Blockchain needs a viable incentive mechanism

The economical and incentivize model is a very underestimate topic when talking about cryptocurrencies. It influences how many people will be willing to operate a node or how secure the protocol will be. Last but not least, it influences also the level of decentralization. Learn more about it.

A decentralized public network is not only about technology. The network is maintained by people for the people. There must be a solid incentive mechanism to economically motivate people to keep the network running. People have to operate validation nodes and pools. It can be said that node owners are basically employees of the network. So the inseparable part of the public network must be a viable economic model including an incentive mechanism. Moreover, it must be sustainable in the long run. As you will see, to keep the network running might be easier at the beginning but much harder after a few years. When building a public network the team must think in decades forward to ensure that the network will remain decentralized, secure, public, and trustless.

In this article, we use the word blockchain as a synonym for a global public permissionless decentralized network.

Consensus and incentives

The hearth of every blockchain is a consensus algorithm. From a technological point of view, there must be more distributed nodes in the network that are responsible for making a consensus. Network consensus serves as a means for processing new transactions or executing smart contracts. At this point, technology meets with the economic interests of participants. To consider the network as decentralized one there must be economic motivation to operate a node. The more independent entities operate a node the better for decentralization. The network needs to attract participants from all corners of the world who would be willing to perform a specific function in the desired standard. The incentive mechanism must motivate people to do so and, at the same time, motivate to honest behavior aligned with the network interests. Properly designed consensus mechanism must ensure at least the following basic requirements:

- Economically motivate people to operate a node in the required quality. You can consider that as a reward mechanism. There might be other than just economic incentives, like idealism, morality, or desire to “do the right thing”. However, economic incentives are the most important ones.

- Distract from dishonest behavior. You can consider that as a punishment mechanism. Public networks will always face attacks and there might be people willing to lose some money in order to destroy or discredit the network.

- Be egalitarian as much as possible.

The node operators are rewarded by network native coins that have certain fiat value. In most cases, the reward consists of network subsidy coins and fees. Fees are paid by users for using the network. It can be a transaction fee or fee for deploying a smart contract. Thus users of the network indirectly pay to node operators for their service via a consensus mechanism. All fees are collected by the network and distributed later in a defined proportion to node operators. Some small part of fees might be kept by the network for a project treassury.

At this point, the economic model of a project gets into play since it can gradually release or generate new coins that are used by the network for rewarding. A given project might be a deflationary or inflationary monetary system. In the case of the deflationary system, there is a pre-programmed model in which a certain amount of coins is regularly created and released by protocol. The amount of newly created coins is gradually decreased (for example, by a halving process) heading towards 0. The logic behind is that at the beginning of the project existence it is expected less interest in using the network so there are fewer transactions. Thus transaction fees are not able to cover the needed amount of rewards for node operators so the significantly greater part of the reward consists of network subsidy — the newly created coins. As new users come and start using the protocol there are more and more transactions and, in some cases, more deployed smart contracts so fees are gradually able to cover the rewards. The network subsidy can be gradually decreasing as the amount of collected fees increase. You can see the example in the picture below.

In the inflation model, new coins are created forever so the network cannot rely only on utility fees. However, inflation devalues existing coins so the inflation rate must be carefully calculated if coins value are to hold or even rise.

Different projects often try to fix the economic model at the beginning. It is questionable whether that is smart doing so without the possibility to predict the future and knowing how the adoption, network usage, and coin price evolves or what level of security will be needed. As a consequence, we have already seen some changes in the economic models or hot debates about the future of projects.

Fix the monetary system in advance might not be the best idea. What if the assumptions made at the beginning proves to be wrong later? What if, after a few years of protocol existence, the adoption is unexpectedly low, the majority of coins have been released sitting on a few addresses, and it is not possible to collect an expected number of fees? The project can get into trouble since blockchain security can depend on the price of coins, collected fees, or distribution of coins among users.

Collecting a sufficient amount of fees for rewarding means that there is a high number of users. In other words, the project must be adopted by people and they have to use it on a daily basis. To achieve that the protocol must have resolved scalability and offer some interesting features that people would want to use. It is not easy and at the moment the adoption is very low and most people are just price speculators. It is not what would be healthy from the point of an incentive mechanism. The holding of coins could increase their fiat value, however, without a sufficient number of transactions the network might strive to collect enough fees.

Economic and incentive model behind Cardano Proof-of-Stake

The economic and incentive model is often overlooked, which is a pity since it is probably the most important part of the public decentralized protocols. Let’s see why is the model so important and how Cardano Ouroboros Proof-of-Stake is designed from the point of view of users. Read more

The only usability brings profitability. Network protocols are here to process transactions or possibly provide other features like issuing tokens and deploy smart contracts. Networks have to offer some valuable features. Users have to pay fees to utilize these functions. Blockchain is not a wealth generator. It needs to collect and redistribute fees to node operators if it uses the deflationary monetary system and there are negligible network subsidy. I might sound weird but blockchain must be profitable to ensure its own future existence. It must keep rewarding node operators to remain public, open and decentralized. Once the business is available only for the richest then the network is not public and open any longer. Thus, not trustless as well.

If we use blockchain rather as a storage of wealth, as we can observe within hodling behavior, then incentive mechanisms should not probably rely on transaction fees and deflationary monetary system.

We do not want to say that it is better to strive for the creation of some form of decentralized governance and drive the monetary system as needed at a given time since we could slowly iterate to a system we have now with banks and politics. However, it would be a solution if the system was able to keep a high level of decentralization. If conditions changes then it is necessary to react to some extent. As we said, it is not possible to predict the future.

Incentives mechanism

Incentives are generally a set of rules encouraging people to participate in and create values that will ensure the success of a platform. Incentives influence the behavior of system participants by changing the relative costs and benefits of choices those participants may make. Incentives include reward systems that compensate individuals with real money but other compensation or benefits might be included.

The incentive mechanism is modeled with an assumption of rationality of actors. Each participant acts to maximize own return. The reward can be tangible, for example, money or coin of the project, or intangible, such as esteem, reputation, status, etc. Selfless actors are rare. Nearly all actors are self-interest and pursue strategies that reward them. The economic model, that is programmed directly in the protocol, defines rules and laws that are used to reward all entities participating in making consensus. You can imagine that as a set of instructions that specify how, when and to whom rewards are paid out. Moreover, in what proportions to reward different levels of stake contribution, and how to punish dishonest behavior.

One of the core principles of game theory is that an ideal system is one where a selfish participant, acting in their own best interests, is also, by design, acting in the best interests of the system.

Node operator interest is most often to be rewarded. The reword should cover costs and generate a moderate profit. The network needs to collect a sufficient amount of fees from users and/or use network subsidy to distribute it as a reward to node operators. However, it is not as simple as we have put. There are more requirements, for example, the economic model and incentives must be sustainable in the long term, the consensus should not get centralized after a few years of running, it should be economically advantageous to become a node operator even when network subsidy will be minimal (or none) and fees should not rise in time just because the network subsidy is not sufficient at a given time. The rewarding must be fairly distributed among operators and the staked number of coins in PoS might not be the only input for the algorithm that decides about nodes that will be given the right to produce a block. If there would be one entity that would get the production right very often just due to the big amount of staked coins then the rest of operators could consider leaving. So the biggest cannot always win the production right (as coins holding would dictate) to avoid the situation when only the richest get richer. Smaller operators should be favored by the protocol. However, it could be also tricky due to the anonymous aspect of public networks. The richest operator can create a few smaller pools instead of having just one. So some randomness could be involved in the process of block-creation.

The reward scheme is a fundamental piece of protocol security and must ensure effective decentralization under all possible conditions. The security of the blockchain cannot be ensured by the protocol itself. There is always an economical aspect and behavior of real participants that must be taken into account. The economical model and incentive mechanism are embedded in the source code and the hope of the team is that it is going to work forever. For the deflationary monetary system, only the incentive mechanism is subject to change.

Moreover, it is not enough for the network to rewarded only node operators. The protocol needs maintenance and adding new features. It means that programmers, researches and possibly scientists must be paid within project governance and it might be a lot of money. It is likely that the protocol will need some significant changes to stay relevant since nobody is able to predict the future. Technology, adoption, regulation, users' needs, and many other aspects evolve every day. If the needs are not addressed then some other newer project can take the chance and offer an alternative to existing projects.

Egalitarianism

Block producers are incentivized to produce blocks by receiving a reward for each block they successfully produce and that is subsequently adopted by the required majority of nodes. The rewards serve a dual purpose. It incentivizes block producers but also creates and distributes coins to the system’s maintainers. In an ideal world, investing a certain amount of capital to produce blocks should result in rewards proportional to that capital. Both a poor investor and a rich investor should receive returns in proportion to their investment in expectation. In this point of view, wealthy investors should not be rewarded with disproportionate rewards and everybody should have an equal opportunity to both participate and earn rewards. However, this is far from true with most cryptocurrencies.

It should not matter how much money an individual wants to invest in order to start participating in making consensus. The return of investment (ROI) should ideally be equal for poor or rich investors. In other words, the consensus should not allow the rich to be richer and handicap the poorer.

Egalitarianism also refers to the power of each coin to participate in the creation of new coins. To participate in PoW consensus you need to buy an ASIC miner or other expensive hardware. Thus, you need a certain amount of money to scale your participation. For example, if a miner costs $1000 you need to wait until you do have that amount of money. Till that time, your money cannot be invested in participation in the consensus. PoS projects might take many possible approaches but basically they can set some staking minimum or cannot. If there is no minimum set and every newly earned coin can be added to the user’s stake then it is definitely a more egalitarian system than we can observe in PoW.

In the case of PoW, there is another limitation from the point of egalitarianism. The price of electricity in each country. It is something that is regulated by states and thus some countries are more favorable for investing within PoW and some others less. There is no such limitation in the case of PoS. Everybody can delegate coins to a pool and their market price is mostly the same all around the world. It is also similar expensive to operate a validator node around the world.

Egalitarianism is the topic that has to be taken into account when the economical model and incentive mechanism is considered. And again, a protocol is not a wealth generator. To be fair and egalitarian does not mean that everybody who puts money into it will profit from it. There must be some equilibrium and it is hard to find it.

Cardano staking

Cardano uses the PoS system, so holding ADA means holding a stake in the network. If you own ADA than you are a stakeholder. Holding ADA in Cardano means more than holding BTC in the Bitcoin network. Owning ADA comes with the right, or even obligation, to participate in making consensus and create a block. Not all ADA owners are able to create an infrastructure for block creation. However, every stakeholder can delegate the right to produce a block to a pool on behalf of the owner. The important is, that stakeholder can profit from the delegation and thus increase own wealth.

Staking can be considered as hodling 2.0. By holding and delegating ADA your wealth increase in the time since you will be rewarded for the participation. The act of delegation does not relinquish spending power. Your ADA fund can be spent normally at any time and coins are not locked by the delegation process. You can delegate ADA once and then switch off your computer.

Cardano incentivizes users to hold ADA what could lead to broader adoption. Generating passive income could be attractive for everybody and thus, it can also be used for ensuring the protocol decentralization. Every stakeholder can always delegate coins to other pool to maximize own profit or avoid some possible troubles with a pool.

However, there might be projects competing with staking. The projects might offer a better profit for locking ADA in some decentralized finance (DeFi) mechanism. We are at the beginning so there is plenty of time to solve that. For example, the protocol could be probably able to autonomously increase or decrease rewards based on the amount of staked coins but only in case, it is able to collect a sufficient amount of coins. So it could consider increasing and decreasing transaction fees as needed.

To send a transaction in the Cardano network a user has to pay a transaction fee. Transaction fees have two main purposes. It prevents DDoS (Distributed Denial of Service) attacks and provides funds for incentives. Cardano strives for achieving high scalability and usability.

For the main-net, there is prepared almost 14,000,000,000 ADA to be distributed as a network subsidy within 10 years. This is a very large amount, but not an infinite one and its use should exponentially decrease over time. When more and more people use Cardano, more and more transaction fees will be available to compensate for the decrease in monetary expansion.

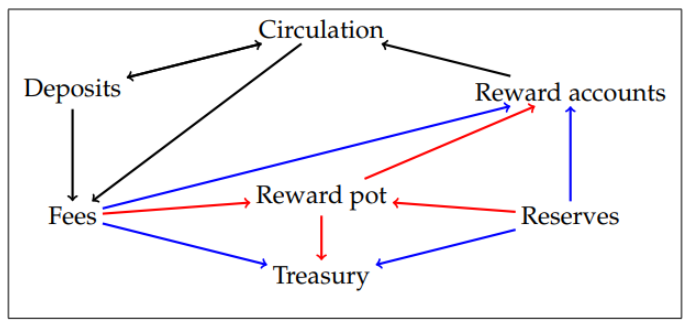

In Cardano, time is divided into epochs and slots. A slot lasts 20 seconds, an epoch contains 21,600 slots and lasts five days. Incentives are distributed on an epoch by epoch base. All transaction fees of the blocks created during the epoch (together with ADA from monetary expansion) are collected into a virtual rewards pool and then the pool is distributed amongst the stakeholders according to their stake.

How much can networks earn on fees

Cardano uses the deflationary monetary system so it is expected that within 10 years it will be able to rely only on fees. How much it can be? Let’s assume that Cardano will be able to process 10,000 transactions per second (TPS) and it could be usual daily traffic. It would be 864,000,000 transactions per day. In case one transaction would cost $0,01 the network collects $100 per second what is $8,640,000 a day.

It can be $8,640,000 a day with 1000 TPS when transactions cost $0,10. Or, it can be $86,400,000 a day with 10 000 TPS when transactions cost $0,10.

Take the numbers easy. At the moment we do not know what the future can bring us.

It is important to mention that the security of Cardano is based on staked coins. Security is not directly dependent on collected ADA coins. The number of coins the network collects serves as a reward for all stake-holders. Even if the collected fees would be low in a given period of time the security budget can be quite big. Learn more in our article.

Security budget of the Cardano project

Security is one of the key features of public networks that strive for public trust and higher adoption. In this…

medium.com

Bitcoin halving occurs every 4 years. In 2030 the Bitcoin block reward will be 1,56 BTC. One block is mined approximately every 10 minutes so there is mined 144 blocks per day. The network is able to process 7 transactions per second which are 604,800 per day. If one transaction would cost $0,01 then the network would generate $6,048 per day. We can neglect transaction wee if we want to presume it remains low. It cannot be like that and fees might rise to keep the network secure. If a transaction fee would be for $10 then $6,048,000 could be collected a day.

So network subsidy is more important for Bitcoin than the collected transaction fees. As we stated above, the block reward will be 1,56 BTC in 2030 so the Bitcoin network would earn $2,246,400 per day when BTC costs $10,000, or $22,464,000 when BTC costs $100 000.

Of course, we did not take into account that also Bitcoin network can evolve. Transaction throughput can be significantly improved, there might be other important changes in the protocol or in the surrounding infrastructure. Take it just as an example.

As you can see, both Cardano and Bitcoin can be able to earn approximately a few $10,000 a day somewhere in 2030.

It is evident that transaction fees cannot keep the network secure if there is used the deflationary monetary system and the network does not scale well. At least in the case transaction fees should remain low.

Summary

As you can see, it is very difficult the design monetary system and incentive mechanism that would work forever. It can be presumed that it will be needed to make some changes to the protocol. It cannot be necessarily related to monetary system or incentives. Improvements within technology, mainly scalability, and usability, can help to collect a sufficient amount of fees that can be distributed to consensus participants. At the moment, we are the experimental stage and strive for higher adoption. We should not be scared of changes in the protocol.