocol development, ecosystem development, etc.

We believe that innovation is and will continue to be important for adoption and maintaining a strong position in a highly competitive environment. It is important to mention that activity on GitHub is an important statistic, but it is also worth noting that the team is implementing a protocol based on scientific research. Cardano is a project that has over a hundred scientific studies behind it. This approach is extremely important and is proving to be the fastest and safest way to reach the goal. For example, IOG has been working on Proof-of-Stake for a shorter time than the Ethereum team, yet this year the Proof-of-Stake on Cardano will celebrate its second birthday. Ethereum still doesn’t have a Proof-of-Stake and if all goes well, it will get one this year. However, Cardano will always have at least a 2-year head start in terms of a working Proof-of-Stake.

Many competing projects have delivered alternative consensus protocols relatively quickly. However, teams have sacrificed decentralization (often intentionally) or protocol quality for speed of delivery. Poor quality led to the need to restart networks. Proof-of-Stake on Cardano runs reliably without rebooting. This is very important in the long run.

People need to trust new technologies and know that behind every network is a team of developers. So people basically trust not only the decentralized protocol but also the IOG team. Don’t be fooled by the false narrative that Bitcoin has no leader. Every public blockchain project has a GitHub, a repository manager, a core team, and a leader or group of leaders. Some projects are more transparent, others less so.

We certainly don’t want to say that Cardano will be the market cap leader just because it has one of the best teams in the blockchain industry and leads the stats related to the activity on GitHub. We don’t even want to say that Bitcoin will fail because its development at the first layer has essentially stopped (maintenance is still ongoing and Bitcoin has received a major upgrade in the form of Schnorr signatures). No one can predict that.

What can be predicted, however, is that a quality technology solution will find its users. The degree of decentralization, scalability, security, programmability, tokenization capabilities, governance, network usage fees, second layer quality, maintaining the value of stable coins, are all characteristics that can be objectively compared to each other. Moreover, they can be improved over time and are more than likely to be improved due to the highly competitive environment. Although everyone has different preferences and different solutions fit different problems, the network effect of Cardano will probably grow fast.

Certainly don’t think that we are done with any of the above characteristics once and for all. Security is definitely one of the most important characteristics. People will not adopt technology if it means risking the loss of their wealth. Unfortunately, we have seen many hacks in the past. The room for improvement is huge.

Ecosystem growth

The Cardano ecosystem is growing incredibly fast in the context that it has been about half a year since the hard-forks that brought smart contracts. Total Value Lock (TVL), the value that is locked in DeFi, makes a new ATH every month. At the time of writing, we have crossed the $200M mark. A boom can be expected in the summer of 2022 as another hard-fork takes place to increase the scalability of the network. Let’s add that due to its age, Ethereum is the largest ecosystem, with around 115 billion locked in (only 75 billion by DeFi Pulse).

Over 500 teams are working on projects that will use Cardano. Of course, there is no guarantee that all projects will be completed. There are over 560 protocols (DeFi services) on Ethereum according to Defi Llama. The Binance Chain is in second place with 330 protocols. Behind the top ten are platforms on which run the order of dozens of protocols. Cardano is now in the top 30 with 6 protocols running.

This statistic is not so much about the total number of running protocols, but about their quality and especially the adoption rate. What determines long-term success is the number of satisfied users. At this point, we are still at the beginning of adoption and it is safe to say that most cryptocurrency holders do not use decentralized services yet. Basically, nothing is decided in this area. A rough estimated 2–4 million people have tried decentralized services on Ethereum. The DeFi sector is literally in its infancy. If every ADA holder tried a decentralized service, Cardano would catch up to Ethereum relatively quickly.

Cardano has a huge advantage in that the community can finance many projects from the project treasury. Thus, Cardano doesn’t need to rely on VC. Within Catalyst projects, people vote on what specific ideas should receive funding for implementation.

At the time of writing, we have completed 6 rounds of voting. In the first round, 1,700 wallets voted and 8 projects received funding. In the sixth round, $4M in ADA was available for 711 applications. Almost 45,000 wallets have voted and 151 projects have received funding. Catalyst is the largest community-driven campaign in the cryptocurrency space.

In a few years, hundreds of projects will be funded in each round. Obviously, the funding received is no guarantee of a quality outcome and we will see many failures. The important thing is that we will also see some successes. In the startup environment, one project out of many will succeed. In a broader perspective, this is sufficient. The entire crypto space is essentially waiting for a killer app, and there will only be a few of those in the next decade.

Cardano’s best is yet to come. We are all waiting for the stable coin Djed, which we can expect on the main-net in Q2 2022. The second tier project Hydra is also doing well. The beautiful thing about technology is that you can never guess what innovations it will bring. This makes it difficult to estimate the speed and rate of adoption.

We can also expect a positive trend in this area. It is unlikely that completely new smart contract platforms will emerge every year to completely replace the current ones. Rather, the current ones can be expected to consolidate their position. The development of a platform takes years if it is to be of the same or even better quality than, say, Cardano. New teams have a certain advantage in that they are inspired by current solutions and can learn from their mistakes. However, this does not mean that it will fundamentally speed up development. Some will do better, some will do worse. Users will try multiple solutions and choose their favorite. The choice is not necessarily at the platform level but at the service level.

It’s not just about hard data and comparisons

To assess the potential of a project, it is critical to understand the stage of development it is in. Common quick comparisons of Cardano with older projects can be misleading. Sizing by market capitalization is downright nonsense. It is necessary to keep an eye on statistics that are meaningful over the long term. However, this may not be enough.

There is data that no statistics will capture. For example, being number one in GitHub activity tells the average person nothing about the quality of the design and security of the protocol. The IOG team has over 400 employees. While you can look at their profiles, it doesn’t tell you anything about their workload and performance. The importance of collaboration with governments and Fortune 500 companies is also hard to measure. Many independent teams and individuals acknowledge Cardano’s qualitative edge. Recently, for example, the Kraken Exchange team. Cardano has a very strong and engaged community. If you want to be intellectually honest in your assessment of the project and get the full picture, you can’t ignore soft data.

Additionally, be aware some hard data can be misleading. A large number of projects can be created on smart contract platforms, but it is important that someone uses them. The number of apps created may not be the most accurate information, as a large number of them may be dead projects that have already been replaced by competitors. What is interesting is the total number of users of a given platform and the amount of Total Value Locked (TVL). However, it could be that the number of users is being faked and that there are several whales behind the high TVL. It is necessary to be very careful and research things in depth.

It’s important to look at a project holistically and connect all the important factors. This is difficult because it requires good insight into many disciplines including information technology, finance, law, regulation, politics, and sociology.

All of these points of view are important. Blockchain is a disruptive technology and will affect almost all areas of human activity. What we don’t know now is when and how exactly it will happen. People tend to compare hard data and that’s perfectly fine. However, in terms of future potential, this is not a complete picture of reality. The maturity of the technology and new features will influence adoption, because the more it enables, the more impact it will have. Regulation will have a major impact, as we will not see the tokenization of shares without permission from authorities. Politicians make adoption decisions at the state level. Financial institutions and firms must be willing to move to new technologies, and this may take years. There are still many unknowns in the world of cryptocurrencies and a few decisions or events can literally turn everything upside down. In a positive or negative sense.

It is difficult to estimate the potential of one particular blockchain project. It is significantly more difficult to get a complete picture of the entire blockchain industry. You should have a deep insight across multiple blockchain projects, which is an unattainable goal for an individual.

There is a lot of hard and soft data available to compare projects with each other. But alongside this, there are your personal reasons and considerations for adopting a given project. It could be the philosophy and mission of the project, the popularity of the team, the community, transparency, a particular activity or service.

An individual will always advocate for the project in which he or she has the most investment. The economic interest is often the strongest. It is good to be aware that many people will not tell you the truth in the cryptocurrency world. For purely selfish reasons, people may knowingly lie to you. It is extremely important to do your own research, check everything out from multiple sources and make up your own mind. It’s easy to resign yourself to this activity and tell yourself that Bitcoin and Ethereum are the current market leaders. Still, we think you shouldn’t overlook Cardano.

From our perspective, the world of cryptocurrencies is not purely about speculation, but about the potential to change our society. It is good to see cryptocurrencies through this lens as well and to be with a project that can bring about this change. At the heart of Cardano is decentralization, as this is a feature that makes the whole industry unique. ADA in your hands is the key to a high level of decentralization.

Some maximalists try to convince us that the only important metric is market capitalization. This is certainly not Satoshi’s original vision. Satoshi’s vision is about decentralization and the ability to replace unreliable middlemen. It is a vision of freedom and privacy. Satoshi would very likely never be a maximalist at the technological level. You don’t have to be a maximalist either.

What is next for Cardano

The mother of all statistics in the Internet world is the network effect. Cryptocurrencies with tens of millions of holders cannot compete with social networks used by billions of people. DeFi services are younger and therefore even further behind in adoption when compared with the first generation of cryptocurrencies. The adoption trend so far is very positive and the numbers can be expected to grow.

Technological progress will drive adoption. The individual features and parameters of the protocols will improve as well as their functionality. Cryptocurrencies will only succeed if they start to be a viable alternative to current banking services. Once it becomes normal for 10% of the population to take out a loan through DeFi services, we will see a meteoric rise. So far we are not even close to 1%. Cryptocurrencies have the best ahead of them and Cardano is doing very well in all the important stats.

Cardano’s main strength lies in its ability to build financial and social infrastructure. The technological capabilities of the Cardano platform and the ability to build secure and reliable DeFi services is what will determine success. Cardano is not here to compete with Bitcoin and its mission is fundamentally different. Ethereum is also a platform, so these projects will bump into each other more often. However, this is only a good thing from the users’ point of view, as the competitive environment speeds up development.

If you want to know the answer to whether Cardano has a future, you should ask whether DeFi makes sense. We believe it definitely makes sense. There is no logical reason why DeFi should fail. It’s just a natural extension of existing decentralization capabilities. The first generation of blockchain could only transfer value. This is useful for making payments to someone you trust or physically see in a restaurant, for example. The next generation can transfer value conditionally. This will allow mutually secure stock purchases between people who don’t trust each other. Both make sense.

DeFi industry is more technologically complex and more connected to the physical world. In many cases, it will require the involvement of real identities and connections to existing financial services, which is something that is coming anyway in the context of current regulations. It’s good to remember that Bitcoin functionality is essentially finished and development will happen on higher layers. Cardano is not finished and will continue to evolve. Think about this when you or anyone else tries to compare Bitcoin and Cardano. You may find that the comparison often makes no sense. It makes more sense to compare Cardano and Ethereum.

We can see the differences in the mission of Cardano and Ethereum. Cardano is trying to build a secure ecosystem at the cost of higher demands on developers. Haskell/Plutus, as the primary programming language for writing scripts, can be something of a hurdle for the average developer to overcome. Cardano is built as a mission-critical system and formal methods are used in the development. This approach can slow down development, although we have seen from the Proof-of-Stake example that this need not be the case.

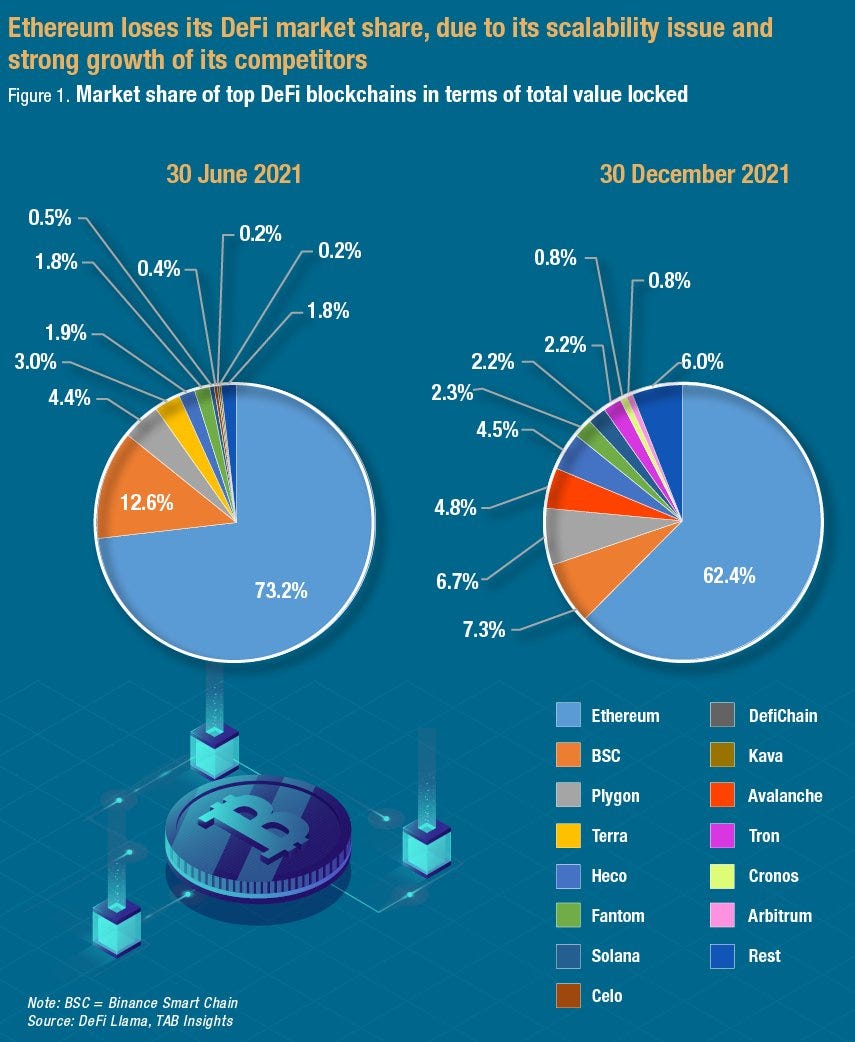

Ethereum has a dominant position in the DeFi sector, but the competition is quickly catching up. Ethereum has lost 11% of its dominance in half a year. In June 2021, Ethereum had a dominance of 73%. In December 2021, it was only 62%. Notice that there is no significant competitor yet. Rather there are more similar projects. Cardano will likely gain a part of the market share in 2022. Anyway, it is not true that Cardano has missed the train, as some often claim. Cardano is going at its own pace for its future users.

To be clear, voluntary adoption of decentralized services across the world is not the only adoption direction. the IOG team seeks direct adoption through collaboration with governments in developing countries. This type of adoption is extremely demanding in terms of administration and the effect may take several years to be felt. However, if successful, adoption could increase by tens of millions of people.

Let’s not forget that people may consider the ADA to be a store of value in the same way that BTC is. They may not desire to use decentralized services. Cardano has a similar monetary policy to Bitcoin and the number of ADA coins is limited to 45 billion. Staking may be the only motivation for people to hold ADA. As we said, people may have different reasons for holding ADA coins. The importance of soft data can be greater than hard data.

Conclusion

The market capitalization of projects will reflect their financial and social significance in society. Speculation is part of social meaning, but it may be a bubble that bursts. Direct network effects and a strong user base take a long time to build, but after that, market capitalization can stabilize. The reverse doesn’t work so well. The growing value may attract new users, but if adoption is built on speculation, it may not last long. Long-term adoption and natural growth must be based on utility.

Holding cryptocurrencies in wallets for the store of value feature is certainly a given form of use. If people are forced to continue using fiat currencies because of their ability to maintain purchasing power, the importance of cryptocurrencies will continue to be marginal. Cryptocurrencies must offer the world not only a store of value but also a reliable means of exchange. Financial services need stability, reliability, and security. Thanks to Cardano, people will get that in the coming years.