Adoption of Cardano will be different from the First Generation of Cryptocurrencies

The adoption of a platform will be quite different from the adoption of the transactional network. A richer set of features allows people to use many new services and better interconnection with the traditional financial system.

The world’s first known cryptocurrency was Bitcoin, which well represents the first generation of cryptocurrencies. The second generation represents Ethereum 1.0, which came with the concept of smart contracts. Cardano belongs to the third generation that will solve other common cryptocurrency problems such as scalability, project governance, and interoperability.

The fundamental difference between the first and the third generation is that Cardano is a platform and Bitcoin is not. We will focus on the differences related to Bitcoin and Cardano adoption since the way of adoption and attracting user attention will be significantly distinct.

What is a platform

Generally speaking, a computing platform or digital platform is the environment in which a piece of software is executed. You might hear about Java. Java is a programming language and a computing platform for application development. Java platform is a collection of programs, tools, compilers, libraries, etc., that help to develop and run programs written in the Java programming language. Thus, a developer can use the Internet for data transferring and communication, work with resources on a given operating system, create fancy UI, etc.

As a software developer, I can use Java programming language to write an application that people can use. It doesn’t matter if the application is commercial or not. The app can be a video player, a notepad, a game, an accounting program, an exchange interface, wallet, or anything else that the platform and my fantasy allow me to create. Thanks to the Java platform, I can count on having my application run smoothly on almost any computer or cell phone in the world. Java platform includes an execution engine and I can rely on it and know, that it will be easy for users to install and use my application if they wish so.

Below, you can see a very simple Java program.

I have written it within a minute so it just prints a single sentence into the console. It is not definitely an app to bother to download and run. I’m definitely not going to get rich. It should just demonstrate the power of the Java platform. I can use available tools for application creation and it would not be difficult to arrange for you to download and use this application on your computer that is probably ready to execute the code — run my application.

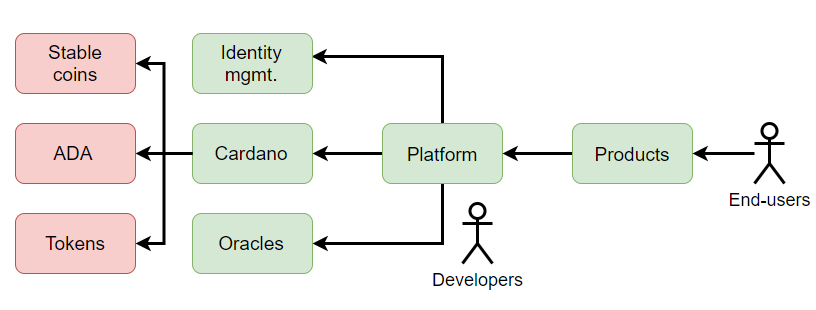

Let us now return to the world of cryptocurrencies. Cardano is an open-source, public platform based on a consensual distributing network and blockchain as information storage. In addition, developers will be able to use smart contracts to write applications in a similar way I have written my Java application. Moreover, in the near future, developers can utilize many other tools, protocols, and services. For example identity management, Oracles, privacy based on zk-SNARKs, stable coins, etc. So more sophisticated and useful applications might be created.

Cardano can be considered as a global social and financial operating system. You can find more details in our article to see how Cardano can be used for example to replace Uber and how end-users can benefit. Within this article, we will focus on the technology stack.

Notice that there is only one global Cardano operating system running for all applications, products, and users. Unlike the Java platform, Cardano will be able to ensure trust among users. On a Java platform (or other similar platforms), client-server applications are usually created. The Internet is used for data transfer and the usual database of the developer’s choice is used for data storage. Cardano is all about decentralization. Users can agree on some conditions, for example through a smart contract, and the consensual network will ensure that the rules are followed. Smart contracts will also be open-sourced. All necessary data is stored in the blockchain and developers can decide whether it will be transparent.

Technology stack

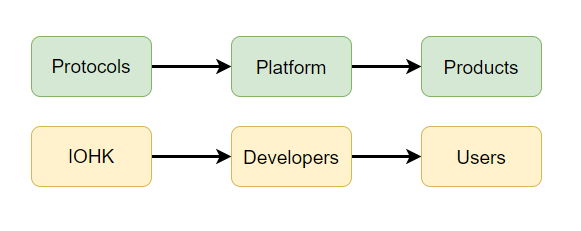

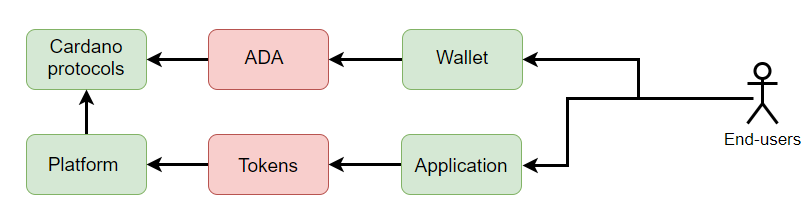

Now is the time to look at Cardano’s technology stack and compare it with Bitcoin. The Cardano, as a blockchain platform, consists of these three categories:

- Protocols and blockchain. This is the very first layer that is built by the IOHK team. On this level, there is the consensual network including Ouroboros PoS, blockchain, a virtual machine for smart contract execution, economic and incentives models, etc. Protocols are responsible for transaction validation, executing smart contracts, producing new blocks, issuing new tokens, interconnection to other blockchains, project governance, etc.

- The platform can be understood as a layer upon base protocols. The platform is used by product and application developers, that build them for end-users. Developers can use smart contracts to create an application, that end-users will use. The platform toolset will grow in time so it allows creating smarter and more user-friendly applications. For example, once Oracles will be available for developers, they can create an application, that will be able to use data from the physical world. For example the current price of assets, sports scores, weather information, flight departures, etc. Once stable coins will be available, users can use applications without price volatility.

- Products or applications are used by end-users. They interact with them and utilize all functionalities and services for their benefit or just for fun.

There are basically two kinds of users. Developers and end-users. Developers use Cardano as a platform to build applications for end-users. End-users directly interact with applications and the interactions often result in the Cardano protocol transactions. For example, a developer can create a game via smart contracts and issue non-fungible tokens representing unique game assets. Exchanging game assets between users can be implemented in a transparent smart contract what is the part of the application. The exchange is realized via transactions on the protocol level. Thus, a network consensus must be achieved to validate the transactions and smart contract conditions. The result is written into the blockchain.

The evolution of cryptocurrencies and how Cardano fits in

Thanks to Bitcoin, the whole blockchain industry has taken off. For a long time, people didn't believe that any other project other than Bitcoin could be successful. They were wrong. Let's take a look at some of the events and trends in this emerging industry. We look at Cardano and how it fits into the future of cryptocurrencies. Read more

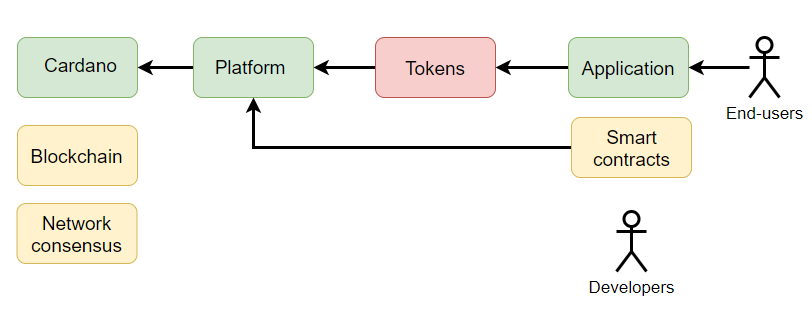

Notice, that users can use ADA coins and interact directly with the Cardano network. Besides that, application developers could issue application tokens. Users can interact with the applications to manipulate with tokens and they might not know anything about ADA coins and even about the platform that has been used to build applications.

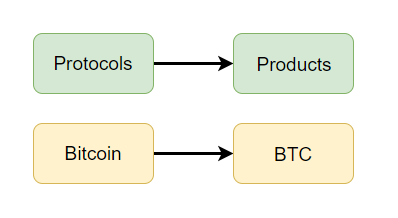

Bitcoin is not a platform but only a transaction network. There is no product or application. BTC coins are basically a product offering some benefits and utility. You can own BTC via keeping the private key and spend it via transaction.

Bitcoin can hardly be considered as a platform since it is very difficult to create an application on top of it. Bitcoin is very unfriendly to application developers and it is also hard to achieve nice user-friendly experience due to PoW consensus that requires ~10 minutes to get transactions into a block. Transactions could be also more expensive in the future on the first layer.

Bitcoin is a pure cryptocurrency while Cardano is a platform with ADA, as a native cryptocurrency, and with the ability to issue application tokens.

Tokens can be fungible or non-fungible. Fungibility is a desired aspect of any currency aiming to become a store of value, medium of exchange, or unit of account. In cryptocurrencies, fungibility is important to maintaining the legitimacy of the currency’s interchangeability between units. Non-fungible tokens (NFT) is essentially a unique representation of an asset or good in the form of a virtual token. Based on cryptography, ownership, and authenticity of an asset can be verifiably proved. For example, a virtual piece of art can be tokenized and ownership of the token directly reflects the ownership of the piece of art, immutably stored on the blockchain.

Non-fungible tokens can be used as certifications for identification, game assets, software licenses, and property ownership including stocks, bonds, and commodities, etc. Cardano is able to ensure the secure and trustless transfer of the tokens. Via smart contracts, conditions of the transfer might be defined.

Fungible and non-fungible tokens can be issued within products and applications to offer some services and functionality to end-users, utilizing Cardano protocols, as a trust machine, that means the blockchain as a reliable data-storage and consensual transaction network as a reliable method for transferring ownership.

Differences in adoption

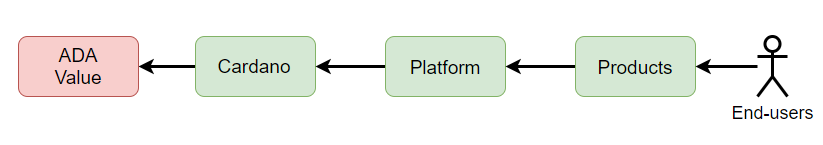

At this point, we might ask what users actually want to use. What product will bring something valuable to users? The answer to this question is crucial as the end-user demand for the product increases the value of the protocol and thus, also the value of underlying assets. As a middleware between protocol and product, the platform can enhance the quality and utility of end products and extend their capabilities.

In the case of Cardano, end-users can demand useful products. To build high-quality products a solid platform for developers must exist in the first place. And to have the platform, there must exist protocols and other related services. If developers are satisfied with the Cardano platform and its capabilities, then end-users will be satisfied with products and ADA coins value will naturally rise with increasing adoption. Notice that end-users do not necessarily need to adopt ADA coins, but just products and applications and possibly related tokens.

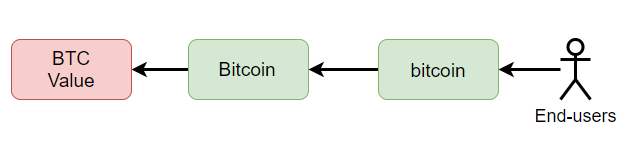

The same applies to Bitcoin, except that the product is the BTC coin itself. BTC value will rise only if people value the end product. So possibilities of BTC coins and Bitcoin transaction systems.

Bitcoin is a scarce asset. If you ask what the adoption is based on, basically it is only on people’s belief that Bitcoin is a new store of value just like gold or a new form of money. The more people believe it, the more likely it will happen. The price of cryptocurrencies is a reflection of supply and demand. Demand is influenced by the quality of the product that end users can utilize. It is important to note that in the case of Bitcoin, in the context of price, it does not matter how many users adopt the product (BTC coins). The high price can be ensured by a few wealthy individuals or the entry of institutions. But it has one catch. People who believe the narrative about digital gold will still be very little regardless of price. The higher the price of BTC coins, the lower the willingness of newcomers to buy them. People often mistakenly think that increasing scarcity will lead to price increases and hence higher adoption. This is probably a big mistake. Scarcity alone cannot ensure higher adoption and thus a higher price of BTC coins. Higher adoption can only be ensured by the usefulness of the end product, and the quality of the end product is influenced by the quality of the protocol. A platform might help here, but it is not the case for Bitcoin. To adopt Bitcoin, people would have to appreciate the scarcity of BTC coins, PoW consensus, and the transaction system. As we said, the scarcity itself cannot help with adoption.

People are unlikely to buy a new form of money since early-adopters had an advantage in cheaper purchases, ie now they hold more coins. The adoption of new money will be voluntary and people will be able to choose from a large number of other projects. From a game theory perspective, it is better for them to bet on another horse when the price of new money is to be volatile, the price rises in time and the entrance conditions are getting worse. Bitcoin’s second narrative as a store of value makes more sense. Scarce asset certainly won’t hold most of the population, but a few rich people. But everyone will be able to buy a small piece if they need it. Thanks to the built-in transaction system and the ability to buy several pieces of Satoshi it is possible. Here, however, we will probably need several decades for the majority of the population to believe. It is healthy to admit that perhaps not more than one percent of the population does believe it now.

The adoption of Cardano takes place mainly through the usefulness of products for end-users in a form of applications and their number and quality will grow in time. Mass adoption is not about price speculation, but the quality of the platform from which a large number of user-friendly products will emerge. Cardano must now deliver quality protocols to create a platform that will attract a large number of developers. Users require fast and cheap transactions, coin stability, privacy, security, transparency, and other benefits. Developers must be able to meet these expectations through the platform. Now is the time to ask what users actually want. What products they desire. This must serve as a basis for building the platform. This has been noticeably lacking in cryptocurrencies for the last decade. Everyone thought users would just start buying cryptocurrencies, but we forgot to ask why they were going to buy them and for what they would use them. The volatile asset turned out to be disadvantageous for payment, so the first generation of crypto came up with the narrative of the store of value. It seems that it does not work either.

Now, we know user demand, or we can easily derive it from what we are able to achieve through distributed networks, smart contracts, and other related services. We are able to improve some processes and make financial services available to everyone. Distributed networks can make it easier to invest, hold and transfer assets, issue and swiftly move game tokens, decentralize sales or exchange assets, or get rid of useless, unreliable, and expensive middlemen. Actually, we can do a lot of things and we are at the beginning.

There is one general rule, that is true also for cryptocurrencies. The only utility can bring profitability. In the case of cryptocurrencies, the only utility might attract more users and thus increase adoption. Naturally, the protocol-associated native cryptocurrency will grow along with adoption. Rising prices without increasing adoption are merely speculation and possibly an inflated bubble. Only increasing adoption will ensure the natural growth of the cryptocurrency and have a positive impact on building a new financial system.

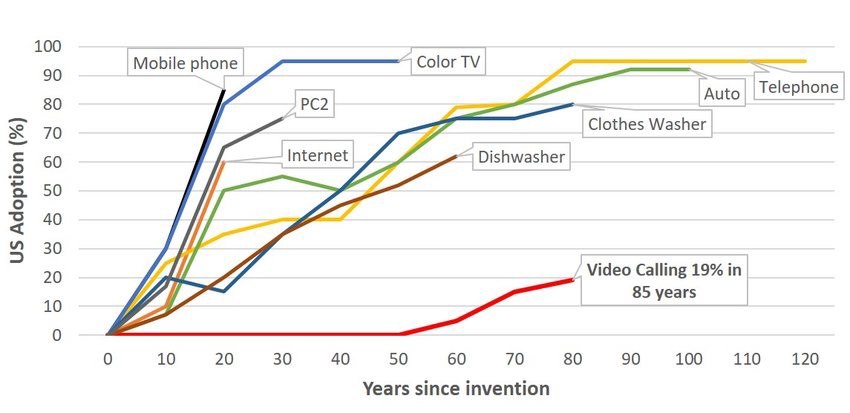

How people adopt new technologies

The speed of technology adoption is steadily increasing. However, it is important to realize that new technologies are often ready for mass adoption and global marketing is an inevitable part of it. In addition, when adopting you do not speculate on the price. The novelty is expensive at the beginning and with increased production and rising competition, the price usually decreases. If you buy a new phone two years after your neighbor owns it, you are buying a better and cheaper model. That is why adoption can be fast.

Cryptocurrencies came to the world unprepared for ordinary users and technically undeveloped. And it is true even now. Early adopters who were willing to overcome technological shortcomings and risk losing money now have a big advantage and hold a large number of coins that newcomers find it hard to buy. So far it was mainly about speculation on the price and the belief that the price will continue to rise without a solid answer to the simple question. Why should the price rise?

With the advent of platforms, this changes. Newcomers will use different services under the same conditions. Only some users, specifically those holding ADA coins, will earn more coins. Other regular users may not mind if they just want to buy Tesla shares or borrow cheaply to buy a new car. People taking care of network consensus and the quality of decentralization will be separated from ordinary users of products and applications. Developers of products for end-users can also earn money if they offer a better service than the existing ones. Cardano adoption will not only depend on the demand for ADA coins but mainly on the usability and quality of the products for end-users.

End users will only see the services and applications and they pay for use. The result of using the applications will be Cardano transactions for which ADA coins are paid. Transaction and smart contract execution fees will go to Cardano stakeholders who ensure protocol-level decentralization. Cardano stakeholders basically replace the owners of a centralized company. Everyone can become a Cardano stakeholder.

Some might argue that even Bitcoin could be a platform and that some projects are being developed. Bitcoin will probably never be able to compete with Cardano or Ethereu as a platform. This would require major changes on the first layer and there is not enough community agreement. In addition, it might be more harmful to Bitcoin because it would set out on a journey where it would be much more difficult to get through. We may see some applications on Bitcoin in the future, but it will always be within the next layers. The economic model and the quality of decentralization will not be the same as with Cardano.

Summary

In this article, we tried to point out the differences in adoption between Bitcoin and Cardano. As you can see, it’s not the same. Both projects have a solid chance of adoption, but each will follow its own path. Occasionally we can hear that the Cardano project’s goals are too ambitious. We think they are ambitious, but in terms of implementation and adoption, they may be more realistic than the idea that Bitcoin will be a new digital gold or a new form of money. The adoption of Cardano may be much easier, but it will have to deal with strong competition. As a platform, it will not be alone in the world of cryptocurrencies and also in the real world where R3 Corda and Hyperledger can be used in some cases. There are multiple platforms that allow creating similar things in the real client-server world and disputes between Java and C# developers are endless. Still, both are used to build applications and services. Platforms have one big advantage. Developers can listen to end-users and adjust the application as they need. There can be more competing applications and services, so users can easily choose what they want to use. The usage and adoption of Cardano will be just rising. In comparison, there is only one physical gold, so Bitcoin basically has no opponent and the adoption is really only about the people’s belief in the digital form of gold. The adoption of Cardano depends only on how good the platform will be and how many developers it will attract. Users will probably start using the applications if they will be useful to them. It is much easier to succeed as a platform in a competitive environment than as a new form of money or digital gold.